Bitcoin’s CME Gap Sets Stage for Explosive ’Uptober’ Rally: Americas Crypto Watch

Bitcoin teeters on the edge of a CME futures gap as October's bullish seasonality kicks in—traders brace for volatility while eyeing historical patterns that could propel prices upward.

The Gap Phenomenon

CME's weekend closure creates pricing voids that Bitcoin frequently fills—creating gravitational pull on spot markets. These gaps have become self-fulfilling prophecies in crypto's leveraged landscape.

Seasonal Tailwinds

October's historical outperformance—dubbed 'Uptober'—combines with technical setups to create perfect storm conditions. Past data shows average 25% returns during this period, though past performance never guarantees future results (except in marketing materials).

Institutional Positioning

Futures open interest climbs alongside options volume—smart money builds positions ahead of what could be Q4's defining move. The CME-Binance basis trade reveals professional versus retail sentiment splits.

Regulatory Crosscurrents

While technicals align, macro uncertainties linger—SEC decisions on spot ETFs and stablecoin legislation could override chart patterns. Because nothing says 'free market' like waiting for government paperwork.

Bottom Line: Gaps get filled, seasons trend—but in crypto, the only certainty is that your stop-loss will get hunted.

What to Watch

- Crypto

- Sept. 29, 8:00 p.m.: PancakeSwap (CAKE) discontinues support for Polygon zkEVM liquidity pools and Perpetual V1 orderbook. Users must withdraw funds by the deadline.

- Macro

- Sept. 29, 7:30 a.m.: Fed Governor Christopher J. Waller gives a speech on "Payments" in Frankfurt.

- Sept. 29, 10:30 a.m.: Sept. Dallas Fed Manufacturing Index (Prev. -1.8)

- Sept. 29, 1 p.m.: U.S. agencies SEC and CFTC hold a roundtable on regulatory harmonization efforts. Watch live.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

- Governance votes & calls

- Lido DAO is voting on the design and implementation of its Lido V3 upgrade, which among other things introduces staking vaults (stVaults) that allow users to select specific staking operators. Voting ends Sept. 29.

- Unlocks

- Nothing scheduled.

- Token Launches

- Sept. 29: Anoma (XAN) to be listed on KuCoin.

- Sept. 29: Ronin (RON) treasury buybacks begin.

- Sept. 29: Falcon Finance (FF) to be listed on Binance, BingX, KuCoin, Gate.io, Bitget and others.

Conferences

- Sept. 29: CoinFerenceX Singapore

- Day 1 of 2: Sonic Summit 2025 (Singapore)

Token Talk

By Oliver Knight

- Plasma’s native token, XPL, is beginning to cool off following its red-hot trading debut. The Tether-backed token is changing hands at $1.29, down 12% over the past 24 hours, as daily trading volume slipped 9% to $2.3 billion.

- On-chain activity, however, tells a different story, with deposits rising 13.7% to $5.5 billion in the same period. Much of that capital is flowing into yield-generating products like Plasma Saving Vaults, which currently offer around 20% annualized returns on lending vaults.

- The combination of attractive yields and rapid inflows has helped Plasma quickly climb the blockchain rankings, already overtaking Coinbase-backed Base in terms of total value locked, according to data from DeFiLlama.

- While trading activity for XPL has cooled, inflows suggest strong investor appetite during a relative lull in the wider crypto markets as assets like BTC and ETH fell back to respective levels of support at the tail end of last week.

- It remains to be seen how well Plasma and its protocols fare during a bullish market phase, but the stablecoin-focused blockchain has already earned its fruits when the market is under pressure.

Derivatives Positioning

- Overall BTC futures open interest has dropped to roughly $29 billion from a recent high of $32 billion, indicating that traders are reducing their exposure.

- At the same time, the three-month annualized basis remains compressed at around 6%, making the basis trade less profitable.

- In essence, the market is showing a clear shift from a bullish bias as traders unwind their long positions and a growing number of shorts enter the market.

- In options, the BTC Implied Volatility Term Structure shows an upward-sloping curve while the 25 delta skew for short-term options (1-week, 1-month) has increased, suggesting that some traders are paying a premium for calls over puts, indicating a bullish bias.

