Dutch Crypto Powerhouse Amdax Secures $35M for Massive Bitcoin Acquisition

Amsterdam-based crypto firm Amdax just pulled off a $35 million funding round with one clear mission: load up on Bitcoin.

The Big Bet

While traditional finance institutions debate digital assets, Amdax is putting real money where its mouth is. The $35 million capital raise signals institutional confidence in Bitcoin's long-term value proposition—proving once again that crypto natives understand this market better than Wall Street analysts reading from decade-old playbooks.

Strategic Accumulation

This isn't just another fundraise. Every dollar of that $35 million is earmarked for Bitcoin acquisition, demonstrating conviction that would make most hedge fund managers sweat. While traditional finance plays with regulatory red tape, crypto firms are building the future with straightforward execution.

Because nothing says 'we believe in this asset' like raising eight figures specifically to buy it—something your average fund manager still can't wrap their head around while they chase quarterly earnings reports.

Amdax’s bid for BTC domination

Based on previous reports from crypto.news, the Dutch crypto asset service initially aimed to close its funding at €23 million before they raised the stakes to €30 million in September 2025. The capital will fuel an initial buying spree ahead of its intended public listing on Euronext Amsterdam. The move would serve to provide the European market with a new BTC-based vehicle.

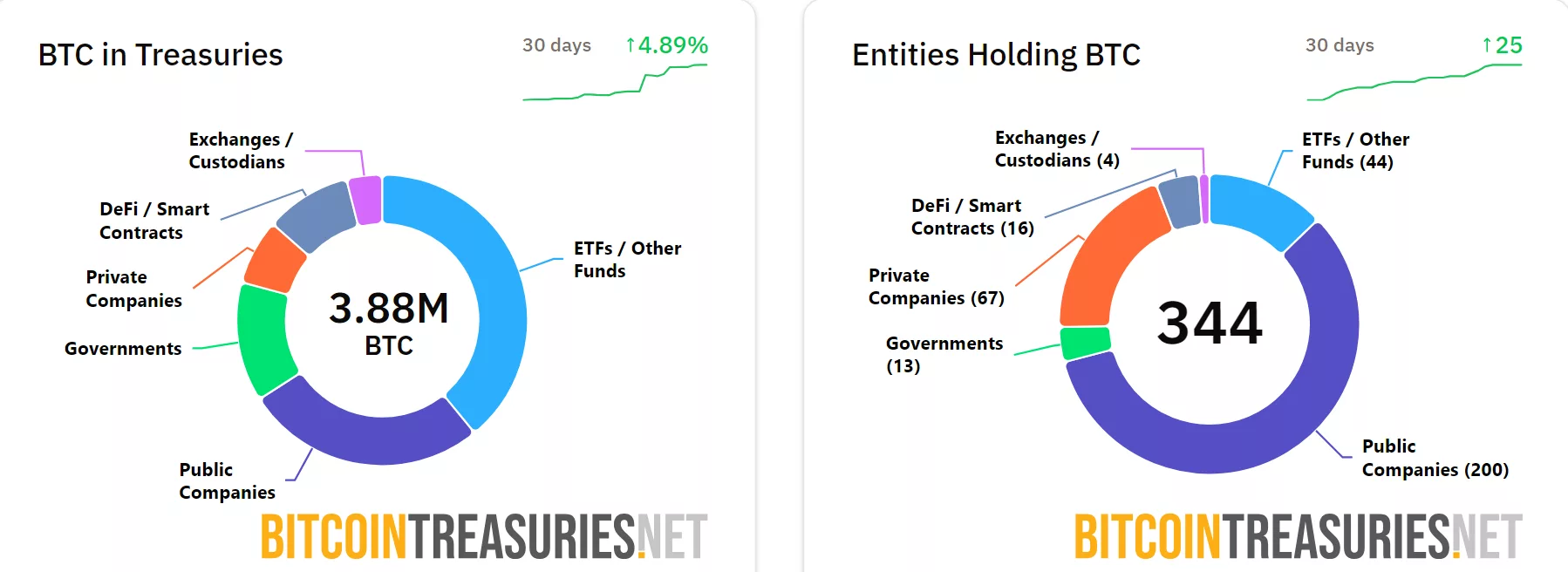

Through its BTC treasury initiative, Amdax aims to stockpile at least 210,000 BTC. If the company does manage to accumulate that much Bitcoin, it WOULD have garnered at least 1% of the total global BTC supply. At press time, the only entity holding above 210,000 BTC is Michael Saylor’s Strategy, which currently owns 640,031 BTC or more than 3% of the total 21 million BTC supply. Strategy’s trove is worth around $73 billion.

Most recently, Bitcoin reached a new all-time high at $126,080, breaking past the previous highest peak at $125,500. The token has recently retreated back to the $123,879 range following the surge. However, it has managed to stay well above the $120,000 threshold.

With $35 million worth of funding, Amdax would be able to purchase at least 282,533 BTC at current prices. This amount would not be enough to topple Strategy off its throne, but it would be enough to position AMBTS as the second largest Bitcoin treasury firm in the world.