Solana Cements Institutional Dominance in Real-World Asset Revolution

Solana's blockchain isn't just surviving—it's becoming the backbone for institutional real-world asset tokenization.

The Infrastructure Play

Major financial institutions are bypassing traditional finance rails, flocking to Solana's high-throughput network for RWA deployment. Transaction speeds that leave legacy systems choking on dust.

RedStone's latest analysis reveals what insiders knew months ago—the smart money already positioned itself. Tokenized real estate, commodities, and private equity finding their digital home on Solana's rails.

Meanwhile, traditional finance veterans still debate whether blockchain is 'here to stay'—classic Wall Street timing, always late to their own funeral.

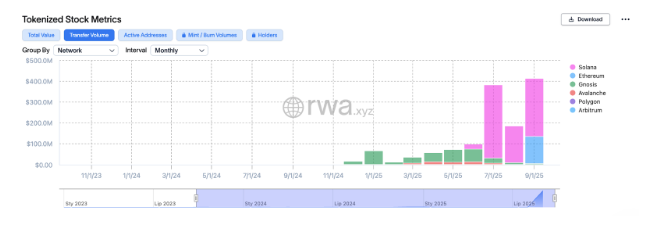

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken, which aim to enable fast and low-cost transfers for their users.

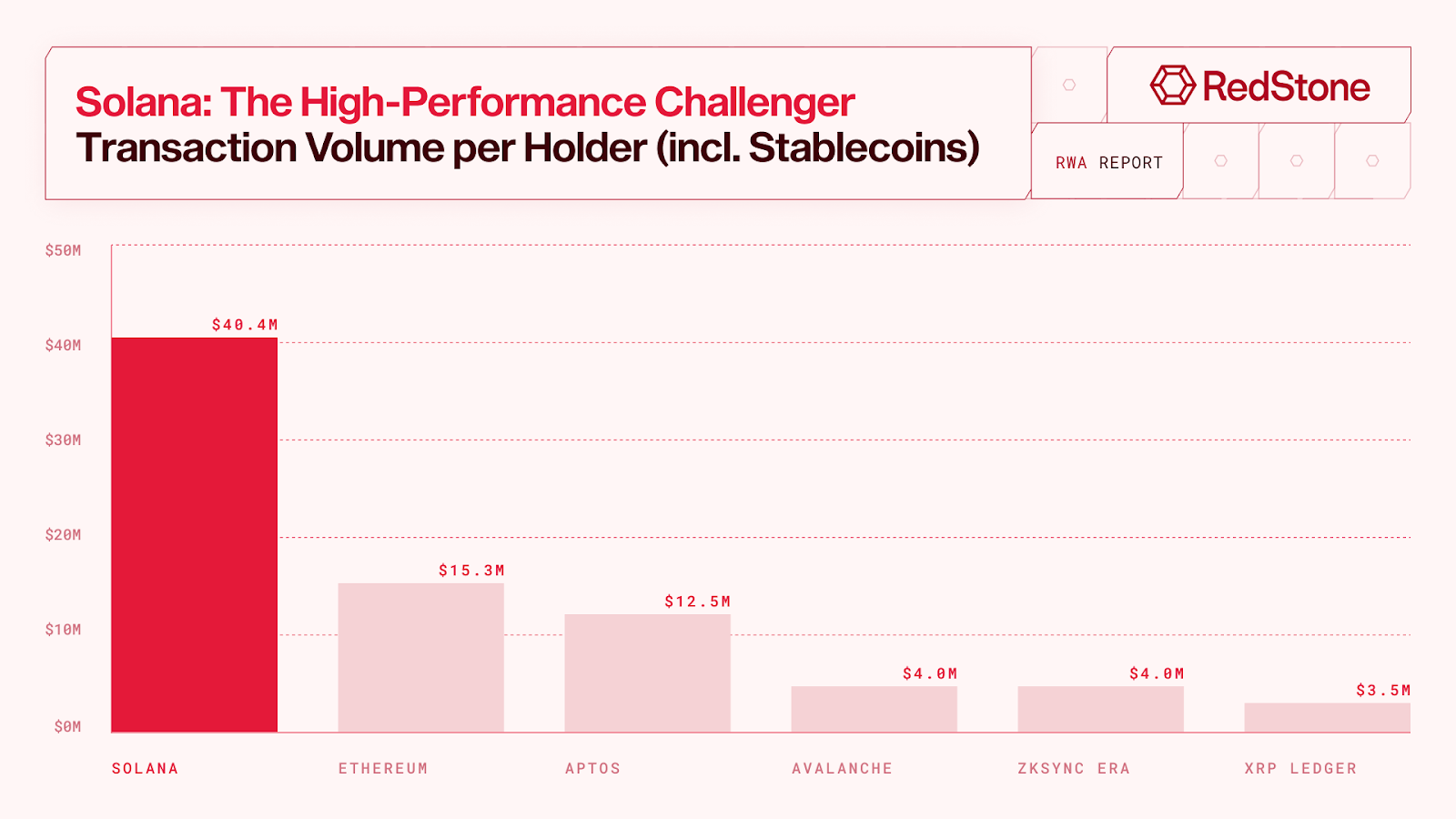

Solana dominates through performance

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

“For RWAs, there are really only 2 places: It’s either ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.