🚀 Ethereum (ETH) Price Prediction: Standard Chartered Bullish with $7,500 Target as ETH Nears All-Time High

Ethereum’s rally isn’t just hype—Standard Chartered just upped its price target to $7,500. Here’s why ETH could smash its ATH sooner than Wall Street expects.

The Institutional Stamp of Approval

When a bank like Standard Chartered throws weight behind crypto, even skeptics pay attention. Their revised $7,500 forecast signals growing confidence in ETH’s utility—not just as a speculative asset, but as the backbone of decentralized finance.

Liquidity, Upgrades, and the ETF Effect

With spot ETH ETFs sucking up supply and the Dencun upgrade slashing layer-2 costs, Ethereum’s fundamentals look stronger than a banker’s martini. Meanwhile, Bitcoin maxis are left grumbling about 'flippening' again.

The Cynic’s Corner

Sure, $7,500 sounds juicy—but remember when analysts swore Dogecoin would hit $1? ETH’s real test? Delivering scalability without becoming the bloated legacy chain it aimed to replace. Tick-tock, Vitalik.

TLDR

- Standard Chartered raised Ethereum (ETH) price targets to $7,500 by end-2025 and $25,000 by 2028

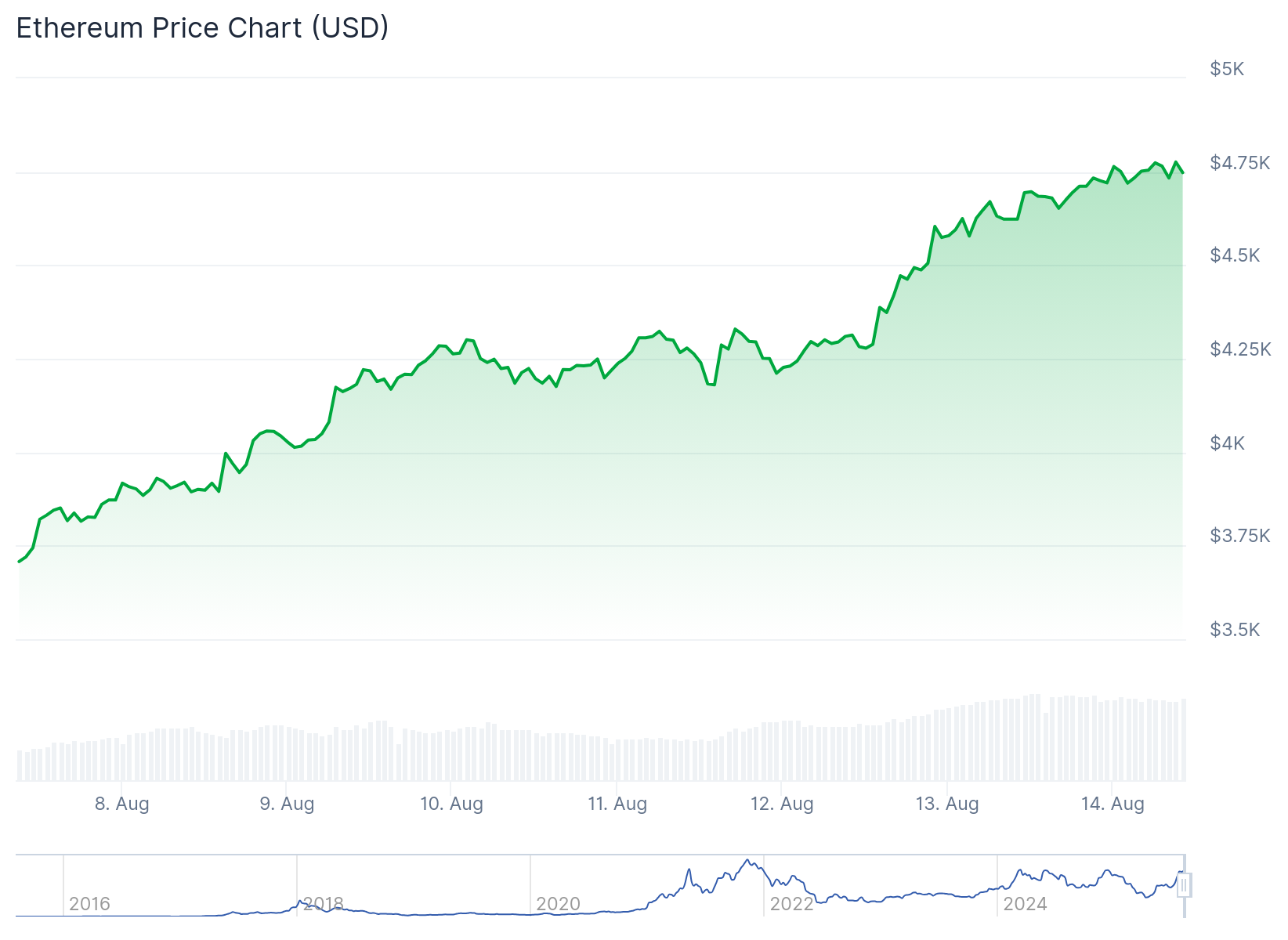

- ETH trading at $4,625, just 4% below all-time high of $4,891, with 30% weekly gains

- Spot ETH ETFs recorded $1.54 billion inflows over two days, with BlackRock’s ETHA leading at $10.5 billion AUM

- Institutional buyers acquired 3.8% of ETH supply since June, twice Bitcoin’s fastest buying pace

- Analysts target $5,241 next, with some forecasting $8,500 if Bitcoin reaches $150,000

Ethereum has captured institutional attention with a strong rally that pushed the cryptocurrency to within striking distance of its all-time high.

Standard Chartered analyst Geoff Kendrick lifted his year-end price target for ETH to $7,500 from $4,000. His longer-term forecast jumped to $25,000 by 2028, up from the previous $7,500 target.

The cryptocurrency currently trades at $4,625, representing just a 4% gap from its record high of $4,891. ETH has gained close to 30% in the past week alone.

Kendrick cited three key factors for his bullish outlook. Institutional demand has surged across multiple channels. Regulatory developments have created a favorable environment. Network upgrades continue to strengthen the platform’s capabilities.

