$4.3 Billion Crypto Options Expiry: Bitcoin and Ethereum Brace for Major Volatility Surge

Massive crypto derivatives event triggers market anxiety as billions hang in the balance.

The Gamma Squeeze Catalyst

Traders scramble to hedge positions ahead of today's monumental $4.3 billion expiry—one of the largest options events in crypto history. Market makers adjust delta exposure while institutional players position for potential cascading effects.

Bitcoin's Make-or-Break Moment

BTC options totaling $2.8 billion approach expiry with concentrated put-call ratios suggesting intense battle between bulls and bears. Key strike clusters at $60K and $65K could dictate short-term price direction.

Ethereum's Volatility Play

ETH's $1.5 billion options expiry adds fuel to the fire as DeFi traders amplify positions. The second-largest cryptocurrency faces its own gamma trap with elevated implied volatility across all timeframes.

Market Impact and Trading Strategies

Expect whipsaw action as dealers dynamically hedge their exposure. Sharp moves likely in both directions—perfect conditions for those who thrive on chaos and terrible for anyone who actually needs price stability.

When Wall Street's derivative machinery grinds against crypto's 24/7 markets, someone's going to get rich—and it probably won't be the retail traders chasing momentum.

TLDR

- Over $4.3 billion in Bitcoin and Ethereum options expire today on Deribit, with $3.5 billion in BTC options and $806.75 million in ETH options

- Bitcoin options have a Put-to-Call ratio of 1.23 with max pain at $114,000, while Ethereum has a ratio of 0.99 with max pain at $4,500

- Traders expect short-term volatility during early European trading hours as markets adjust to options expiry

- Bitcoin futures open interest has climbed back toward all-time highs at $86 billion according to CoinGlass

- Next Friday September 26 will see the largest weekly Bitcoin options expiry in history worth over $18 billion

Over $4.3 billion worth of Bitcoin and ethereum options contracts will expire today on Deribit exchange. The large expiry could create short-term price volatility for both cryptocurrencies.

Bitcoin accounts for the majority of today’s expiring contracts with a notional value of $3.5 billion across 30,208 contracts. The Put-to-Call ratio stands at 1.23, indicating more bearish bets than bullish ones.

The maximum pain level for Bitcoin options sits at $114,000. This represents the strike price where most options expire worthless, causing maximum losses for option holders.

Ethereum options make up $806.75 million of today’s expiry with 177,398 contracts. The Put-to-Call ratio is 0.99, just below 1, suggesting slightly more bullish sentiment for ETH.

Ethereum’s maximum pain level is set at $4,500. With ETH trading around $4,590 at press time, the price could face downward pressure toward this level.

Market Positioning Ahead of Expiry

The balanced Put-to-Call ratios for both assets indicate traders are hedging their positions. Some are betting on higher prices while others prepare for potential selloffs.

Options had repriced ahead of the Federal Reserve’s Wednesday interest rate decision. Implied volatility ROSE while trading volume declined, showing market caution.

Bitcoin futures open interest has climbed back toward all-time highs at $86 billion according to CoinGlass data. This indicates strong institutional participation in the derivatives market.

Glassnode analysts note that 95% of bitcoin supply is currently in profit after the recent rally. The asset needs to hold above $115,200 to maintain momentum.

Today’s expiry is similar in size to last week’s $4.3 billion expiry. The consistency suggests options markets have stabilized after recent volatility.

Historical Context and Future Outlook

Recent actual volatility has increased compared to last month despite declining trading volumes. This divergence between volatility and volume is unusual for crypto markets.

