Binance Stablecoin Reserves Explode To $42B Record—Market Liquidity Roars Back

Digital asset markets just got their mojo back—Binance's stablecoin war chest hits unprecedented levels as capital floods into crypto.

The Liquidity Tsunami

That $42 billion mountain of stablecoins sitting on Binance isn't just sitting pretty—it's fuel waiting to ignite the next market surge. When this much dry powder accumulates, you can almost hear the trading engines revving.

Institutional Money Talks

While traditional finance guys were busy worrying about yield curves, smart money was building positions. The sheer scale of this liquidity injection suggests major players are positioning for what comes next—and they're not using pocket change.

Market Mechanics Shift

This isn't retail FOMO—this is sophisticated capital deployment at scale. The stablecoin surge creates a foundation so solid that even the most cynical traders are starting to believe in the rally's legs.

Watch what happens when $42 billion decides it's tired of earning negative real returns in traditional finance—crypto markets are about to get interesting again.

Liquidity Surges As Binance Hits Record High Reserves

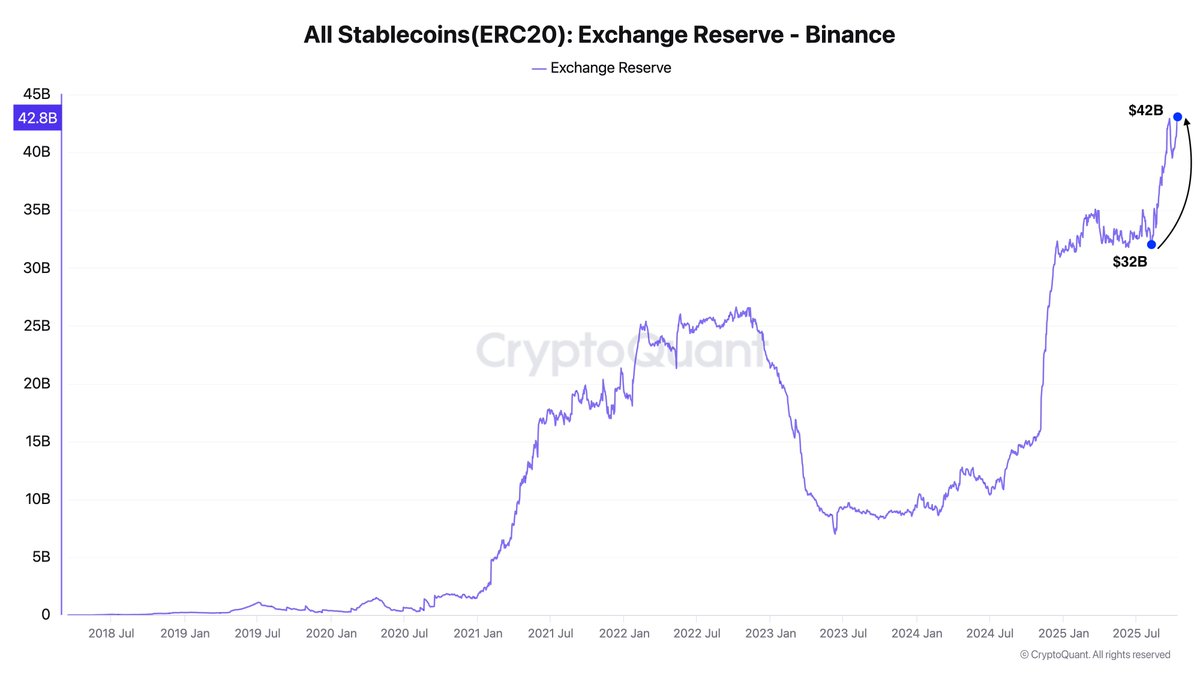

Darkfost shared data showing that the ERC-20 stablecoin supply on Binance has seen a massive surge over the past two months, rising by $10 billion since August, from $32 billion to $42 billion. This marks the highest level of ERC-20 stablecoin reserves ever recorded on the exchange, a significant milestone that signals renewed liquidity inflows into the market.

This sharp increase in stablecoin reserves suggests two major dynamics at play. First, investors continue to deploy capital into the crypto market through stablecoins, a common precursor to renewed accumulation and trading activity. Second, Binance’s dominance in global trading volume remains unchallenged, with increasing user participation demanding more available liquidity on the platform.

While part of this increase may stem from investors rotating capital back into stablecoins after the recent market crash, this explanation alone doesn’t capture the full picture. Binance typically adjusts its reserves in response to active trading behavior, meaning this spike is more likely linked to rising demand and capital readiness than to risk aversion.

Despite recent volatility and sharp liquidations, the data show that liquidity is flowing back in, positioning the market for a potential rebound. If this trend continues, stablecoin accumulation on Binance could serve as the foundation for the next major leg up across bitcoin and the broader crypto ecosystem.

Stablecoin Dominance Spikes: Capital Rotates After Market Crash

The chart shows a sharp rise in stablecoin dominance, which recently spiked above 9% before cooling to around 8.15%. This MOVE reflects a rapid flight to liquidity following last week’s extreme volatility, when Bitcoin plunged below $105K and altcoins saw significant losses. Historically, such spikes in stablecoin dominance indicate that traders are exiting risk assets to hold stablecoins, waiting for market stabilization before redeploying capital.

Interestingly, the pullback from 9% to 8% suggests that the panic phase may already be easing. The market appears to be entering a reaccumulation phase, where stable capital is preparing for the next major move. On a technical level, stablecoin dominance remains well above its 50-day and 200-day moving averages, signaling persistent strength in liquidity reserves.

If dominance continues to consolidate NEAR these highs while Bitcoin stabilizes, it could create the foundation for renewed inflows into risk assets. In other words, money hasn’t left the market—it’s waiting on the sidelines. Stablecoin dominance above 8% generally marks periods of strong capital positioning, often preceding new market uptrends. The current setup, therefore, highlights growing investor caution but also a buildup of dry powder that could soon reenter the market.

Featured image from ChatGPT, chart from TradingView.com