XRP Rocketing to $3: ETF Inflows Explode, CME Open Interest Skyrockets, RLUSD Assets Surge

XRP's charging toward the $3 mark as institutional money floods the cryptocurrency space.

ETF Frenzy Fuels Fire

Exchange-traded fund inflows hit unprecedented levels, with billions pouring into digital asset products weekly. The institutional stampede signals growing mainstream acceptance of cryptocurrencies beyond Bitcoin's dominance.

CME Open Interest Breaks Records

Chicago Mercantile Exchange open interest for XRP derivatives smashed previous benchmarks, indicating sophisticated traders are positioning for major price movements. The surge in institutional participation validates XRP's growing importance in the digital asset ecosystem.

RLUSD Assets Multiply

Ripple's stablecoin ecosystem shows explosive growth, with RLUSD assets increasing tenfold in recent months. The expansion demonstrates real-world utility beyond speculative trading—though Wall Street will probably find a way to overcomplicate that too.

Market momentum suggests XRP's trajectory could challenge historical resistance levels sooner than expected.

Ripple ETF inflows and futures demand

XRP price continued its strong rally this month, with data showing robust institutional demand for the coin.

One sign of this is that the CME Futures products launched in May have already crossed the $66 billion mark in open interest. This makes them among the most actively traded contracts for the company.

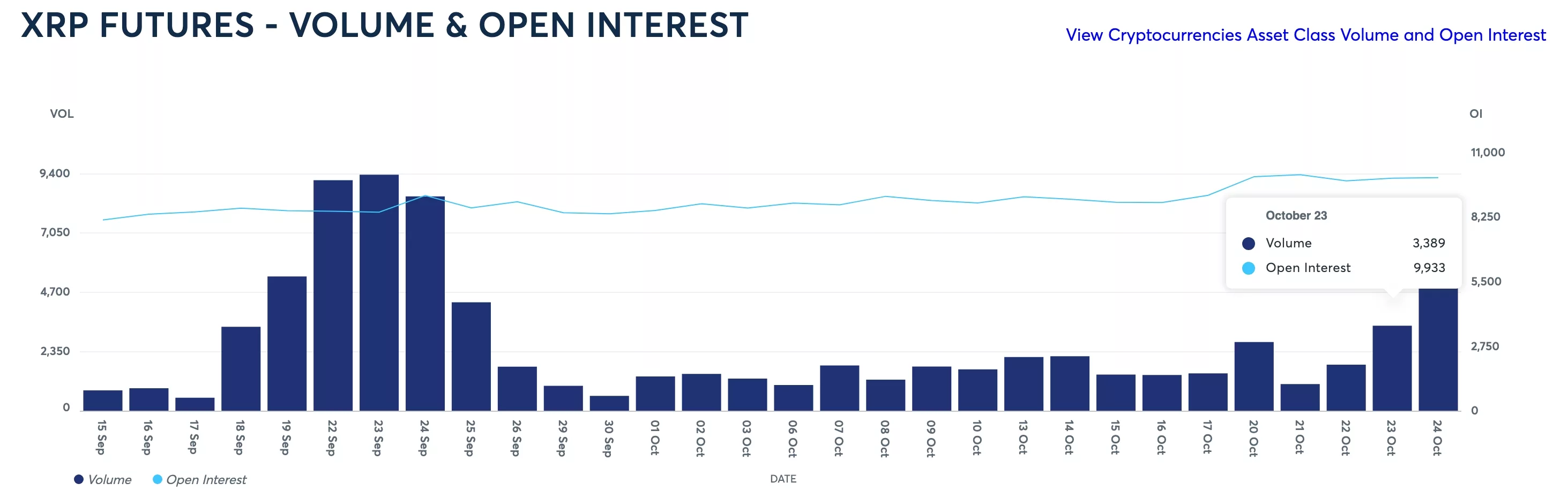

Data on CME’s website shows that open interest has continued rising this month. On Friday, open interest jumped to $9.9 billion, the highest level since Sept. 24. It has been in a strong rebound since bottoming earlier this month.

As the chart below shows, the volume of XRP futures on CME has been in a strong uptrend over the past few weeks, a sign of institutional and retail demand.

The xrp price has also jumped as futures open interest in crypto exchanges continues rising. This interest jumped to $4.39 billion on Oct. 26, up from this week’s low of $3.4 billion.

Meanwhile, institutional investors continue allocating money to the XRP ETF this month. Data shows that the recently launched spot XRP ETF by REX-Ospey has achieved over $100 million in assets within the first month.

This surge is notable because it occurred during a period when the XRP price plunged to the year-to-date low of $1.3790 earlier this month.

Similarly, the Teucrium Leveraged XRP ETF has gained over $366 million in assets, a trend that may continue.

This growth happened after some notable XRP news. For example, Ripple Labs launched Ripple Primeafter closing the Hidden Road buyout. The Ripple USD (RLUSD) stablecoin is also approaching the $1 billion asset mark, nearly a year after its launch.

XRP price technical analysis

The daily timeframe chart shows that the XRP price bottomed at $1.3790 earlier this month. It has now bounced back by about 88% to $2.62, its highest point since Oct. 10.

The coin is now attempting to MOVE above the 200-day moving average, which will confirm the bullish breakout. It has also formed a small inverse head-and-shoulders pattern.

Therefore, the most likely XRP price forecast is for it to continue rising as bulls target the psychological $3 level, about 14% above the current level.