Ethereum (ETH) Price Prediction: Binance Futures Shatters $4 Trillion Record Amid Rally Pause

Ethereum's momentum hits a wall as derivatives volume explodes—classic crypto divergence at play.

Record-Setting Derivatives Activity

Binance Futures just smashed through the $4 trillion mark while ETH's price action stalls. That kind of volume typically signals either massive institutional accumulation or leveraged speculation gone wild—take your pick.

Price Prediction Conundrum

ETH's consolidation around key levels suggests whales are repositioning rather than abandoning ship. Technical indicators flash neutral-to-bullish, but those futures volumes scream caution. When derivatives dwarf spot markets, volatility becomes inevitable.

Market Mechanics Exposed

Traders pile into perpetual swaps while actual ETH accumulation slows. It's the eternal crypto dance—real adoption versus paper promises. Meanwhile, traditional finance types clutch their pearls over 'unregulated speculation' while quietly allocating through backdoor channels. Nothing new here.

TLDR

- Ethereum gained 5.52% in 24 hours to $4,369 but remains down 8.27% over the past week

- Binance leads ETH futures market with over $4 trillion in trading volume, surpassing 2024’s $3.7 trillion record

- Technical analysis shows key resistance at $4,380 level with potential for further declines if broken

- Open interest on Binance grew from $2.8 billion to nearly $13 billion since April when ETH was below $1,500

- Derivative-driven rally raises concerns about market stability and increased liquidation risks

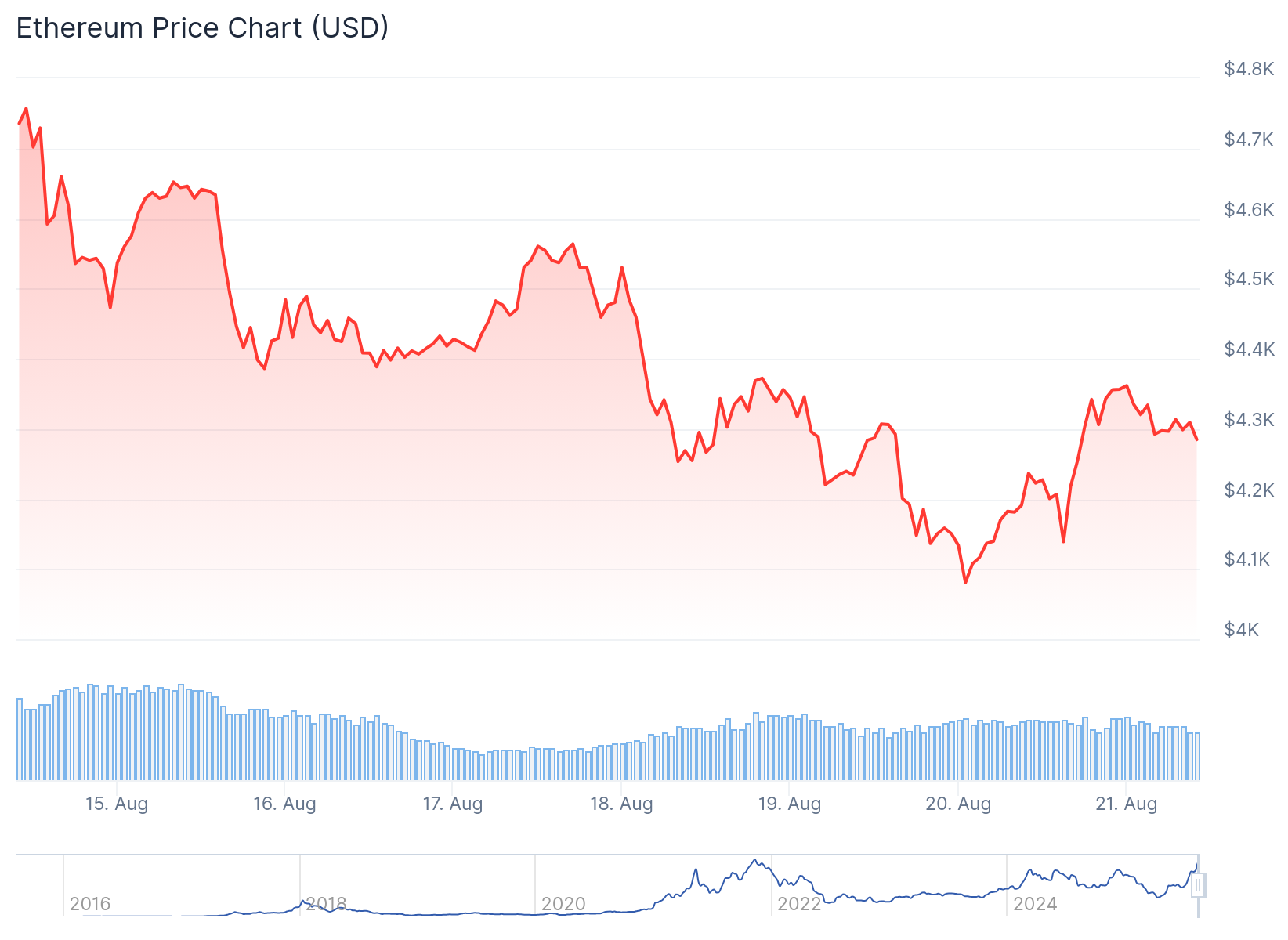

Ethereum price reached $4,369 with a 5.52% gain over 24 hours. The second-largest cryptocurrency by market cap shows mixed signals after declining 8.27% over the past week.

Trading volume increased 1.22% to $51.65 billion in the last 24 hours. This represents growing market activity despite the recent weekly decline.

The recent rally started from the $4,050 support zone. ETH moved above the $4,150 and $4,220 levels during its recovery wave.

Technical analysis reveals key resistance levels ahead. The price faces barriers NEAR $4,350 and $4,380 zones.

A bearish trend line forms with resistance at $4,355 on hourly charts. The cryptocurrency trades below the 100-hourly Simple Moving Average.

Ethereum Price Prediction

Binance holds the dominant position in ethereum futures markets. The exchange recorded over $4 trillion in ETH futures trading volume this year.

This figure exceeds Binance’s previous record of $3.7 trillion achieved in 2024. The platform maintains its lead over competitors including Bybit, OKX, and Hyperliquid.

Open interest on Binance grew dramatically since April. When ETH traded below $1,500, open interest stood at $2.8 billion.

The metric has since expanded by almost $10 billion. This liquidity influx contributed to Ethereum’s recent price recovery.

Technical Levels and Market Structure

Current price action shows ETH trading below key resistance zones. The $4,350 level aligns with the 61.8% Fibonacci retracement from recent highs.

If the price breaks above $4,380 resistance, the next target sits at $4,460. A MOVE beyond this level could push ETH toward $4,500 and potentially $4,550.

Downside risks remain present if support fails. Initial support appears at $4,240 with major support at $4,200.

A break below $4,200 could target the $4,120 level. Further weakness might push the price toward $4,050 support.

The hourly MACD indicator shows weakening momentum in bearish territory. However, the RSI moved above the 50 level, indicating some buying interest.

Analysts express caution about the derivative-driven nature of the current rally. High open interest levels create potential for increased volatility and liquidation events.

Binance achieved a new milestone with $4 trillion in ETH futures volume, cementing its market leadership position.