Why Traders Are Fleeing Litecoin & Cardano for This AI Crypto Gem – Already Surging 34% This Cycle

Market tides are turning fast. Legacy altcoins like Litecoin and Cardano are getting dumped as capital floods into this cycle's breakout AI token—already up 34% in a brutal rotation.

The AI Crypto Gold Rush Is On

Forget 'old tech' blockchains. Traders are chasing asymmetric bets in AI-driven protocols that actually generate revenue—not just hype. This one's eating LTC and ADA's lunch.

34% Pump Is Just the Warm-Up

The smart money knows: AI coins aren't waiting for Bitcoin's permission to rally. While Cardano devs debate governance proposals, this project's tokenomics are already printing gains. (Cue eye-roll at 'academic blockchain' speeds.)

A Warning Shot Across the Bow

Let's be real—half these AI projects will crater when the VC funding dries up. But for now? The alpha's in catching the wave early... before Wall Street 'discovers' it and ruins everything.

Litecoin Price Set For Breakout Moves?

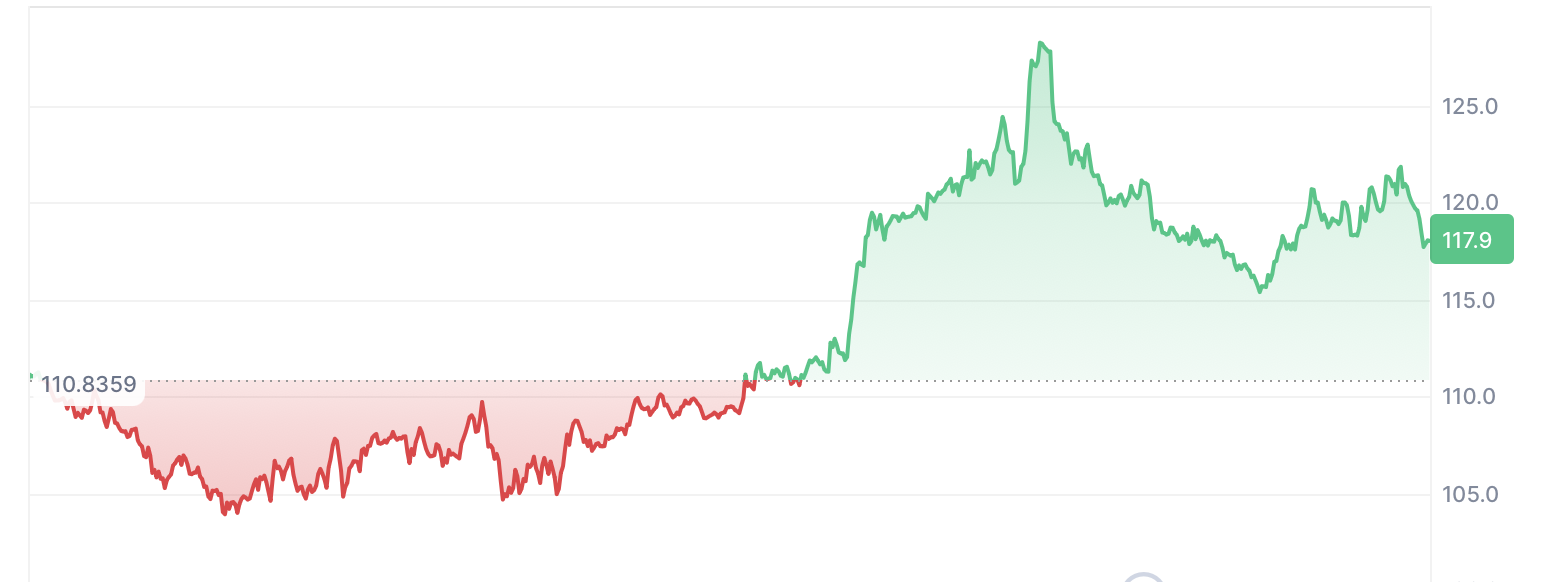

The Litecoin Price has finally been able to move past the $110 resistance level that was a challenge for it all month. Right now, the Litecoin price is around the $117 mark, after facing a strong rejection from the $127 range. If it is successful in breaking over the $125 range, technical indicators show potential for a $135 target. But if it fails again, the Litecoin price could drop back to the $110 zone where it has hovered for most of July. The RSI and MACD are favoring upside potential, but the market is in a wait zone with volumes down by 32% suggesting a wait-and-see strategy by most.

Source: CoinMarketCap

According to trading experts, the Litecoin price could climb up to over $135 and even as high as $150 if ETF approvals finally materialize and technical momentum is sustained. However, with rising regulatory challenges and altcoin competition, the $110-120 range is critical. This prediction for the Litecoin price is highly optimistic.

