Cardano (ADA) Price Alert: Dormant Wallet Activity Sparks Fresh Selling Pressure

Sleeping giants awaken—and ADA holders feel the tremors.

Dormant ADA wallets suddenly spring to life, triggering cascading sell orders across major exchanges. The movement from long-inactive addresses creates immediate downward momentum that catches the market off guard.

Technical indicators flash warning signs as selling pressure intensifies. Resistance levels crumble under the weight of unexpected volume from sources everyone assumed had left the game.

Traders scramble to adjust positions while the classic crypto pattern plays out: when wallets that haven't moved in years suddenly activate, someone knows something the rest of the market doesn't. Whether it's strategic profit-taking or portfolio rebalancing, the effect remains the same—price discovery gets messy.

Meanwhile, traditional finance analysts scratch their heads at yet another example of crypto markets moving on signals they can't find in their spreadsheets. Guess quarterly earnings reports don't cover 'zombie wallet resurrection' as a fundamental metric.

TLDR

- Cardano (ADA) broke below ascending trendline support, signaling potential deeper correction ahead

- Dormant wallet activity has increased, creating fresh selling pressure on exchanges

- Technical indicators show bearish momentum with RSI at 40 and MACD crossover confirming downtrend

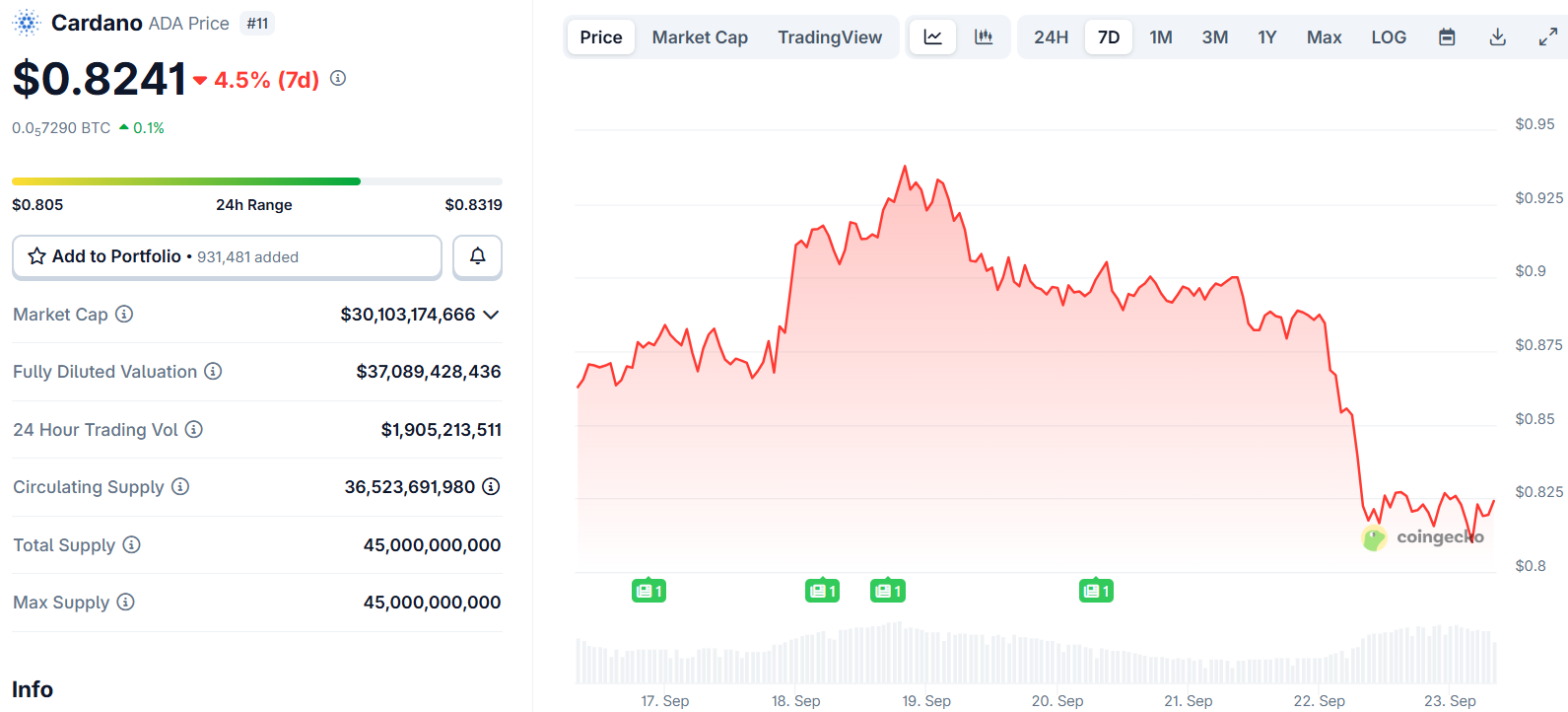

- ADA currently trading around $0.81, down 6.1% after breaking $0.84 support level

- Next key support target sits at $0.76, representing 50% retracement from recent lows to highs

Cardano price has entered correction territory after breaking below a key ascending trendline on Monday. The cryptocurrency now trades at $0.81, extending losses from the $0.84 support level.

The technical breakdown comes as on-chain data reveals increased activity from dormant wallets. These long-inactive addresses are moving tokens to exchanges, creating fresh selling pressure.

Santiment’s Age Consumed index shows recent spikes that historically precede price declines. The metric tracks when dormant tokens begin moving after extended periods of inactivity.

%20[07-1758596946833-1758596946836.32.59,%2023%20Sep,%202025].png) Source: SantimentThe latest uptick occurred Monday, coinciding with ADA’s trendline break. Previous spikes in this indicator have marked local price tops as holders transferred tokens from storage to trading platforms.

