Cardano (ADA) Soars: Major Bank Integration and ETF Approval Fuel Explosive Momentum

Breaking: Institutional adoption hits hyperdrive as traditional finance finally catches up with blockchain innovation.

Banking Giants Embrace ADA

Wall Street's sudden love affair with Cardano isn't just talk—major global banks are integrating ADA into their digital asset divisions. They're building infrastructure that supports staking, transfers, and custody solutions. Suddenly everyone's a blockchain expert after years of dismissing crypto as a fringe experiment.

ETF Green Light Changes Everything

Regulatory approval for the first Cardano ETF opens floodgates for institutional capital. Pension funds, asset managers, and retail investors now access ADA through traditional brokerage accounts—no more wrestling with crypto exchanges or worrying about self-custody. The irony? Same institutions that called crypto dangerous now profit from selling it to their clients.

Market Momentum Builds

Trading volumes spike 300% as momentum traders pile in. Technical indicators flash bullish signals across multiple timeframes. The combination of institutional validation and easier access creates perfect conditions for sustained upward movement. Even the usual skeptics are quietly allocating portions of their portfolios—nothing makes traditional finance believe in innovation like the chance to monetize it.

Cardano's proving that sometimes the slowest, most methodical approach wins the race—while Wall Street firms suddenly remember how to read whitepapers when there's commission revenue involved.

TLDR

- OpenBank, Santander’s digital arm, now offers Cardano trading to over 2 million clients across Europe

- SEC approval odds for Grayscale ADA ETF have jumped to 87% with October 22 deadline approaching