Ethereum treasury companies and spot ETFs have purchased 3.8% of all ETH in circulation since early June. This buying pace is twice as fast as Bitcoin’s strongest institutional accumulation period.

Spot ethereum ETFs recorded $1.54 billion in inflows over just two days. BlackRock’s ETHA fund leads the pack with over $10.5 billion in assets under management.

BitMine Immersion Technologies announced plans to raise up to $24.5 billion for ETH purchases. The company aims to control up to 5% of the total supply. SharpLink followed with a $389 million fundraising round, dedicating nearly all proceeds to Ethereum acquisitions.

ETF Inflows Drive Price Action

The regulatory environment has improved with the passage of the GENIUS Act in July. This legislation paves the way for mainstream stablecoin adoption. More than half of all stablecoins are issued on Ethereum, and these tokens already account for 40% of blockchain fees.

Ethereum developers are working to boost LAYER 1 throughput by 10 times current levels. This positions the network for higher-value transactions and expanding Layer 2 ecosystems.

Analyst Ali Martinez points to MVRV pricing bands suggesting a potential move toward $5,241. Trader Yashasedu believes Ethereum could surge past $8,500 if Bitcoin reaches $150,000, based on historical market cap ratios.

Clearing $4,300 could send Ethereum $ETH straight toward $5,241, according to the Pricing Bands. pic.twitter.com/3GT5UotJwm

— Ali (@ali_charts) August 11, 2025

On-chain data from Santiment shows retail traders are selling into the rally. This pattern has historically preceded further price gains. Corporate treasuries continue accumulating aggressively.

Market Dynamics Favor Continued Growth

Ethereum’s dominance extends beyond its own price performance. Benjamin Cowen highlights that altcoins excluding ETH and BTC have dropped 50% against ETH since April.

Total value locked on Ethereum has surpassed $90 billion, the highest level since 2022. Derivatives market activity shows increased interest with open interest hitting $12.1 billion, the highest since March 2024.

The ETH/BTC ratio currently sits at 0.039. Kendrick forecasts this could rise to 0.05 as Ethereum continues to outperform Bitcoin.

Standard Chartered noted that companies buying ether for treasury strategies offer better investment opportunities than ETH spot ETFs for investors.

A break above $4,750 could send ETH toward the $5,000 level and beyond according to current technical analysis.