Solana Battles at $200 Support Level as Open Interest Undergoes Critical Reset

Solana's momentum hits a wall at the crucial $200 threshold—just as derivatives markets flush out speculative positions.

The Support Standoff

Traders watch the $200 level like hawks. This isn't just psychological support—it's where futures markets are quietly resetting open interest after last week's volatility. Liquidations have trimmed over-leveraged positions, creating cleaner footing for the next move.

Derivatives Data Tells the Tale

Open interest dropping while price consolidates? That's the market taking a breather. Too many bulls got squeezed when SOL tested resistance, forcing a healthy pullback. Now the question becomes whether institutional money steps in at this level—or if retail panic triggers another leg down.

The Bigger Picture

Remember: Solana's infrastructure keeps growing despite price action. Developer activity hits new records weekly, and network upgrades continue rolling out. Short-term traders focus on charts while builders keep shipping—typical crypto divergence where the real value accumulates during sideways action.

Will $200 hold? The options market suggests bigger players are betting on a bounce, but in crypto, support levels sometimes break just to trap the maximum number of participants. After all, what's finance without a little predictable unpredictability?

Solana price key technical points

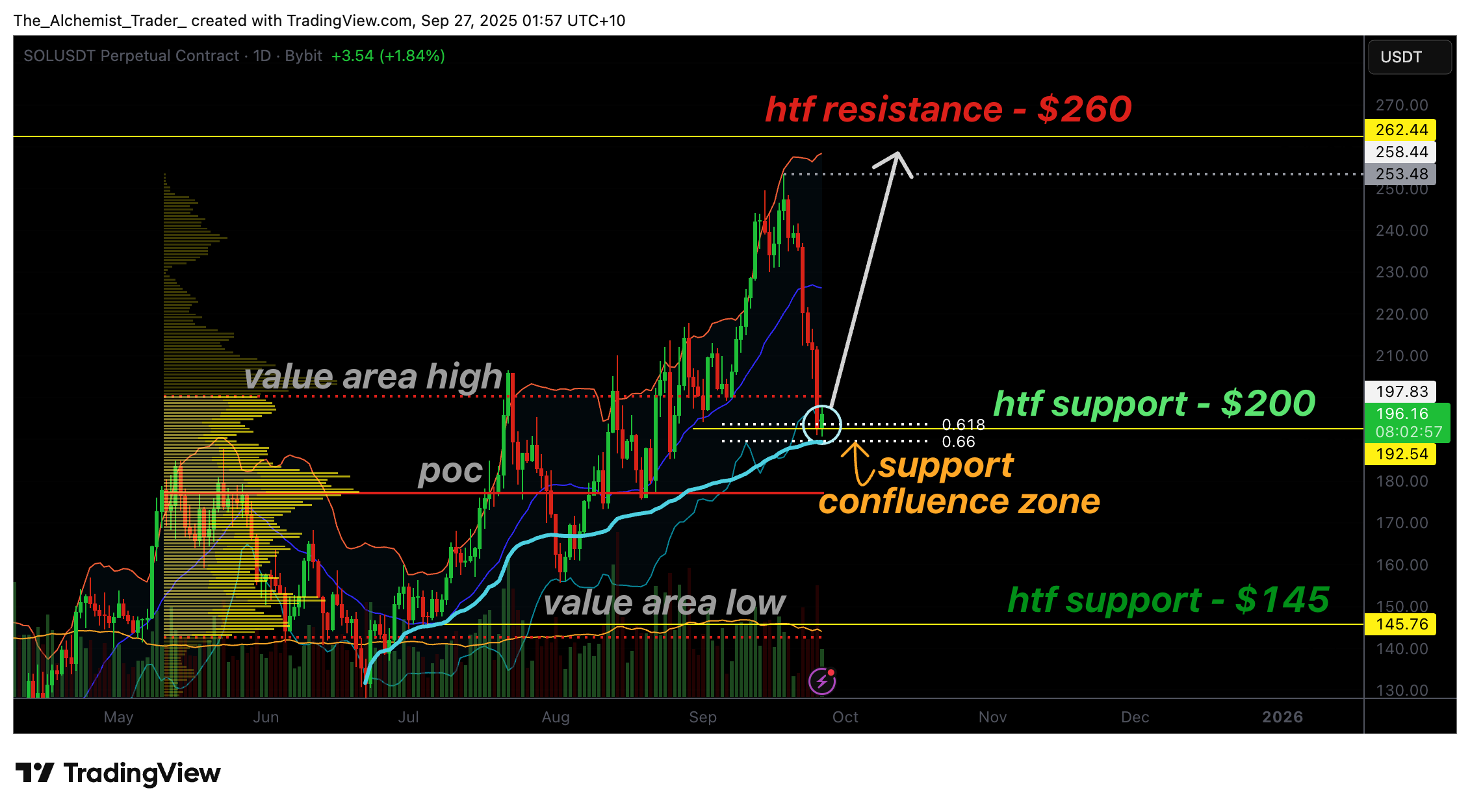

- $200 Support Zone: Solana is holding at $200, supported by the 0.618 Fibonacci retracement, VWAP, and high timeframe levels.

- Open Interest Reset: Contracts have been closed following the correction, setting the stage for new positions to fuel the next move.

- Bullish Structure: Higher highs and higher lows remain intact, supporting continuation toward $260 resistance and beyond.

The correction from Solana’s attempt to test the $260 resistance led to a sharp decline, sending price directly into the $200 region. This level, now reinforced by the 0.618 Fibonacci retracement and VWAP support, has acted as a strong floor for buyers.

The psychological significance of $200 has further enhanced its role as a pivot for potential reversal. Price has stalled here over the past sessions, suggesting market participants are waiting for confirmation before committing to the next trend move.

From a structural perspective, Solana’s broader uptrend remains intact. The sequence of consecutive higher highs and higher lows has not been broken, which means the current MOVE can still be classified as a higher low in the context of the larger bullish trend. Holding above $200 increases the probability of continuation toward $260 and potentially higher resistance levels.

One of the most notable developments during this correction has been the reset of open interest. As price fell, many active contracts were closed, returning open interest to neutral levels. This is a healthy sign for market structure because it clears excessive leverage and creates the conditions for fresh positions to open.

When open interest begins to rise again alongside increasing price, it will indicate new bullish flows entering the market, adding momentum for continuation higher.

What to expect in the coming price action

If solana continues to defend the $200 support, the probability of a bullish rotation increases. With market structure intact and open interest reset, conditions favor another leg higher toward $260.

A sustained breakdown below $200 WOULD weaken the bullish outlook, but for now, the confluence of support and reset positioning points to continuation of the broader uptrend.