Whale Withdrawals Impact Cardano Price

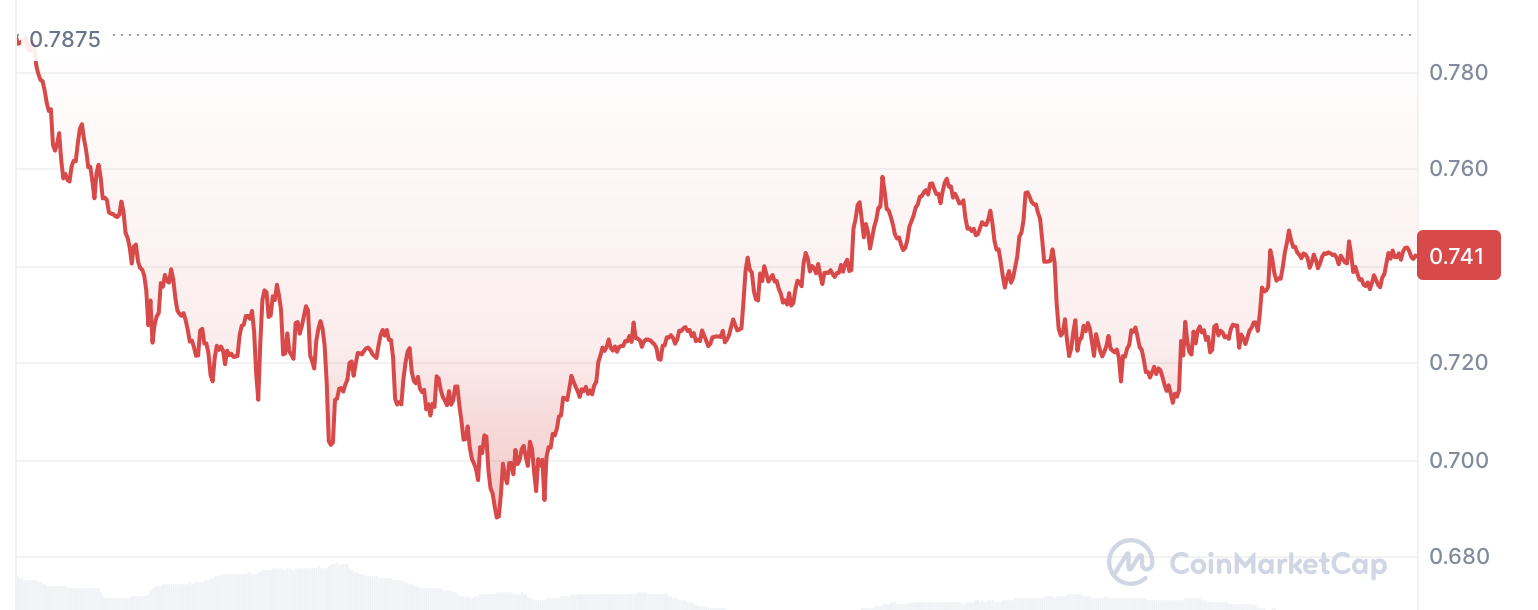

Cardano news shows concern about on-chain activity as whales withdrew from the network. This has hampered ADA’s performance as retail investors also pulled away. Despite sustained upgrades to its network, Cardano remains under pressure due to dropping confidence. Delays in ETF approvals from the SEC are also contributing to a bearish outlook for the altcoin.

Source: CoinMarketCap

The ADA is currently trading around the $0.74 range, and market volume is down by 24% as investors pull back from the network. Many are now entering early-stage projects like Unilabs Finance (UNIL) for its utility-based offering and potential for accumulation before others catch on.

Latest market trading volumes confirm that most big players are diversifying into this upcoming crypto project with its real shot at stable earning potential through its passive income and staking utility.

Unilabs Is The New DeFi Contender For 100x Crypto

Cardano and Litecoin prices may have left investors skeptical. But Unilabs, which has quietly raised over $11.8 million at $0.009 per token before launch, is offering a new window of opportunity. This DeFi sensation is set to deliver real-world applicability for users who want to access multiple investment opportunities without the logistical headache involved in investing (and keeping track) of multiple crypto projects.

The platform uses the technical advances offered by AI tools to offer users four distinct funds designed to cater to different risk preferences as well as cover diverse project risk assessments. These funds have been formulated with top crypto and investment industry experts.

Unilabs Finance (UNIL) is the first dedicated crypto asset management platform and has the power to transform the way people invest their capital. It can also change the way we invest, manage, and optimize our digital assets for the highest possible returns.

Here’s why experts believe Unilabs will be the next 100x crypto:

- It already has $30M Assets Under Management.

- Its four AI-Powered Funds: AI Fund, BTC Fund, RWA Fund, Mining Fund, cater to investors of all risk profiles

- The platform covers all digital asset baskets and offers a combination of DeFi gains with the ease of a conventional investment process.

-

Token holders can stake their Unilabs tokens to earn passive income

For more information about Unilab Finance, visit the links below:

Website: https://www.unilabs.finance

Social: Unilabs Telegram