Source: SantimentThe latest uptick occurred Monday, coinciding with ADA’s trendline break. Previous spikes in this indicator have marked local price tops as holders transferred tokens from storage to trading platforms.

Selling Pressure Builds Across Multiple Metrics

CryptoQuant data reinforces the bearish outlook through the Taker CVD indicator. This metric measures the cumulative difference between buy and sell volumes over three months.

%20(1)-1758596968053-1758596968055.png)

ADA’s Taker CVD turned negative in mid-August and continues declining. The persistent negative readings indicate sustained selling pressure outweighing buying interest.

When the 90-day CVD decreases while negative, it signals a Taker Sell Dominant Phase. This phase typically coincides with extended price weakness as market participants favor selling over buying.

The combination of dormant wallet activity and negative volume flows creates a challenging environment for price recovery.

Technical Indicators Point Lower

The daily chart shows ADA broke its ascending trendline connecting multiple lows since early July. This trendline had provided support during the summer rally to $1.02 in August.

Monday’s 6.1% decline pushed the cryptocurrency below the $0.84 daily support level. The break confirms the start of a deeper correction phase.

The Relative Strength Index sits at 40, below the neutral 50 level. This reading indicates bearish momentum has taken control of price action.

The Moving Average Convergence Divergence also flashed a bearish crossover Monday. This technical signal typically precedes extended downward moves.

Target Levels and Recovery Scenarios

Bears are targeting the $0.76 support level as the next major downside objective. This level represents a 50% retracement from June’s $0.51 low to August’s $1.02 high.

The $0.76 area has served as support during previous corrections. A test of this level WOULD complete approximately 25% decline from current levels.

Recovery remains possible if buyers emerge at current prices. A bounce back above $0.84 would restore the previous support as resistance.

However, the technical evidence favors continued weakness in the NEAR term. Multiple indicators align to suggest lower prices ahead.

ADA closed Monday below $0.84 after breaking the ascending trendline that had supported prices since July.