XRP Price Alert: Can Whale Dumping Derail the $2 Rally? This Critical Level Decides

Whales are circling—and XRP's next move hangs in the balance.

Key resistance breached? The $2 dream isn't dead yet.

Market watchers brace as mega-holders play chicken with retail traders. Will they trigger a sell-off or get caught chasing momentum? Classic crypto theater.

Meanwhile, institutional investors quietly accumulate—because nothing says 'trust the process' like betting against the herd. The irony? Even Wall Street's getting FOMO now.

TLDR

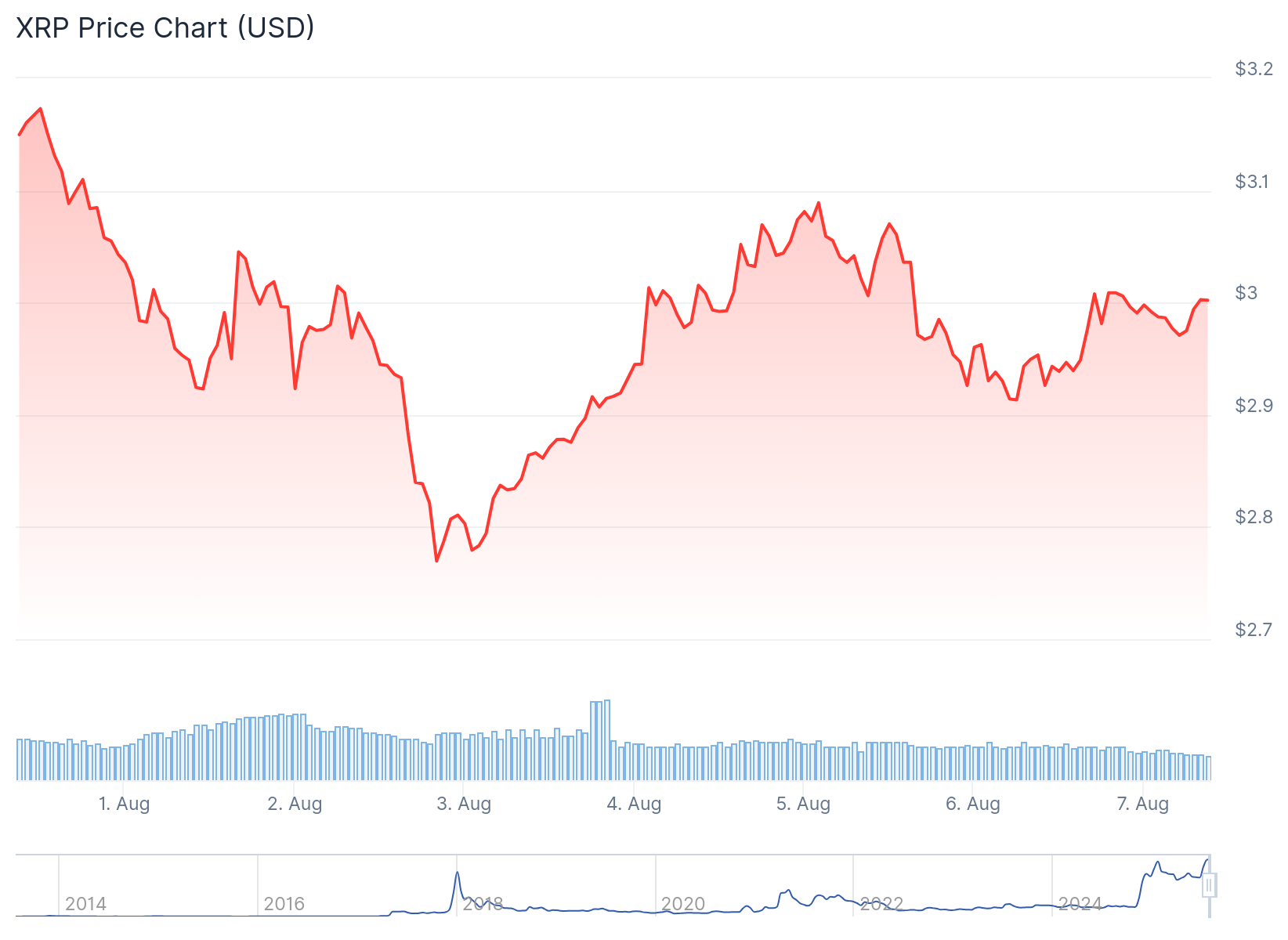

- XRP price has fallen 19-20% from July peak of $3.65, currently struggling near $3.00 resistance zone

