AgriFORCE Rebrands to AVAX One, Plans $550M Raise for Avalanche Treasury Strategy

Corporate reinvention hits crypto: AgriFORCE sheds its agricultural roots to become AVAX One, betting big on Avalanche's ecosystem with a massive treasury play.

The $550 Million Gambit

AVAX One isn't just changing its name—it's loading up for a strategic assault on the Avalanche treasury landscape. The planned $550 million capital raise signals one of the most aggressive moves into layer-1 treasury management this cycle.

Treasury Strategy Unleashed

The rebrand positions the newly minted entity as a dedicated vehicle for Avalanche ecosystem growth. Instead of farming crops, they'll be farming yield—deploying capital across Avalanche's DeFi protocols, staking operations, and ecosystem projects.

Wall Street Meets Crypto

Because nothing says 'web3 innovation' like a good old-fashioned nine-figure fundraise—proving that even in decentralized finance, the traditional playbook of 'more money, more problems' still applies. The move could either turbocharge Avalanche's ecosystem or become another case study in corporate crypto confusion.

TLDR

- AgriFORCE Growing Systems rebrands to AVAX One and pivots to building an Avalanche token treasury

- Company plans to raise $550 million and accumulate over $700 million worth of AVAX tokens

- Anthony Scaramucci joins as advisory board head, Matt Zhang from Hivemind Capital leads board of directors

- Stock surged 132-200% following the announcement Monday

- Over 50 backers include Galaxy Digital, Kraken, ParaFi, and other major crypto firms

AgriFORCE Growing Systems announced Monday it will rebrand as AVAX One and pivot to become the first Nasdaq-listed company focused on accumulating Avalanche tokens. The agricultural technology company’s stock surged over 200% at market open following the announcement.

🚨BREAKING: NASDAQ-listed AgriForce is rebranding as AVAX One and plans to raise $500M to scoop up $AVAX! pic.twitter.com/JPwlrrPVGV

— Coin Bureau (@coinbureau) September 22, 2025

The company plans to raise $550 million to build a treasury centered on AVAX, the native token of the Avalanche blockchain. Their goal is to accumulate more than $700 million worth of AVAX tokens as part of a long-term strategy.

Anthony Scaramucci, founder of SkyBridge Capital, will lead the company’s strategic advisory board. Matt Zhang from Hivemind Capital will serve as chairman of the board of directors.

The funding strategy includes a $300 million private investment in public equity deal, subject to shareholder approval. The company also plans to raise another $250 million through equity-linked instruments.

Hivemind Capital is leading the raise with participation from over 50 backers. Major investors include ParaFi, Galaxy Digital, Kraken, Big Brain Holdings, and FalconX.

Strategic Focus on Avalanche Network

Zhang told reporters that Avalanche was “a very deliberate choice” for the treasury strategy. His team had turned away four other blockchain foundations before selecting Avalanche for its focus on onchain finance and partnerships.

Staking plays a central role in the company’s business model. The practice involves locking up crypto tokens to secure a blockchain and earn yield in return.

Zhang said staking makes the business profitable from day one rather than operating as a passive treasury. Based on current validator rewards of about 6.7% annual yield, a $700 million AVAX position could generate around $46.9 million in yearly rewards.

