Cardano (ADA) Set to Surge? Whales Gobble $157M as ETF Approval Hits 75% Probability

Whales are betting big on Cardano—$157 million big—as institutional interest spikes. With ETF approval odds now at 75%, ADA’s poised for a potential breakout.

Why the frenzy? The crypto market’s sniffing blood in the water after recent regulatory nods. Traders are piling in, convinced Cardano’s next in line for the ETF treatment.

But let’s not pop the champagne yet. Wall Street’s sudden love affair with crypto smells more like FOMO than fundamentals—typical finance herd mentality. Still, with whale wallets swelling and odds improving, ADA’s gearing up for a wild ride.

TLDR

- Crypto whales bought $157 million worth of Cardano tokens in 48 hours, pushing whale holdings to 10.3% of total supply

- ETF approval odds jumped from 60% to 75% according to Polymarket data

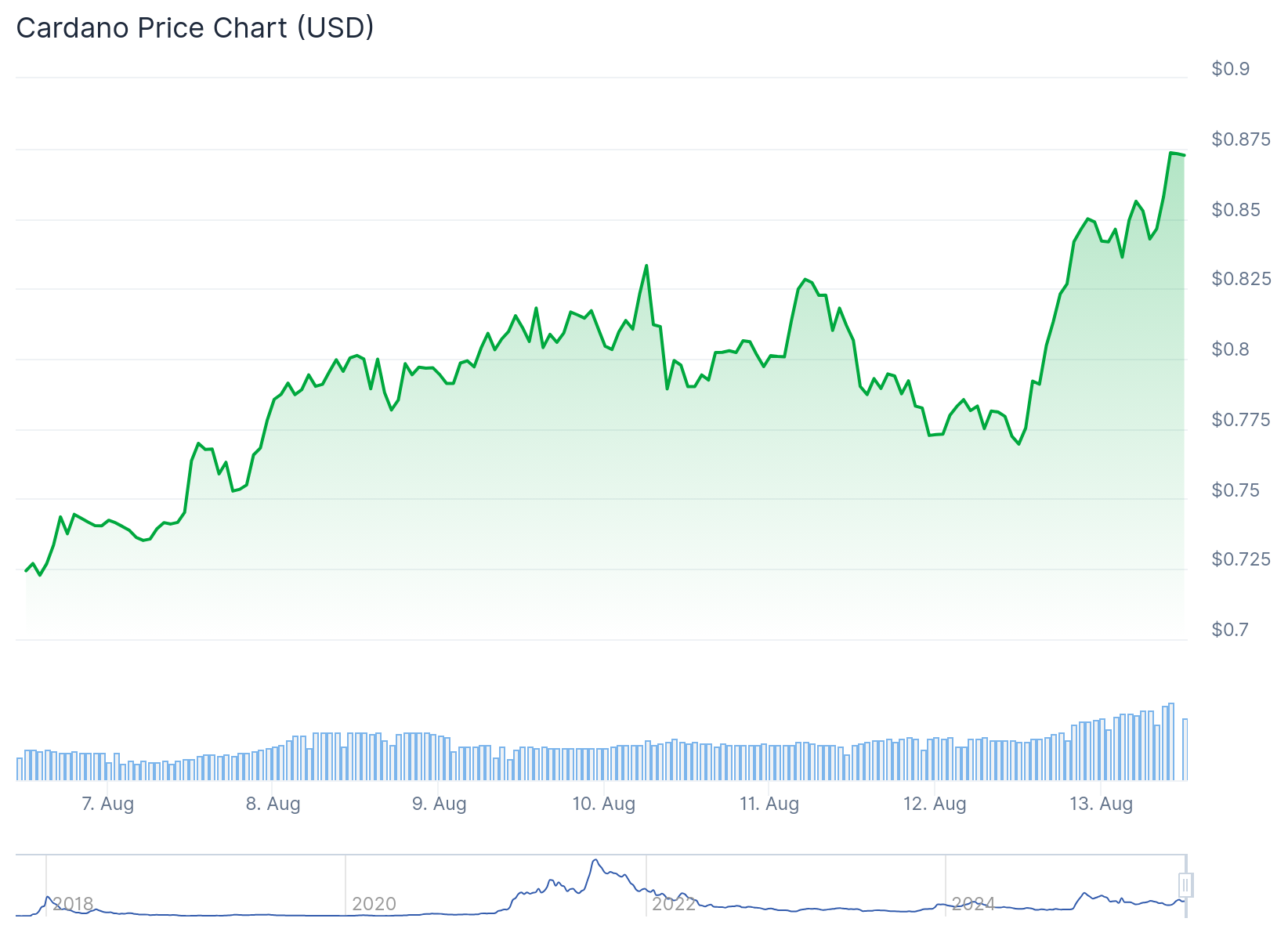

- ADA trades near $0.78 with key resistance at $0.82-$0.83 and support at $0.70

- Long-term holders continue accumulating positions with minimal selling pressure since 2021

- Technical indicators show room for upside movement with RSI at neutral levels

Cardano has captured whale attention with massive accumulation activity over the past two days. On-chain data reveals that 200 million ADA tokens worth $157 million changed hands through large-scale purchases.

This buying spree has lifted whale holdings to 10.3% of total supply. The pattern mirrors the 2021 accumulation phase that preceded ADA’s previous rally.

The timing coincides with rising speculation around a Cardano ETF. Approval odds have climbed from 60% to 75% on Polymarket betting markets.

An approved ETF could open doors for institutional investment. Pension funds and hedge funds would gain easier access to cardano exposure.

ETF Speculation Drives Interest

Current approval odds of 75% represent a jump from earlier estimates. This development has drawn institutional watchers to the project.

Bloomberg analysts estimate a 75% chance the Cardano $ADA ETF will be approved. pic.twitter.com/6Gtqg67wkF

— Cardanians (CRDN) (@Cardanians_io) August 8, 2025

If granted, ETF approval could amplify demand through traditional finance channels. Institutional players typically MOVE larger amounts than retail investors.

The ETF narrative has become a key catalyst for several cryptocurrencies this year. Cardano appears to be benefiting from this broader trend.

