Binance Research Highlights U.S. Treasury Issuance as Critical Macroeconomic Factor

In its latest analysis, Binance Research identifies U.S. Treasury issuance as a pivotal macroeconomic indicator that market participants should closely monitor. The report underscores how shifts in Treasury supply could influence liquidity conditions, risk asset valuations, and broader financial stability. As the Federal Reserve’s balance sheet normalization continues, the interplay between Treasury issuance and market absorption capacity may create volatility across crypto and traditional asset classes. Institutional investors are advised to track these developments, particularly given their potential impact on dollar liquidity and global capital flows.

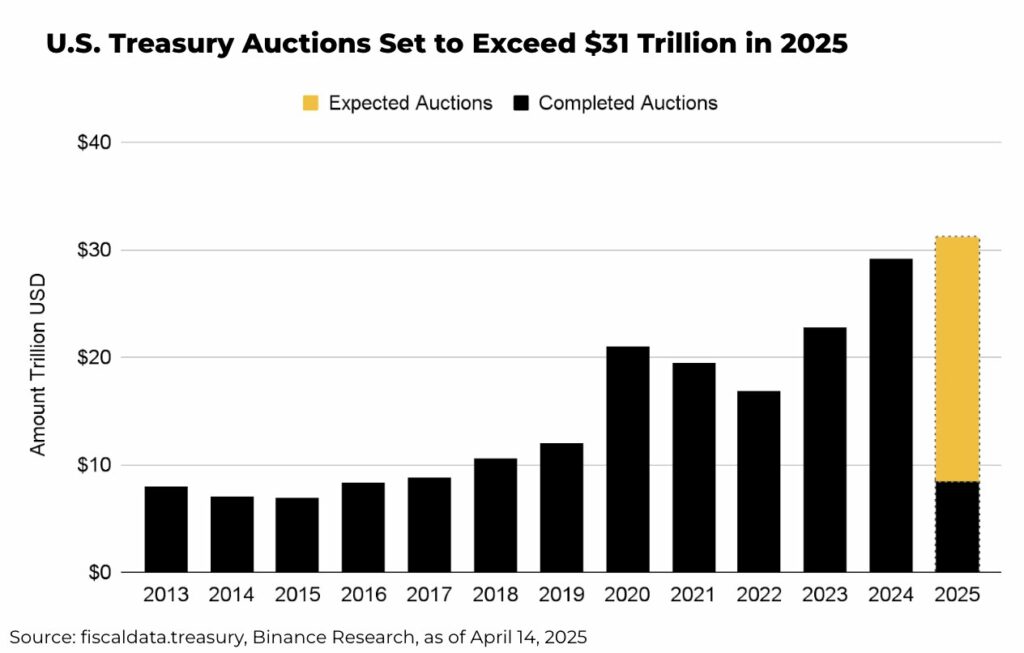

U.S.Treasury auctions to exceed $31 trillion. Source: Binance Research

U.S.Treasury auctions to exceed $31 trillion. Source: Binance Research

Of the expected supply, about a third will be owned by foreign holders.

If appetite for U.S. debt falls, or there’s “outright selling, driven by geopolitics or portfolio rebalancing”, a ballooning of financing costs will follow. Yields, elevated, will go higher.

“Even if demand holds steady, the sheer scale of issuance is a structural challenge. Recent risk asset relief—possibly tied to Optimism around trade talks—does little to offset the ongoing pressure that this massive supply pipeline places on interest rate markets throughout 2025,” Binance Research noted.

Stocks and crypto, including Bitcoin (BTC), have suffered notable downside pressure in recent weeks. Tariffs have added to jitters, with the Federal Reserve not coming to the party with a rate cut. President Donald Trump has even threatened to fire Fed chair Jerome Powell.

Analysts say persistent upward pressure amid a surge in Treasury supply has the potential to impact risk assets. Nonetheless, a scenario where the government turns to debt monetization, with the money printer going “brrrr”, would be bullish for risk assets.

In this case, investors seeking to hedge against currency debasement will flock to Bitcoin and other “hard assets.”