- This is directly contradicted by the 24-hour put-call volume, which shows puts dominating with 58.43% of contracts traded, a sign that a large number of traders are still seeking downside protection.

- The divergence suggests a highly polarized market where some are betting on a short-term rally while others are actively hedging against further declines, leading to a state of indecision and mixed sentiment.

- BTC funding rates have recently turned negative, suggesting a growing bearish sentiment. After holding steady for most of the week, the annualized funding rate on Hyperliquid dropped significantly to a negative -6%. This indicates a strong conviction from traders who are shorting BTC on that platform.

- Meanwhile, funding rates on major venues like Binance and OKX remain near neutral. The overall trend, particularly the sharp drop on Hyperliquid, suggests that traders are actively taking risk off the table and positioning for a decline in BTC prices.

- Coinglass data shows $350 million in 24 hour liquidations, with a 24-76 split between longs and shorts. ETH ($130 million), BTC ($52 million) and SOL ($37 million) were the leaders in terms of notional liquidations. Binance's liquidation heatmap indicates $113,000 as a core liquidation level to monitor, in case of a price rise.

Market Movements

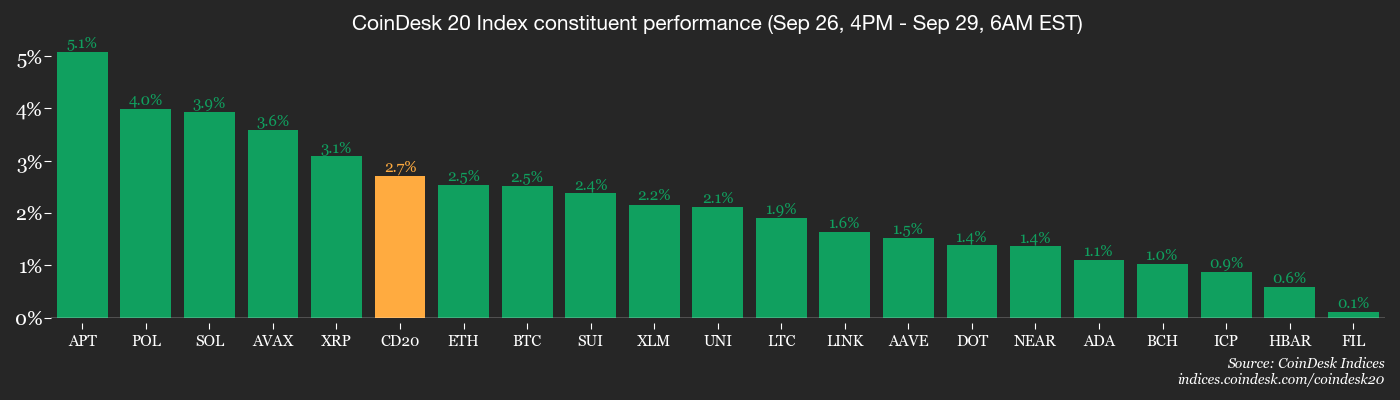

- BTC is up 2.54% from 4 p.m. ET Friday at $112,164.29 (24hrs: +2.49%)

- ETH is up 3.1% at $4,136.88 (24hrs: +3.38%)

- CoinDesk 20 is up 2.76% at 3,985.34 (24hrs: +3.2%)

- Ether CESR Composite Staking Rate is down 9 bps at 2.81%

- BTC funding rate is at -0.0012% (-1.2855% annualized) on Binance

- DXY is down 0.19% at 97.96

- Gold futures are up 0.76% at $3,838.10

- Silver futures are up 0.73% at $46.99

- Nikkei 225 closed down 0.69% at 45,043.75

- Hang Seng closed up 1.89% at 26,622.88

- FTSE is up 0.58% at 9,338.77

- Euro Stoxx 50 is up 0.14% at 5,507.35

- DJIA closed on Friday up 0.65% at 46,247.29

- S&P 500 closed up 0.59% at 6,643.70

- Nasdaq Composite closed up 0.44% at 22,484.07

- S&P/TSX Composite closed up 0.1% at 29,761.28

- S&P 40 Latin America closed up 0.43% at 2,920.80

- U.S. 10-Year Treasury rate is down 4.4 bps at 4.143%

- E-mini S&P 500 futures are up 0.51% at 6,730.75

- E-mini Nasdaq-100 futures are up 0.64% at 24,885.75

- E-mini Dow Jones Industrial Average Index are up 0.4% at 46,741.00

Bitcoin Stats

- BTC Dominance: 58.61% (0.11%)

