Analyst Scott Melker Highlights Bitcoin’s Bullish Indicators Amidst Low Trading Volume Concerns

Noted cryptocurrency analyst Scott Melker has identified several bullish technical signals in Bitcoin’s recent price action, suggesting potential upward momentum. However, he cautions that subdued trading volumes could indicate a lack of strong market conviction at current levels. The divergence between positive chart patterns and weak volume metrics presents a complex scenario for traders, requiring careful risk assessment. Market participants are advised to monitor both spot and derivatives volume trends alongside key support/resistance levels for clearer directional signals. This comes as Bitcoin continues to consolidate following its recent rally, with institutional interest and macroeconomic factors likely to determine the next major price movement.

Low volumes mean bad news for Bitcoin

The token broke through this level several times over the past week but was unable to sustain the momentum. At the same time, Melker points out that low trading volume suggests that buyers are still reluctant to join the market.

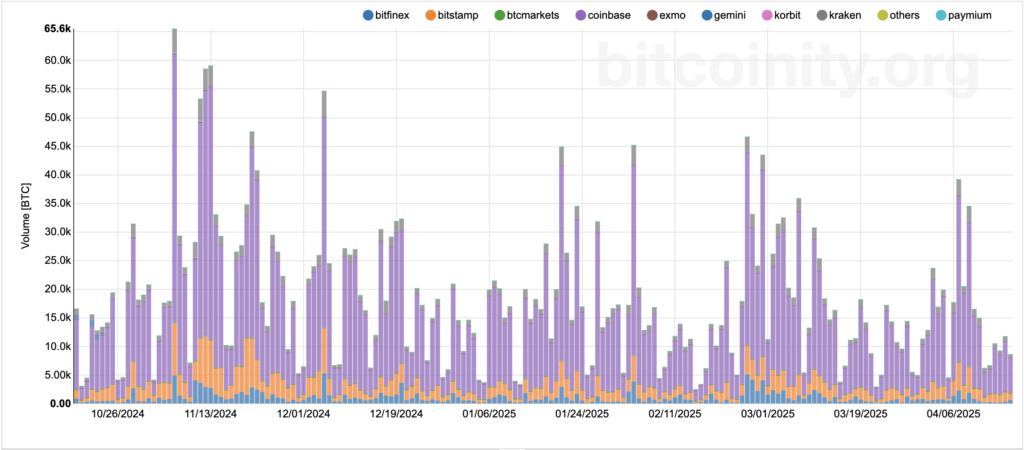

For instance, trading volume on major exchanges amounted to about 8,000 BTC on April 17, significantly down from last week’s levels. On April 9, for example, trading volume on major exchanges was around 26,000 BTC.

This suggests that investors are likely waiting for positive macro news, which has been lacking in recent weeks. Notably, the ongoing trade war with major U.S. partners is causing fears over a potential economic recession. At the same time, the Federal Reserve is slow to add support, fearing that U.S. tariffs, especially on China, would give rise to domestic inflation.

In any case, Bitcoin will face resistance at the $85,000 level, which corresponds to a long-term descending channel forming from its January all-time high. And if volumes continue to decline, the asset risks falling to the channel’s midline at around $75,000.