Coinbase CEO Doubles Down on Bitcoin Following Strong Q3 Earnings Performance

Coinbase chief announces major Bitcoin acquisition after company's impressive third-quarter results.

BULLISH BET

The cryptocurrency exchange leader is putting corporate money where his mouth is - scooping up more Bitcoin just as traditional finance institutions continue dragging their feet on digital asset adoption.

Q3 MOMENTUM

Strong earnings performance fuels confidence in Bitcoin's long-term value proposition, demonstrating that those actually building in the crypto space understand what Wall Street analysts still can't grasp.

While traditional finance debates whether digital assets are legitimate, industry pioneers keep stacking sats - because nothing says 'I believe in this technology' like buying more when the suits are still scratching their heads.

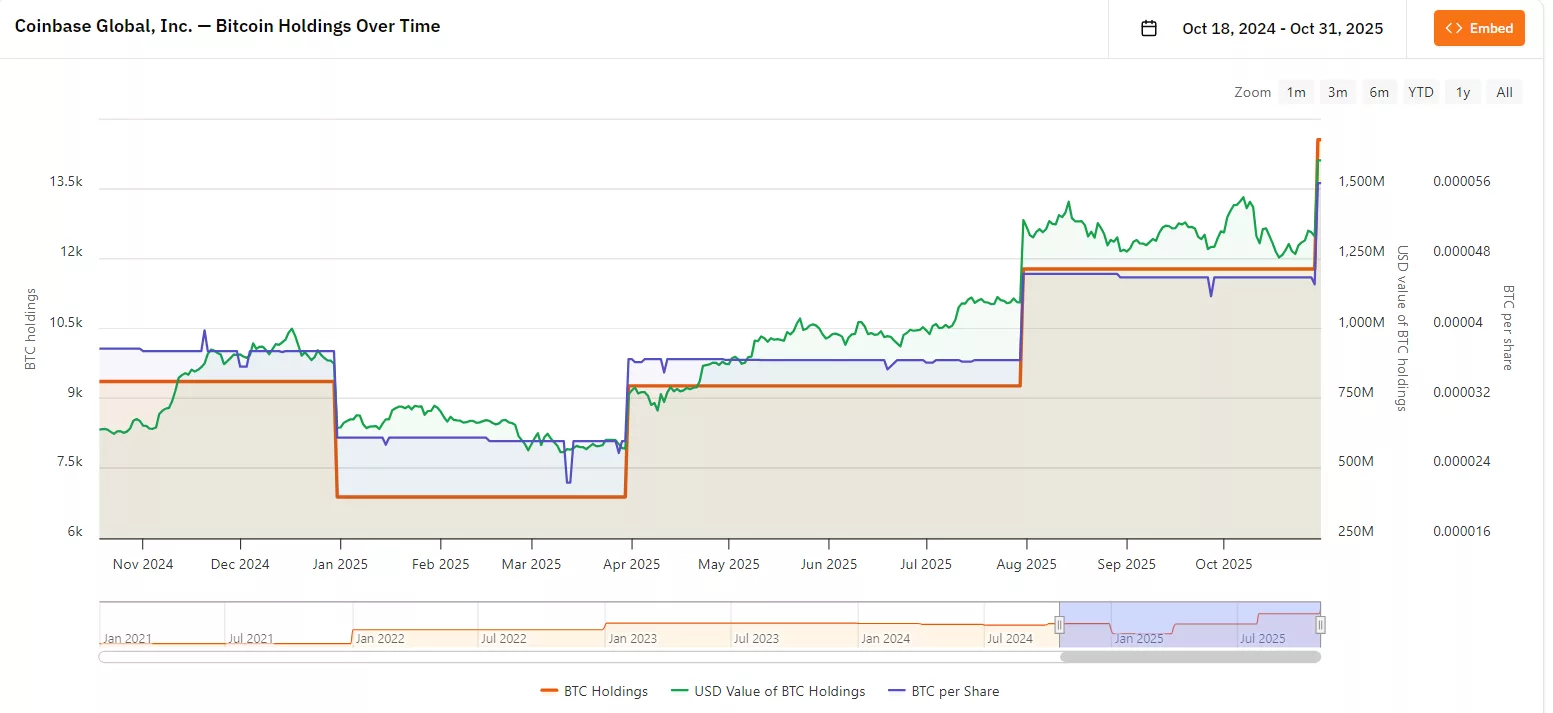

Coinbase’s BTC holdings have increased to 14,548 BTC in its third quarter | Source: Bitcoin Treasuries

Coinbase’s BTC holdings have increased to 14,548 BTC in its third quarter | Source: Bitcoin Treasuries

At press time, the company’s market Net Asset Value stands at 52.539 based on its basic market cap. With its stock price at $328.51, having dipped slightly by 5.77% in the past 24 hours, this means that the market is valuing the company at about 52.5 times the value of its BTC trove.

In contrast, Strategy, the largest corporate Bitcoin holder in the world, has an mNAV of 1.04x based on basic market value. This means that more of its value is represented in Bitcoin holdings compared to Coinbase.

Nevertheless, conditions might change if Coinbase decides to get braver with their BTC accumulation. Compared to its Q1 and Q2 BTC purchases, Q3 marks the largest amount of BTC bought this year at 2,772 BTC. Meanwhile, the last time the company sold its holdings was at the end of 2024, when it offloaded 2,478 BTC.

Coinbase earnings rise by 25% in Q3 2025

Most recently, Coinbase revealed in its third-quarter earnings report that it has reached a total revenue of $1.9 billion. This number has gone up 25% compared to the previous quarter. Its strong earnings were attributed to favorable market conditions as well as a result of its current expansion strategy.

As of late, the exchange has been expanding on its “Everything Exchange” vision by adding more products to its platform, including derivatives, stablecoins, and institution products. On the other hand, it has cited the rise of Bitcoin and regulatory advancements made by the TRUMP administration as factors that have improved market conditions.

In addition, the company has also benefitted from more mainstream adoption of crypto among institutional players. This quarter, institutional trading activity on Coinbase rose by 22% from the prior quarter, reaching $236 billion.

The acquisition of Deribit, which generated $52 million in revenue and strengthened Coinbase’s global options and futures operations, subsequently fueled a 122% boost in institutional transaction revenue to $135 million.