Bitcoin’s $120K Quest: Analysts Sound Alarm on Macroeconomic Headwinds

Bitcoin faces its ultimate test as it eyes the elusive $120,000 threshold while battling against global economic pressures.

The Macro Squeeze

Traditional finance veterans are waving red flags as interest rate policies and inflation concerns create the perfect storm against crypto's flagship asset. Market indicators suggest institutional money might be getting cold feet just when Bitcoin needs it most.

Technical Resilience vs Fundamental Reality

While the charts show potential for another massive rally, fundamental analysts point to decreasing liquidity and regulatory uncertainty as major roadblocks. The $120,000 target suddenly looks much farther away than the pure technical analysis suggested.

Wall Street's latest 'risk-off' sentiment proves once again that traditional finance moves with all the agility of a sedated elephant—just when digital assets need nimble support. Bitcoin either breaks through these macro barriers or faces another extended consolidation phase.

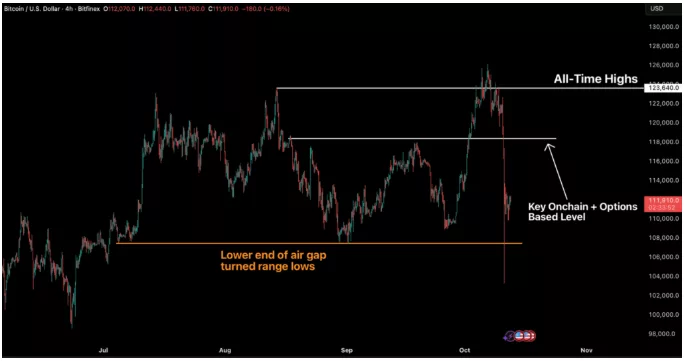

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

While Bitcoin (BTC) fell 18.1%, altcoins declined as much as 80%, with some temporarily becoming illiquid. The report notes that a 2.5x imbalance toward sellers created the conditions for the flash crash, contributing to $19 billion in futures liquidations in a single day. Although BTC bounced, further recovery remains uncertain.

Will Bitcoin recover to $120,000?

According to Bitfinex analysts, the recovery will largely depend on BTC holding key support at $110,000. That WOULD put it in position to retest the $117,000 to $120,000 range. However, additional gains will depend on spot demand and the macro backdrop.

For a full recovery, Bitcoin needs fresh capital inflows to drive spot demand. This will largely depend on macro conditions, which are currently clouded by the lack of economic data due to the U.S. government shutdown.

“For now, the absence of data may be masking underlying fragility. If the shutdown persists, delayed reports on inflation and employment could amplify volatility once they are released. But the market message is clear: liquidity, credit confidence, and the expectation of further easing from the Fed are keeping the economy afloat, even as the lights in Washington remain dim,” wrote analysts at Bitfinex.