- Large holders have sold over 640 million XRP tokens valued at $340 million since July 9, 2025

- Critical support level at $2.65 matches quarterly VWAP and 50% Fibonacci retracement zone

- XRP price could retrace to $2.00 if $2.65 support fails, eliminating recent rally gains

- Some institutional traders are increasing long positions despite bearish whale activity

XRP price action shows continued weakness following a steep correction from yearly highs. The altcoin reached $3.65 on July 18 before entering a downtrend that has erased nearly 20% of its value.

The xrp price decline coincides with heavy selling from large wallet holders. CryptoQuant data reveals whale addresses have maintained negative netflows over the past three weeks.

Whale wallets containing significant XRP holdings have offloaded 640 million tokens since July 9. This selloff represents approximately $340 million worth of XRP entering the market during the correction phase.

Santiment analytics show addresses holding between 1 million and 1 billion XRP reduced their positions dramatically. These large holders decreased their collective holdings from over 10 billion tokens to 8 billion tokens.

The sustained distribution from whale addresses has created downward pressure on XRP price. Saturday saw brief testing of support between $2.66 and $2.80 before Sunday’s recovery attempt.

XRP Price Technical Analysis: $2.65 Support Level Critical

XRP price faces a crucial test at the $2.65 support zone. This level previously served as resistance throughout the first half of 2025 before converting to support after the July breakout.

Technical analyst Dom highlights that XRP price has maintained levels above $2.80 while avoiding the critical $2.65 zone. The $2.65 level corresponds with the quarterly Volume-Weighted Average Price calculation.

The current XRP price structure shows completion of a 50% Fibonacci retracement from the $3.65 high. Technical analyst Mind Trader suggests successful defense of this level could enable a push toward $4.15.

However, failure to hold $2.65 support could trigger what traders call a “full pump retrace.” This scenario WOULD see XRP price potentially declining to the $2.00 base of the previous rally.

Bearish Indicators Mount Pressure on XRP Price

Analyst Ali Martinez identifies a bearish MVRV death cross signal affecting XRP price outlook. Historical data shows the previous occurrence in March led to a 30% decline from $2.40 to $2.00.

Meanwhile, the MVRV ratio just flashed a death cross, another sign that a steeper correction could be underway for $XRP.https://t.co/Jl1aV6ny5Q

— Ali (@ali_charts) August 5, 2025

On-chain analysis suggests $2.80 provides immediate support for XRP price, while major support exists at $2.48. This deeper support level represents the accumulation zone where most current holders acquired their positions.

The $2.48 support zone aligns with traditional chart analysis NEAR the 200-day Simple Moving Average. A break of current support levels could result in an additional 15% decline for XRP price.

Despite bearish pressure, some traders are positioning for a potential XRP price bottom. CoinGlass data shows sophisticated Binance traders increased long positions from 64% to 69% recently.

This shift follows a period where long positions dropped from 79% to 64% between mid-July and early August. The recent increase suggests some institutional players believe XRP price has found near-term support.

XRP price movement remains correlated with broader cryptocurrency market sentiment. Bitcoin’s ongoing uncertainty continues to influence altcoin performance across the sector.

Maintaining levels above $2.65 remains essential for preserving XRP price uptrend structure. Any sustained MOVE below this technical level could invalidate near-term bullish scenarios.

The current XRP price correction reflects broader market dynamics as whale distribution continues. Weekend trading saw temporary stabilization, but overhead resistance near $3.00 remains intact.

Market participants are closely monitoring XRP price action around current levels. The outcome of the $2.65 support test will likely determine whether the correction extends or reversal patterns emerge.

XRP price currently trades near $2.90 after bouncing from weekend lows, but faces continued pressure from ongoing large holder distribution and technical resistance above current levels.