Bitcoin & Ethereum Stumble—While RBLK Soars on Surging Investor Confidence

Crypto giants bleed as altcoin dark horse rallies.

Bitcoin and Ethereum continue their August slump—down 12% and 9% respectively since last week—while little-known RBLK defies gravity with a 34% weekly surge. Traders are rotating out of blue-chips faster than a Wall Street quant can say 'risk-adjusted returns.'

Market psychology flips as institutions pile into RBLK

The shift suggests growing appetite for high-risk plays, with RBLK's volume spiking 217% amid whispers of an imminent tier-1 exchange listing. Meanwhile, Bitcoin whales are moving coins to cold storage—never a bullish signal.

Will the trend hold? History says August crypto rallies tend to be mirages. Then again, so do most 'institutional adoption' PowerPoint decks.

Rollblock (RBLK): Momentum Rising for a GambleFi Powerhouse

Rollblock (RBLK) is a fully operating Web3 gaming platform redefining the GambleFi sector with over 12,000 AI-powered games, live poker and blackjack tables, a sports prediction league, and blockchain-secured payouts.

It combines the excitement of live dealer modes with the transparency of the Ethereum chain, eliminating bid manipulation once and for all and building trust through verifiable smart contracts.

The platform is licensed under Anjouan Gaming and offers fiat payment options through Apple Pay, Google Pay, Visa, and Mastercard, opening the doors for mainstream adoption.

Recent updates on Rollblock’s X describe nonstop action across its games, with new users joining daily for the variety, instant deposits, and lucrative token rewards. This level of product maturity sets it apart from new altcoins to watch that are still in concept stages. The project is already live, attracting a growing player base and fueling token demand.

Professor Crypto’s recent coverage (https://www.youtube.com/watch?v=z1TahMr56Qw) dives into how Rollblock’s revenue-sharing tokenomics create consistent buy pressure.

With up to 30% of platform revenue buying back RBLK, 60% of those buybacks burned to reduce the supply, and the rest funding staking rewards of up to 30% APY, this is a top crypto project with built-in scarcity:

- Over $15 million in bets processed

- Weekly revenue share rewards for holders

- Sports betting added for new revenue streams

- Deflationary token model with permanent burns

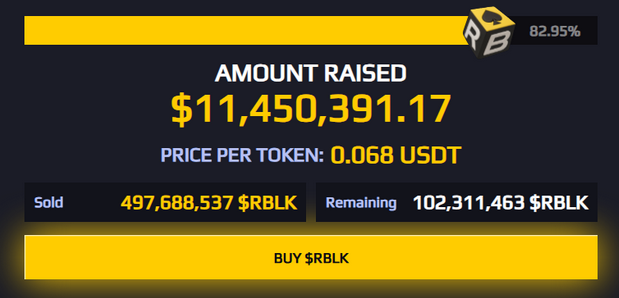

Tokens are selling fast, and over 82% of the latest presale round is now complete at $0.068, with over $11.4 million raised so far. Major exchange listings are due later this year, and the presale end date will be announced in just 45 days.

With its mix of blockchain security, DeFi principles, and real revenue streams, Rollblock stands out as one of the best cryptos to invest in for 2025.

| Metric | Rollblock (RBLK) | Bitcoin (BTC) | Ethereum (ETH) |

| Price | $0.068 | $117,462.10 | $4,390.36 |

| Market Cap | Low cap gem | Over $2.3T | Over $556B |

| Total Supply | 1 Billion (hard cap) | 21 Million | 120 Million+ |

| Revenue Share | 30% buyback & burn | None | None |

Bitcoin (BTC): Holding Near Key Support

Bitcoin (BTC) is down by 1.49% today to $117,462.

E R Y X noted: “$Bitcoin dropped hard after the #ATH and dropped hard after the liquidity grab. The dump was sharp due to news yesterday rolled out. Price is now NEAR the support area, and bouncing off.”

This points to a critical juncture where bulls must hold support to prevent further downside.

Bitcoin’s long-term cryptocurrency fundamentals remain intact, but short-term traders are watching the trendline retest for confirmation. In the wider crypto news cycle, Bitcoin’s role as a hedge remains a key narrative despite inflation headwinds.

Bitcoin has dropped below $118,000 after a hotter-than-expected US Producer Price Index report reignited inflation concerns in the market. The data pushed Federal Reserve interest rate cut odds down to 90.5% from 99.8%, signaling reduced confidence in imminent monetary easing.

Technical indicators, including a potential double top formation, are pointing toward a short-term pullback in BTC price, which could create favorable conditions for altcoins to stage a rally.

For those seeking the best long-term crypto, patience may be rewarded if accumulation zones hold.

Ethereum (ETH): ETF Inflows Could Cushion Decline

Ethereum (ETH) is down 5.66% today to $4,390.

Analyst ‘Sasha why NOT’ wrote: “📉 Strong Ethereum ETF inflows ($1B/day) could cushion downside… Holding $4,390 could pave the way toward a new ATH at $4,788.”

Ethereum’s fundamentals are still among the strongest in the blockchain interoperability and smart contracts sectors, with network demand driving high staking yields.

U.S. spot Ethereum ETFs hold $29.22 billion in net assets, making up 5.34% of ETH’s total market cap. In August alone, Ethereum ETFs have attracted more than $3 billion in net inflows.

While the RSI shows overbought levels, the inflows from ETFs could support a recovery and position Ethereum as one of the best altcoins 2025. Traders will be watching the $4,390 support for signs of bullish continuation.

Could RBLK Become A Leading Opportunity In Q3?

This is a market where leaders like Bitcoin and Ethereum can still shine, but where lower-cap plays can deliver outsized gains.

Rollblock’s combination of live product, deflationary tokenomics, and regulatory compliance positions it for explosive growth this year. For investors looking beyond the giants, RBLK has likely the most upside potential of them all.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino