a16z Backs Pakistan’s Stablecoin Revolution in Major Funding Round

Andreessen Horowitz just placed a massive bet on Pakistan's crypto future—proving even traditional finance giants can't ignore stablecoin potential anymore.

The Funding Frontier

a16z leads the charge in Pakistan's emerging digital economy, backing a stablecoin startup that could reshape regional finance. This isn't just another crypto investment—it's a strategic move into one of Asia's fastest-growing markets.

Stablecoins Go Global

While Wall Street debates regulation, a16z bypasses the noise entirely—investing directly in real-world utility. Because nothing says 'financial inclusion' like betting on emerging markets while traditional banks still struggle with basic cross-border payments.

Pakistan's digital finance landscape just got its most powerful ally yet. Watch traditional banks scramble to explain why they missed this opportunity—again.

a16z report: Stablecoin transfers surpass Visa transactions

According to Andreessen Horowitz’s State of Crypto 2025 report, stablecoins have been used to process $46 trillion in transaction throughout the past year. When compared to Visa’s annual transaction volume, the number has nearly tripled.

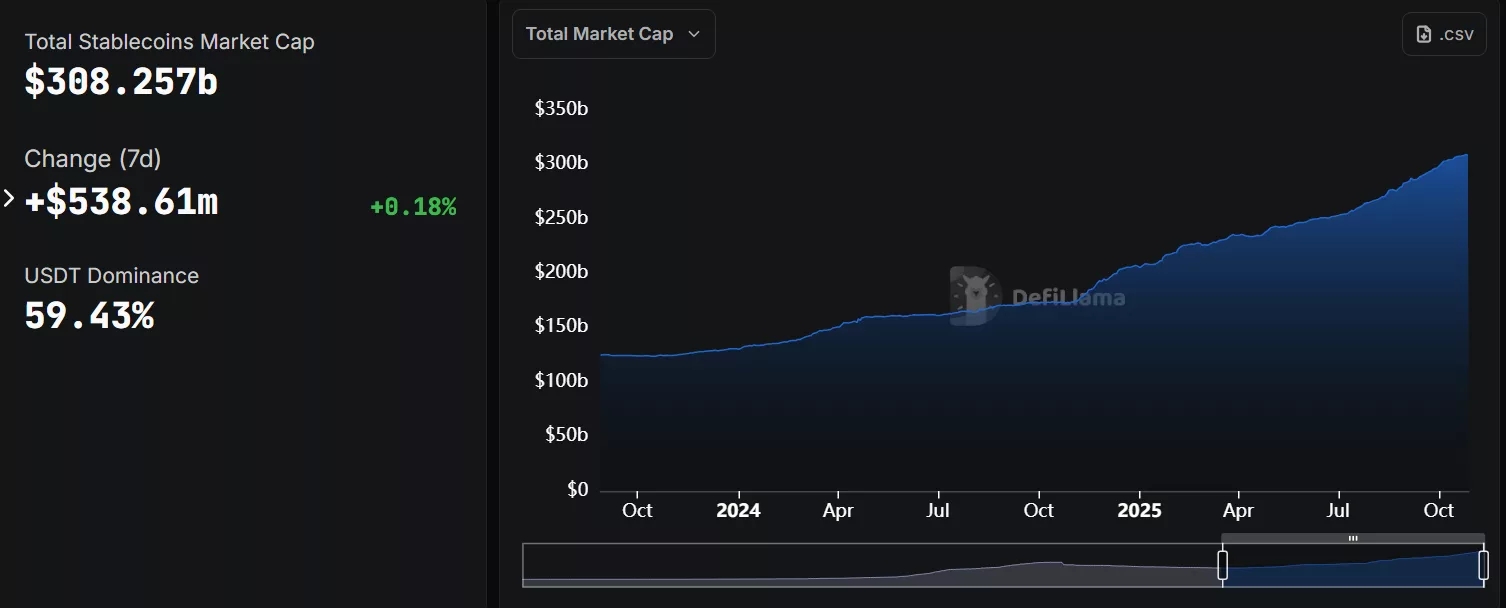

The report notes that stablecoin transaction volumes reached nearly $1.25 trillion in September 2025, marking one of the highest monthly totals to date. The market value for stablecoins have surged to $308.25 billion, with an increase of $538.6 million within the past week. However, most of the industry is still dominated by U.S-backed tokens, specifically USDT (USDT) which is nearing 60% in domination.

Analysts from a16z also highlighted that the growth of the stablecoin industry has become increasingly detached from the overall crypto trading activity, suggesting that stablecoins are now being used for real-world economic transactions rather than mere speculative trading.

Not only that, the number of monthly active crypto users now has increased by around 10 million people over the past year. It now ranges somewhere between 40 million to 70 million. This rise in users has been fueled by major improvements in infrastructure.

For instance, nowadays blockchain networks can handle over 3,400 transactions per second, representing a more than hundredfold increase in processing capacity compared to five years ago.