Dogecoin Teeters at Critical Resistance—Analysts Eye Imminent Breakout Signals

Dogecoin isn’t just knocking at resistance—it’s kicking the door.

Market watchers are glued to charts as DOGE flirts with a key technical threshold. Break above, and it could trigger a cascade of bullish momentum. Fail, and it’s back to the land of memes and ‘wait till next time’.

What’s driving the surge? Pure speculation, as always—because nothing says ‘sound investment’ like a cryptocurrency that started as a joke. Traders are piling in, hoping this isn’t another ‘buy the rumor, sell the news’ circus.

Keep an eye on volume. If it spikes alongside price action, the breakout might just have legs. If not? Well, there’s always another crypto narrative around the corner.

Key Insights:

- Dogecoin price formed triangle and cup-and-handle patterns on recent charts.

- Analysts tracked $0.29 as the resistance level and $0.19–$0.20 as support.

- RSI shifted upward as traders monitored potential breakout conditions.

Dogecoin price traded in a narrowing range during August 2025. Analysts said the token was repeating chart patterns that previously led to strong rallies. Could these signals push Doge toward higher levels in the coming quarter?

Dogecoin Price Shows Rouding Bottom and Triangle

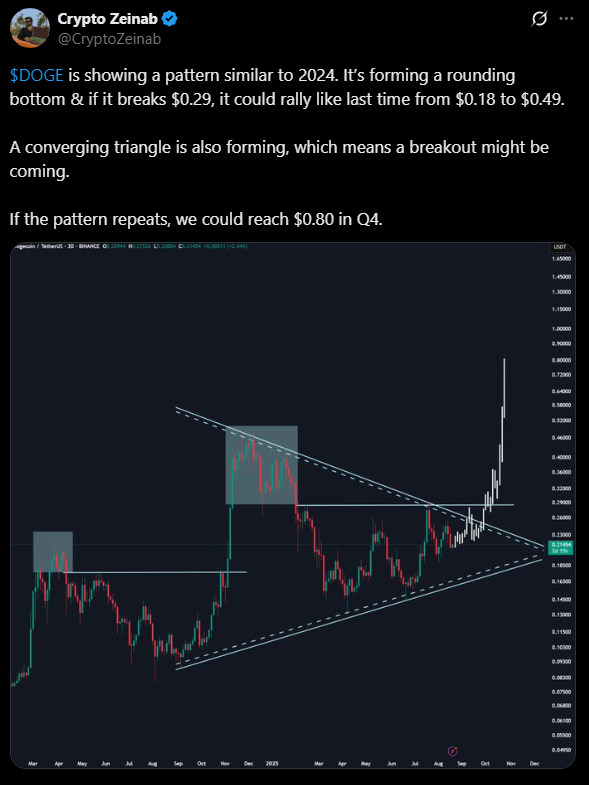

Analyst Zeinab said DOGE displayed a rounding bottom, a chart formation that often develops before a new uptrend.

She added that the token also moved within a converging triangle. A triangle pattern signals falling volatility before a breakout.

According to her analysis, the next major resistance sat NEAR $0.29. She said a clear move above that level could resemble an earlier climb when the token advanced from around $0.18 to $0.49. If momentum extended further, she said DOGE could target near $0.80 by the final quarter of 2025.

Traders monitored the $0.29 level closely. Zeinab said this zone acted as the primary ceiling for the current trend. Until the token broke above that point, the setup remained unconfirmed.

Volume trends supported her view. Data showed steady buying interest in recent weeks, although liquidity remained below levels recorded during previous rallies.

Analysts said a sharp increase in trading activity could validate the bullish scenario.

Short-Term Dogecoin Price Setup Offers Risk Reward

Analyst Cryptoinsightuk identified a separate opportunity for shorter-term traders. He said DOGE had swept both recent highs and lows.

That means the token cleared stop orders on both sides of the market, often a prelude to reversal.

He calculated a risk-to-reward ratio of 6.5 for this setup. A ratio above 1 suggests the potential return outweighs the risk. Ratios above 5 are generally considered attractive.

He added that the Relative Strength Index (RSI), a momentum indicator, had turned upward after reaching oversold territory.

RSI measures the strength of price moves on a scale from 0 to 100. Values below 30 indicate oversold conditions, while values above 70 show overbought conditions.

At the time of writing, RSI was approaching the midpoint, signaling improving momentum. Cryptoinsightuk said this aligned with the potential for a price recovery.

He maintained a low-leverage swing position in DOGE, but argued the technical setup was particularly relevant for traders seeking shorter-term entries.

Volume analysis also supported this thesis. He said the combination of rising RSI and steady turnover increased the odds of another test of the $0.29 level.

If the token failed to clear that zone, downside risk remained toward the $0.20 support band.

Outlook for Dogecoin in Coming Months

At press time, the Dogecoin price was around $0.21, up about 2.3% in the past 24 hours. The token declined nearly 4.4% over the past week and about 17% over the past month.

The all-time high stood at $0.7375. The market capitalization was about $33 Billion, with trading volume close to $3.4 Billion.

Analyst Andrew Griffiths said the token also shaped a cup-and-handle formation, another bullish chart pattern.

A cup-and-handle appears as a rounded base followed by a smaller pullback, often preceding a breakout.

Griffiths said a confirmed MOVE above $0.30 could push DOGE toward the upper channel boundary. He identified support between $0.19 and $0.20 as the critical floor.

If the token held this area, his model pointed to resistance near $0.38 as the next target.

The alignment of multiple technical signals, rounding bottom, triangle, and cup-and-handle, led analysts to track DOGE closely.

They said momentum indicators and volume WOULD decide whether the token could advance toward higher levels in the final quarter of 2025.