- Ether to bitcoin ratio: 0.03687 (-0.16%)

- Hashrate (seven-day moving average): 1,051 EH/s

- Hashprice (spot): $49.78

- Total Fees: 2.19 BTC / $241,364

- CME Futures Open Interest: 134,900 BTC

- BTC priced in gold: 29.6 oz

- BTC vs gold market cap: 8.35%

Technical Analysis

- Ether has rebounded from the 100-day exponential moving average, reclaiming ground above the key psychological level of $4,000. While this recovery signals resilience, the short-term trend remains tilted to the downside, with the 50-day EMA — currently near $4,210 — acting as immediate resistance.

- For bullish momentum to build, traders will be watching closely to see if ETH can continue to respect weekly support and establish acceptance above the recent weekly swing low.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $312.59 (+1.92%), +2.26% at $319.66 in pre-market

- Circle Internet (CRCL): closed at $126.99 (+1.87%), +1.98% at $129.50

- Galaxy Digital (GLXY): closed at $30.90 (-3.78%), +3.27% at $31.91

- Bullish (BLSH): closed at $62.59 (+1.23%), +1.9% at $63.78

- MARA Holdings (MARA): closed at $16.13 (+0.37%), +2.67% at $16.56

- Riot Platforms (RIOT): closed at $17.69 (+5.68%), +3% at $18.22

- Core Scientific (CORZ): closed at $16.85 (+0.06%), +2.08% at $17.20

- CleanSpark (CLSK): closed at $12.96 (-5.26%), +3.16% at $13.37

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.61 (-3.68%)

- Exodus Movement (EXOD): closed at $28.51 (-1.35%), +2.81% at $29.31

- Strategy (MSTR): closed at $309.06 (+2.78%), +2.3% at $316.17

- Semler Scientific (SMLR): closed at $28.31 (-6.29%), +2.3% at $28.96

- SharpLink Gaming (SBET): closed at $16 (-1.9%), +1.94% at $16.3 1

- Upexi (UPXI): closed at $5.22 (-1.23%), +1.63% at $5.30

- Lite Strategy (LITS): closed at $2.56 (+0.79%), +4.3% at $2.67

ETF Flows

Spot BTC ETFs

- Daily net flows: -$418.3 million

- Cumulative net flows: $56.78 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: -$248.4 million

- Cumulative net flows: $13.14 billion

- Total ETH holdings ~6.52 million

Source: Farside Investors

While You Were Sleeping

- Swift to Build a Blockchain-Based Ledger for Financial Firms (Bloomberg): The first prototype, developed in collaboration with more than 30 banks, will use Joe Lubin-led Consensys' technology for real-time cross-border payments.

- Revolut Weighs $75B Dual Listing in New York and London (Sunday Times): The move could be a vote of confidence for London's financial center and would make fintech the first company to simultaneously list in New York and enter the FTSE 100.

- Economists Favour Christopher Waller to Lead Fed but Expect Trump to Pick a Loyalist (Financial Times): Economists surveyed by the FT expect Kevin Hassett, chair of the White House’s National Economic Council, to prevail, citing Trump’s focus on loyalty and aggressive rate cuts.

- Maple Finance to Tie Into Elwood to Bring Institutional Credit Strategies On-Chain (CoinDesk): The integration is meant to give banks and asset managers smoother entry into digital credit markets by pairing on-chain lending strategies with institutional trading and risk systems.

- Fear and Hope in Venezuela as U.S. Warships Lurk (The New York Times): As U.S. warships circle and threats intensify, Venezuelans remain split between calls for foreign-backed regime change, fear of chaos after Maduro and weary resignation that little will change.