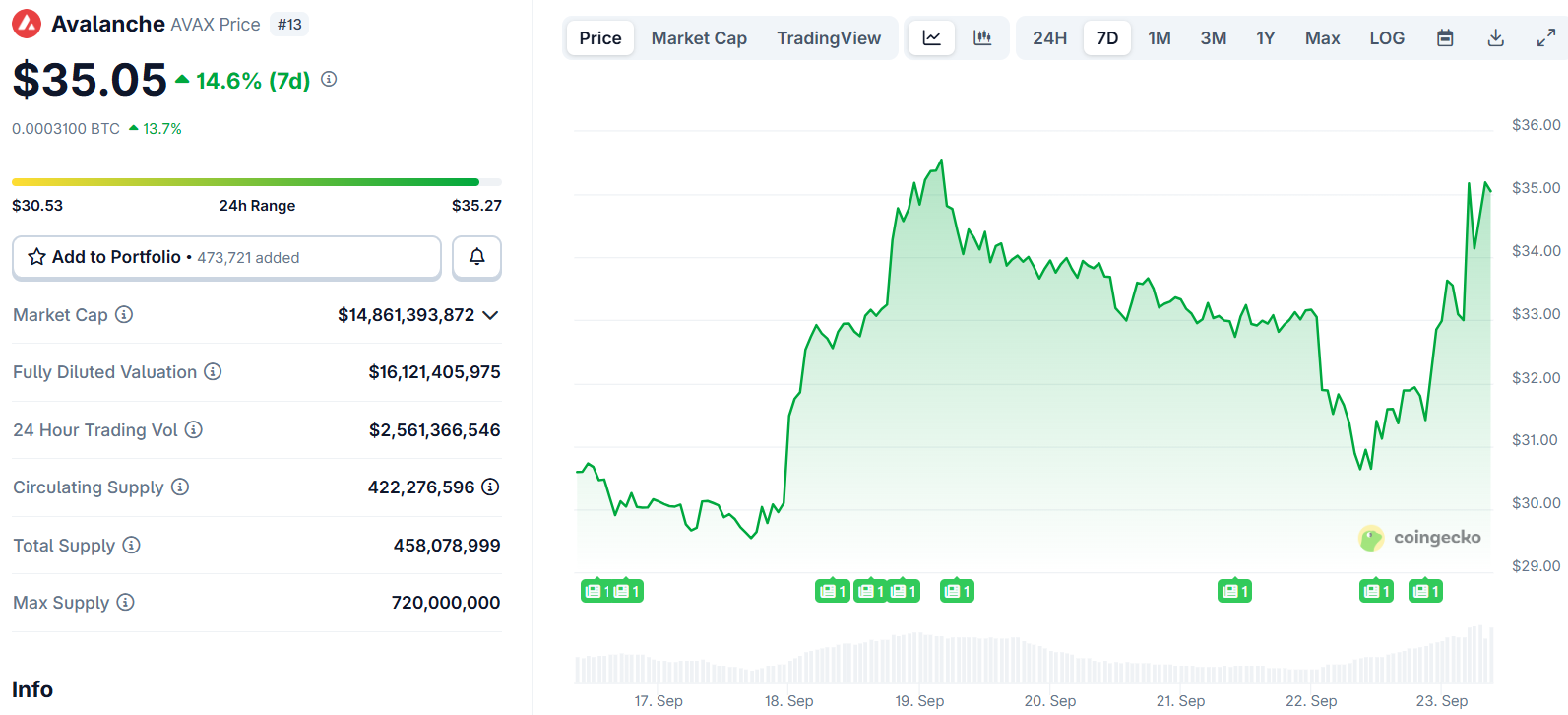

AVAX was trading at $31.76 at the time of the announcement. At that price, the planned $700 million investment WOULD amount to approximately 22 million AVAX tokens.

Growing Institutional Interest in Avalanche

The announcement comes less than two weeks after the Avalanche Foundation revealed plans to raise $1 billion for digital asset treasury companies. The foundation is specifically targeting AVAX accumulation initiatives.

Avalanche has gained traction in Web3 gaming recently. In June, the blockchain surpassed 1 million daily transactions twice in one week, driven primarily by MapleStory Universe activity.

Institutional interest in AVAX has been building throughout 2024. Sweden-based asset manager Vitune introduced a crypto exchange-traded product in February, exposing Finnish investors to AVAX.

VanEck filed with the SEC in March to launch an Avalanche exchange-traded fund. Grayscale Investments sought to convert its existing Avalanche Trust into an ETF in August.

At the end of August, Avalanche led all blockchains in transaction growth. The network recorded a 66% increase in one week with over 11.9 million transactions.

The user growth followed an announcement that the US Department of Commerce plans to post real GDP data on several blockchains, including Avalanche. AVAX has climbed around 24% in the past two weeks, though it remains far below its November 2021 all-time high of $144.96.

AGRI stock opened at $7.30 on Monday after closing at $2.41 on Friday, finishing the trading day at $5.73 for a 137% gain.