Ethereum Bulls Charge: Can ETH Smash Through $4,265 Resistance?

Ethereum stages dramatic comeback as bulls gather momentum

The Rebound Rally

ETH price action defies broader market sentiment, climbing steadily toward that crucial $4,265 threshold. Trading volumes spike as institutional money flows back into digital assets—proving once again that traditional finance moves slower than your grandma's dial-up internet.

Technical Breakout Territory

All eyes on the charts as Ethereum tests resistance levels that could trigger the next major bull run. The $4,265 barrier represents more than just a number—it's the line between consolidation and explosive growth.

Market Psychology at Play

Traders hold their breath while Wall Street analysts scramble to update their outdated models. Meanwhile, the crypto-native crowd just keeps building—because real innovation doesn't wait for permission or traditional validation.

Will Ethereum shatter expectations and leave doubters in the dust? The charts don't lie, but hedge fund managers certainly do.

Circle’s stablecoin empire

According to data from DeFi Llama, Circle’s USD-backed token, USDC is currently the second largest stablecoin by market cap. Falling behind only to Tether’s USDT (USDT), USDC has a market cap of $75.28 billion. However, it does have a faster daily growth rate than Tether, with a rise in market value by 0.41% compared to USDT’s 0.06%.

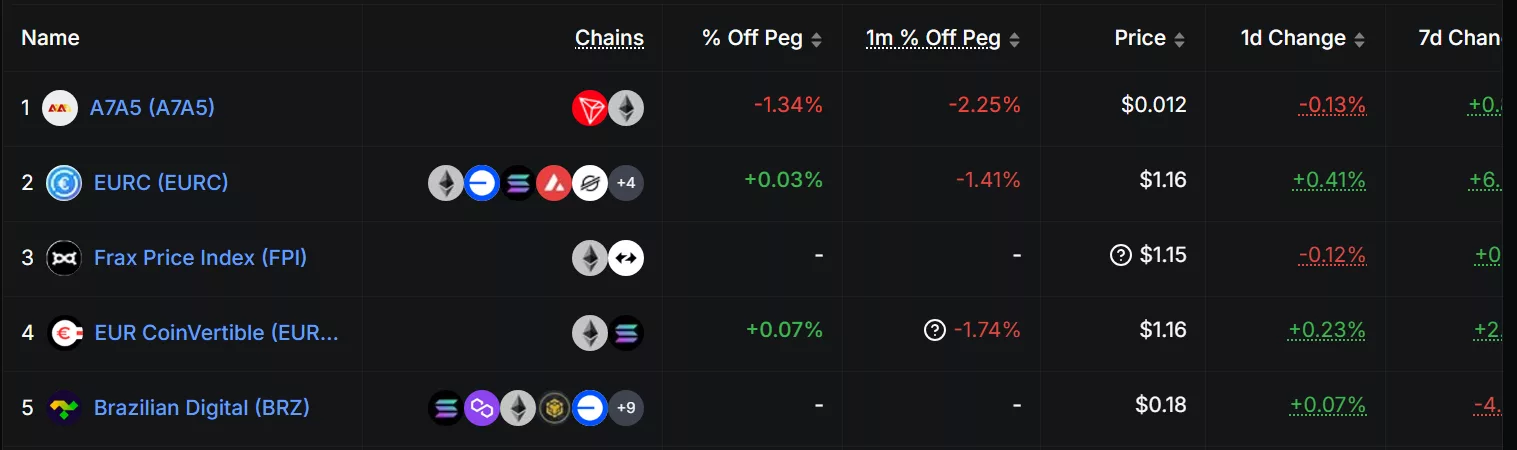

On the other hand, Circle is still the largest stablecoin issuer by market cap amongst the euro-backed stablecoins. The firm’s EURC (EURC) has a market cap of $266.5 million, contributing to more than 45% of the total $570 million market cap generated by euro-backed stablecoins.

With regards to non-USD backed stablecoins, EURC is still behind the ruble-backed A7A5. The ruble-backed stablecoin dominates the non-USD backed stablecoin market by more than 40%. Meanwhile, EURC still requires an additional $213 million if it wishes to surpass A7A5 as the largest non-USD pegged stablecoin issuer.

The stablecoin industry has been growing at an unprecedented pace, as it recently surpassed $300 billion in total market cap. JPMorgan’s latest report predicted that the stablecoin market is due for a massive increase, reaching $2 trillion within the next two years.