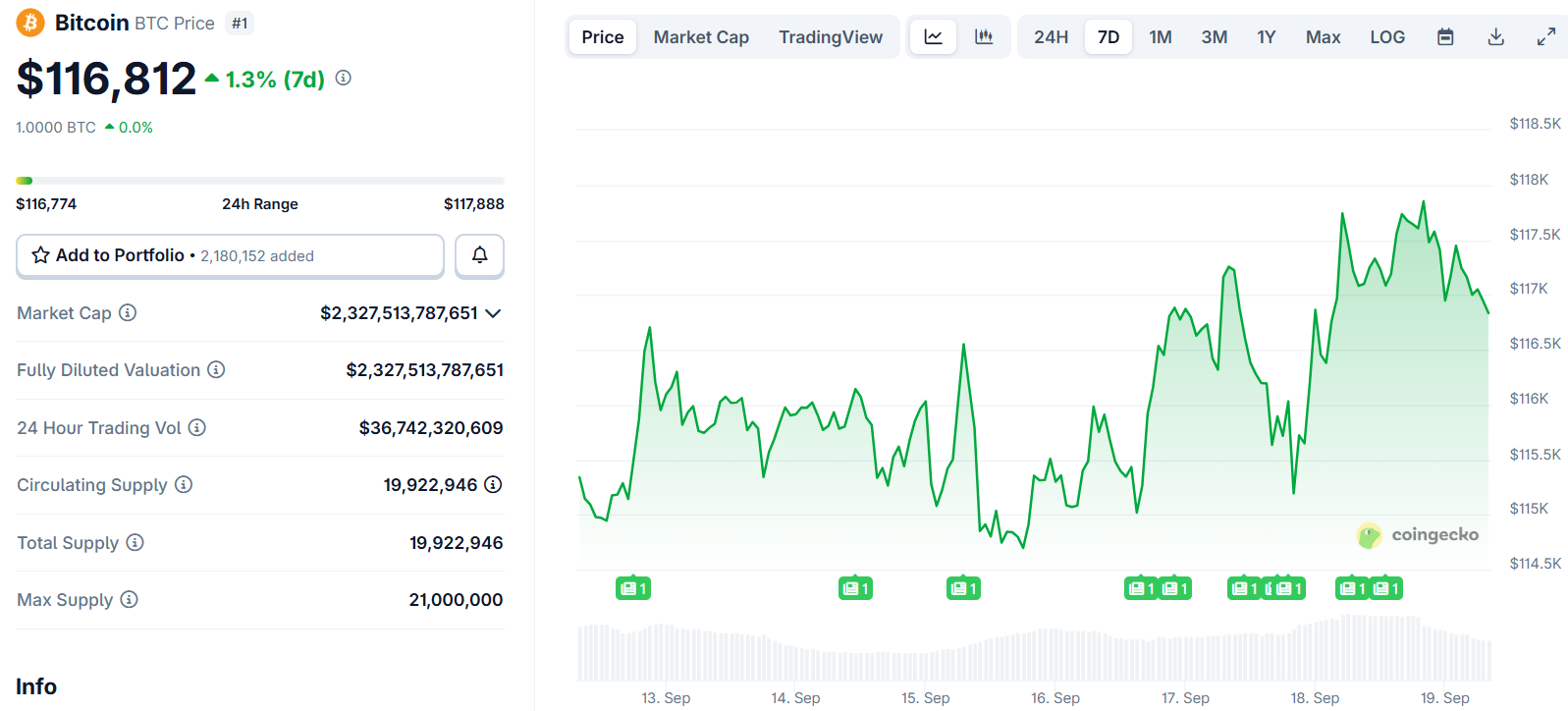

Bitcoin trading near $117,147 remains about 5.6% below its all-time high. Ethereum at current levels sits roughly 7% from its peak.

Next Friday September 26 will bring the largest weekly Bitcoin options expiry in history. Over $18 billion in notional value will expire that day.

At Bitcoin’s current price of $118,000, over $2.4 billion worth of contracts are in the money. The maximum pain for that expiry sits at $110,000.

The crypto market cap holds near $4.2 trillion despite slight overnight retreats. Digital assets have traded sideways since mid-July according to market data.

Bitcoin took a brief dip to $116,750 Thursday night before recovering above $117,000 in Asian trading Friday morning.