SOON’s Infrastructure and Perpetuals Stacks Set to Deliver Solana-Level Speed to Enterprise Markets

Enterprise blockchain just got its performance upgrade ticket.

The Need for Speed

Traditional enterprise infrastructure moves at dial-up speeds compared to Solana's high-frequency trading pace. Legacy systems choke on transaction volumes that modern decentralized networks swallow whole.

Infrastructure Meets Derivatives

SOON's dual-stack approach tackles both the plumbing and the products. The infrastructure layer provides the rails while the perpetuals stack delivers the sophisticated financial instruments enterprises crave but can't efficiently access.

Wall Street's Coming Crypto FOMO

When institutions finally realize they're trading with 1990s technology against 2030s infrastructure, the migration will make the dot-com rush look like a leisurely Sunday stroll. Because nothing motivates traditional finance like the terrifying prospect of being left behind with obsolete tech while competitors lap them with faster, cheaper, smarter systems.

SOON unveils Solana-speed infra and trading stacks for enterprises

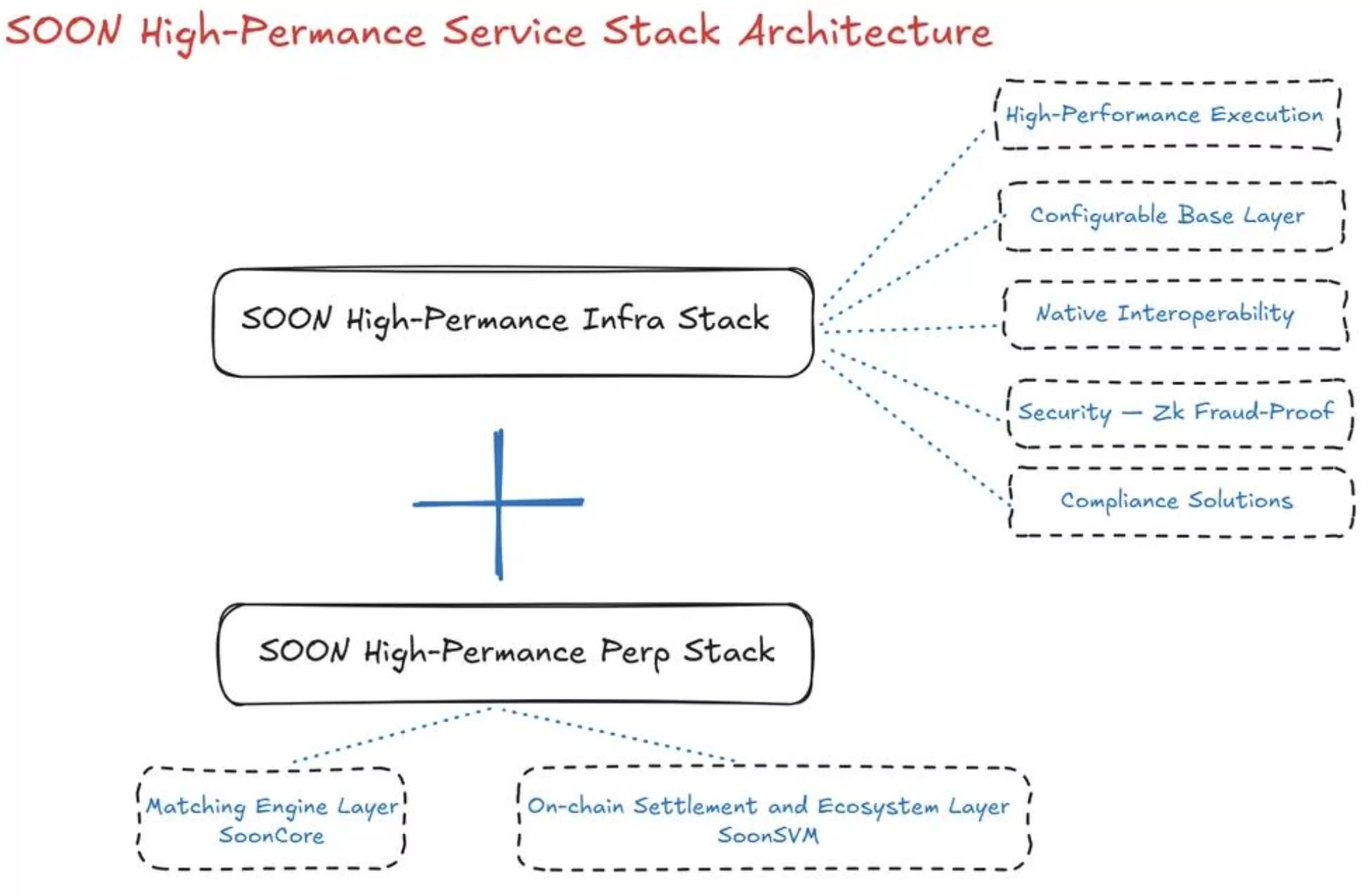

SOON, formerly known as solana Optimistic Network, has announced a rebrand and the launch of two new products: the SOON High-Performance Infra Stack and the SOON Perp Stack.

The SOON Infra Stack allows users to deploy their own custom Solana VIRTUAL Machine (SVM) chains, which can operate as standalone L1s, L2s, or application-specific chains with built-in speed, security, and interoperability. The system packages Solana’s core performance architecture into an on-demand infrastructure layer, allowing enterprises or governments launch blockchains that perform at Web2 speed without creating a new base layer from scratch.

The SOON Perp Stack focuses on decentralized trading infrastructure, enabling users to build their own “Hyperliquid,” as the company describes it. It combines an offchain execution LAYER called SoonCore with an onchain settlement and ecosystem layer called SoonSVM. Together, they form a high-speed central limit order book (CLOB) system intended for exchanges, trading platforms, and capital market applications. The dual-layer design aims to provide the performance of TradFi systems while maintaining onchain transparency and compliance through zero-knowledge security.

“Solana remains the best performance architecture — parallelized, low-latency, deterministic, and built by an ecosystem that refuses to slow down. We’re not reinventing that. We’re extending it — bringing Web2-grade enterprises and capital markets on-chain,” said Joanna Zeng, CEO and Co-Founder of SOON.

The announcement coincides with a sharp surge in the SOON token, which has risen over 60% in the past 24 hours following several key catalysts. Most notably, its recent listing on Kraken triggered a breakout past the critical $0.42 resistance, propelling the token toward August’s liquidity range. Despite typical expectations of a pause or retracement after breaking a key level, SOON price continued climbing and is now trading at $0.81, just 17% below its ATH from May.

The rally has been further supported by growing engagement on TON Station, where users earn SOON through play-to-earn challenges.

Technicals, however, signal caution as the RSI is extremely overbought at 88, suggesting an imminent pullback, possibly toward $0.60 or back to the previous breakout level at around $0.42.