ADA currently trades NEAR $0.78 after pulling back from last week’s move above $0.80. The coin gained 13% over the past week before the recent consolidation.

Cardano Price Prediction

The $0.82-$0.83 zone remains the immediate resistance barrier. A break above this level could target $0.93 and the psychological $1 mark.

Support holds firm at $0.70, where ADA has bounced consistently since mid-2023. This level aligns with the 0.236 Fibonacci retracement at $0.704.

Higher lows on weekly charts suggest ongoing accumulation. Open interest in ADA derivatives reached $1.44 billion, matching multi-month highs.

The Relative Strength Index sits at 54.58, leaving room before overbought conditions. Moving averages on 20-day and 50-day timeframes point to constructive trends.

MACD indicators show the signal line above zero with positive histogram bars. This suggests continued upward momentum in the near term.

Bollinger Bands are compressing around the upper boundary. This could indicate building momentum but also warns of potential short-term corrections.

The Chaikin Oscillator reads 10.45M, showing stronger buying pressure versus recent weeks. Volume patterns support the current price action.

Long-term holder data reveals continued accumulation since 2021 without major distribution. This shows persistent belief in the project’s future potential.

Short-term players have also shifted behavior compared to 2021. Instead of selling on rallies, they’ve shown small accumulation over recent days.

Valuation metrics indicate balanced market conditions. The market temperature indicator combining MVRV Z-Score and other metrics signals neutral territory.

Current levels don’t show euphoria, providing room for healthy price appreciation. This contrasts with overheated conditions seen in previous cycles.

Analysts project end-of-August targets between $0.95 and $1.015 under current conditions. This assumes the bullish setup continues to develop.

A failure to hold $0.81 and break $0.884 with volume could shift momentum. A drop below $0.70 WOULD likely target $0.51 and break the recent structure.

The elevated adjusted Sharpe Ratio supports prospects for continued upward momentum. This measures risk-adjusted returns for the asset.

Open interest levels of $1.44 billion signal growing trader participation but also set the stage for increased volatility.