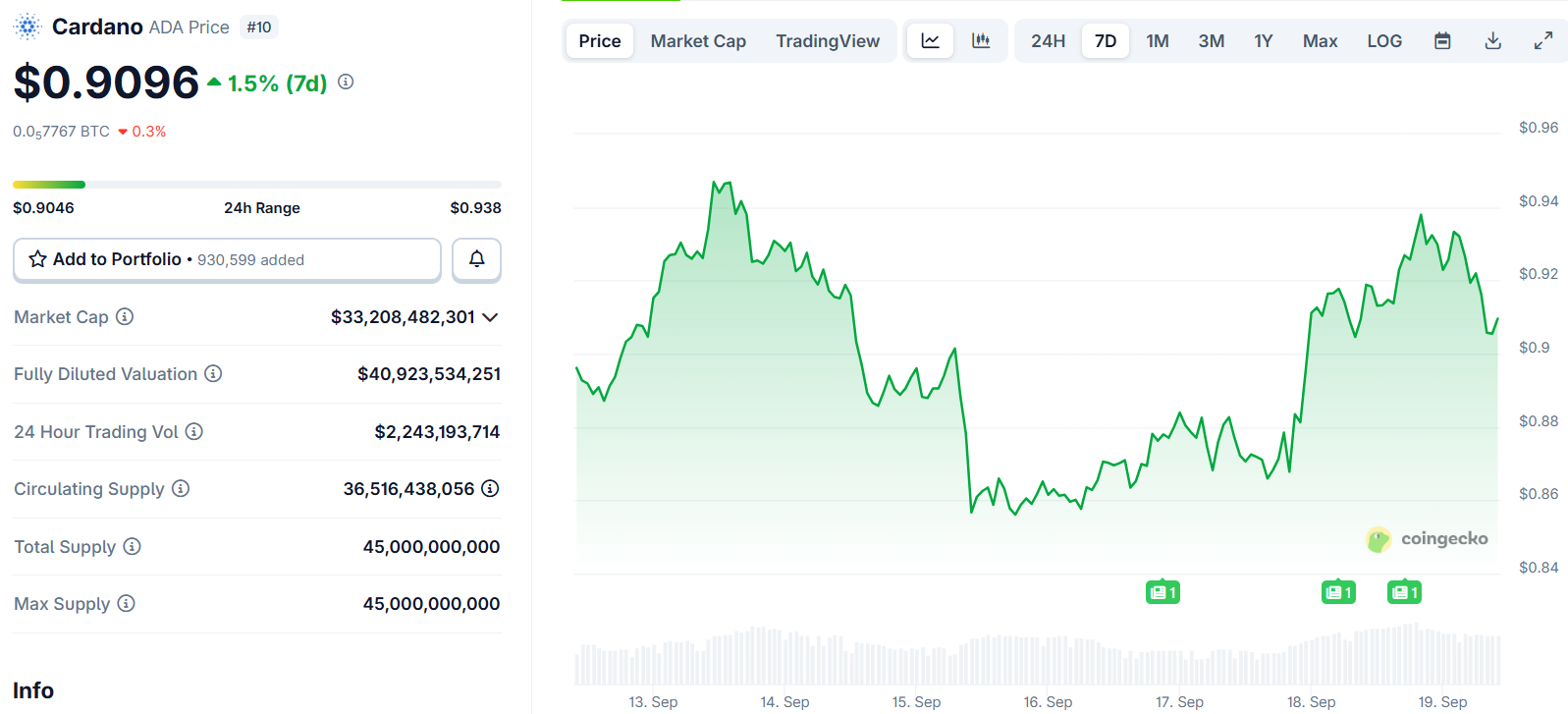

- ADA price remains above key technical indicators including Ichimoku cloud and moving averages

- The integration allows customers to trade ADA alongside stocks and bonds in one portfolio

- Technical analysis points to potential 45% price increase targeting $1.3272 resistance level

Cardano has gained substantial momentum through two major developments that could reshape its market position. The cryptocurrency now trades above crucial technical levels while institutional adoption accelerates.

OpenBank, the digital banking division of Santander, launched crypto services on September 16, 2025. The platform allows over 2 million customers across Germany and Spain to buy, sell, and hold ADA directly in their portfolios. The service charges a flat 1.49% transaction fee with a minimum purchase of €1.

Santander’s digital bank, OpenBank, has added Cardano’s $ADA.

Clients can now buy, sell, and hold ADA directly alongside stocks, bonds, and ETFs in their portfolios.

A major step in bringing Cardano into mainstream European finance.

Full article ↓https://t.co/6PFgT0J0bJ pic.twitter.com/0jytkhRVwl

— TapTools (@TapTools) September 17, 2025

The integration places cardano alongside traditional assets like stocks, bonds, and ETFs in the same dashboard. Customers no longer need third-party exchanges to access ADA. OpenBank plans to expand the service across Europe, potentially exposing millions more users to Cardano.

Growing Institutional Interest

The bank integration comes as regulatory approval for a Cardano ETF appears increasingly likely. The SEC has set October 22 as the final deadline for the Grayscale ADA ETF decision. Market predictions on Polymarket show 87% odds that the agency will approve the fund by that date.

The SEC recently approved generic standards for altcoin ETF listings, requiring funds to have Coinbase futures products. Cardano meets this requirement. The agency has already approved multiple ethereum ETFs from companies like BlackRock and Franklin Templeton.

OpenBank serves as Europe’s largest fully digital bank by deposits. The platform operates in Spain, Germany, the Netherlands, Portugal, Mexico, and the United States. Its cloud-based infrastructure allows faster service rollouts compared to traditional banks.

Technical Patterns Support Upward Movement

Daily chart analysis reveals bullish patterns for ADA price action. The token formed a double-bottom pattern at $0.5025, reaching these levels in both April and June 2025. This formation typically signals a bullish reversal.

ADA currently trades above the pattern’s neckline at $0.8650, the May 2025 high. The price has moved above the Ichimoku cloud indicator, suggesting bulls have gained control. The cryptocurrency also formed a golden cross pattern on July 22, remaining above both moving averages since then.

The Murrey Math Lines tool shows ADA trading above its strong pivot reverse level. These technical factors align with the fundamental developments from institutional adoption.

Technical targets point to $1.3272 as the next major resistance level. This represents the December 2024 high and sits approximately 45% above current prices. A break below $0.8300 support WOULD invalidate the bullish outlook.

OpenBank’s crypto service started in Germany with Spain following soon after. The bank’s RoboAdvisor investment product will incorporate crypto holdings into automated portfolio management. This creates seamless integration between digital assets and traditional finance.

The timing aligns with growing institutional acceptance of cryptocurrencies in Europe. OpenBank’s MOVE demonstrates how major financial institutions are bridging traditional banking with blockchain networks.

Cardano now appears in the same interface where customers manage their conventional investments, potentially normalizing crypto ownership for mainstream users.