Michael Saylor’s Strategy Scoops Up 525 BTC as Bitcoin’s Financial Dominance Grows

Bitcoin just scored another corporate convert—and this one's playing for keeps.

The Acquisition Breakdown

Strategy's latest move isn't just a dip-buy—it's a full-throated endorsement of crypto's original heavyweight. Snapping up 525 BTC signals more than confidence; it's a bet against traditional finance's shaky foundations.

Saylor's Stamp of Approval

When MicroStrategy's founder talks, institutions listen. His praise isn't just lip service—it's a roadmap for corporations tired of watching inflation chew through cash reserves. Bitcoin isn't just digital gold anymore; it's becoming corporate treasury's escape hatch from monetary debasement.

The Bigger Picture

While Wall Street still debates Bitcoin's merit, pragmatists are building positions. Another 525 BTC off the market—another nail in the coffin of 'it's just a speculative asset' narratives. Funny how traditional finance still dismisses what's actively replacing their outdated playbook.

TLDR

- Strategy now holds 638,985 BTC worth $73.4B after its latest 525 BTC purchase.

- Michael Saylor credits Bitcoin for Strategy’s impressive long-term performance.

- Strategy’s recent Bitcoin purchase was funded through preferred stock sales.

- Despite market volatility, Strategy continues acquiring Bitcoin weekly.

Strategy, the company formerly known as MicroStrategy, has once again increased its Bitcoin stash, acquiring 525 BTC for $60.2 million. This marks the company’s seventh consecutive week of Bitcoin purchases. The latest acquisition comes as Michael Saylor, the company’s executive chairman, reiterated his belief in Bitcoin’s importance, saying, “Bitcoin deserves credit.” With this move, Strategy’s total Bitcoin holdings have now exceeded 638,000 BTC.

Latest Bitcoin Acquisition Details

Between September 8 and 14, Strategy purchased 525 BTC at an average price of $114,562 per Bitcoin. The total cost for the recent acquisition was approximately $60.2 million. This purchase follows a consistent strategy of acquiring bitcoin during periods of price fluctuations. Despite market volatility, Strategy has maintained its Bitcoin buying momentum, with no signs of slowing down.

The company’s total Bitcoin holdings now amount to 638,985 BTC, valued at about $73.4 billion. These holdings were acquired at an average price of $73,913 per Bitcoin, reflecting a significant increase in value from when they were originally purchased. Strategy has funded these acquisitions through sales of its perpetual preferred stocks, rather than issuing common equity or selling MSTR shares.

Funding Strategy and Capital Structure

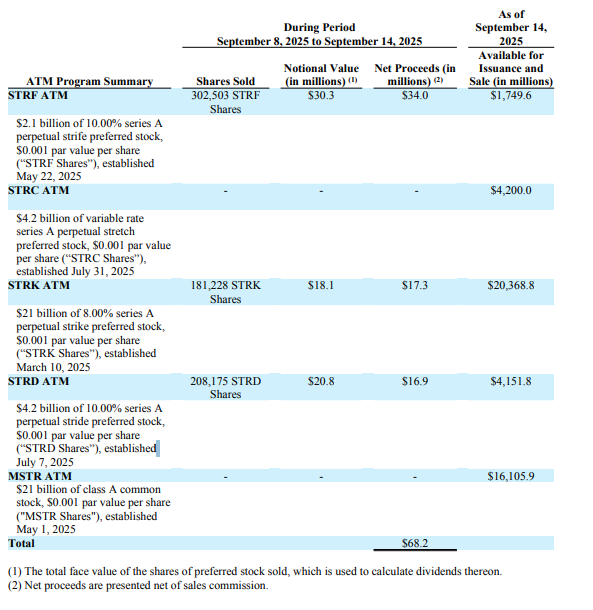

To finance the latest Bitcoin purchase, Strategy utilized proceeds from the sale of its perpetual preferred stock, including STRF, STRK, and STRD shares. These instruments raised significant capital, totaling $68.4 million across the three preferred stock offerings. Strategy’s funding approach has allowed it to continue expanding its Bitcoin reserves without impacting its common stock market performance.

While Strategy’s stock price has remained relatively flat in recent days, analysts note that the company’s capital structure is designed to withstand market fluctuations. Michael Saylor has expressed confidence in this approach, stating that Strategy is prepared for a long-term strategy that can endure significant drops in Bitcoin’s value.

Strategy’s Continued Commitment to Bitcoin

Strategy’s ongoing Bitcoin purchases demonstrate its strong commitment to the cryptocurrency. Michael Saylor’s regular social media posts, including his recent comment that “Bitcoin deserves credit,” continue to highlight his belief in Bitcoin’s potential as a store of value and a driver of company performance. Despite recent challenges, including the company’s exclusion from the S&P 500 index, Strategy remains focused on its Bitcoin acquisition strategy.

Source: Strategy SEC Filing

This dedication to Bitcoin as a Core asset is evident in Strategy’s growing portfolio and its efforts to position itself as a major player in the corporate Bitcoin treasury space. With Bitcoin’s long-term potential in mind, Strategy continues to expand its holdings, aiming to build a robust foundation for the future.