Dogecoin (DOGE) Skyrockets 14% as Whales Gobble Up Supply—Is This the Start of a Meme Coin Revival?

Whales are betting big on DOGE—and the market's reacting. A sudden 14% price surge follows massive accumulation by deep-pocketed traders, leaving retail investors scrambling to catch up.

Behind the pump: On-chain data reveals whale wallets swallowing DOGE at levels not seen since the 2021 meme coin mania. Liquidity's tightening as large holders refuse to sell.

The cynical take: Just another day in crypto—where 'fundamentals' mean watching whale wallets instead of balance sheets. But with this much buying pressure, even the skeptics are glancing at DOGE charts.

What's next? If whale accumulation continues at this pace, we could see a test of key resistance levels. Or—like most meme coin rallies—this could just be another pump before the inevitable dump.

TLDR

- Dogecoin surged 14% as mystery whales purchased over $200 million worth of DOGE tokens

- The price dropped 30% from July’s peak of $0.28 to test crucial $0.19 support level

- Technical indicators show cooling momentum with RSI dropping below 50 and MACD turning bearish

- Long traders outnumber shorts 3:1 on major exchanges despite recent market pressure

- Whale accumulation now controls nearly half of all circulating DOGE supply

Dogecoin price has experienced a dramatic turnaround after testing key support levels following a month-long decline. The meme cryptocurrency dropped nearly 30% from its July peak of $0.28 before finding buyers at the $0.19 support zone.

The recent selling pressure pushed Doge below both the 50-day and 200-day exponential moving averages. This technical breakdown raised concerns among traders about further downside potential.

However, whale investors stepped in with massive buying power during the selloff. Between August 12-13, large holders purchased over 1 billion DOGE tokens worth approximately $200 million.

This institutional-level buying helped drive a 14% price surge. The MOVE showed that major players remain confident in Dogecoin’s prospects despite recent weakness.

Trading volume exceeded the 24-hour average of 387.7 million tokens during the rally. The increased activity suggests growing interest from both retail and institutional participants.

Dogecoin Price Prediction

The daily Relative Strength Index dropped from overheated readings above 80 to below 50. This shift indicates that buying momentum has cooled after the July rally.

The moving average convergence divergence indicator recently flipped bearish. This confirms that the recent bull run has lost steam in the NEAR term.

Despite these bearish signals, the 20-day and 200-day golden cross from late July remains intact. This long-term bullish pattern suggests the primary uptrend has not been invalidated.

DOGE found solid support at $0.220 during the recent volatility. This level served as a launching pad for the subsequent bounce toward $0.238 resistance.

The price action created a higher lows pattern throughout the session. This technical development supports the case for continued upward momentum.

Market Sentiment Remains Bullish

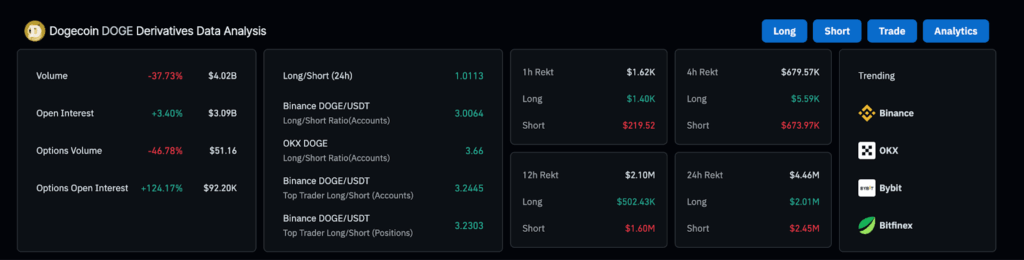

Futures data reveals that open interest remained stable at around $3 billion despite the price volatility. This indicates that traders are holding their positions rather than closing them.

Long accounts outnumber short positions by a 3:1 ratio on Binance. OKX shows an even stronger 3.6:1 ratio in favor of bullish bets.

The whale accumulation pattern shows big money controlling nearly half of all circulating supply. These large holders continue buying dips and show no signs of reducing exposure.

Aggregate futures volume decreased 37% to $4 billion over the past 24 hours. However, the stable open interest suggests consolidation rather than capitulation.

Macroeconomic factors including new import taxes and Federal Reserve policy have pressured risk assets. These headwinds created selling pressure across cryptocurrency markets including DOGE.

Price Targets and Key Levels

Resistance sits at $0.238 based on recent price action. A break above this level could trigger additional buying and target the $0.24-$0.30 range.

Support remains at the $0.232-$0.220 zone backed by heavy volume. A break below $0.19 WOULD target the $0.17 and $0.15 levels representing 12-24% downside.

The $0.22 level aligns with the 20-day exponential moving average. This technical level could serve as initial resistance on any bounce attempt.

Whale investors purchased over $200 million worth of DOGE tokens during the recent price surge from $0.225 to $0.233.