Colgate-Palmolive ($CL) Crushes Q2 Earnings—But Can It Brush Off Margin Woes?

Colgate-Palmolive just flashed a grin with its Q2 earnings beat—yet Wall Street’s still side-eyeing those squeezed margins. Here’s the breakdown.

The Good: Earnings Flex

CL slapped analyst estimates into the dirt, proving even toothpaste giants can surprise. Numbers don’t lie—unless they’re buried in a 10-K.

The Bad: Margin Meltdown

Rising costs bit into profits like a cavity. Inflation? Supply chains? Pick your poison—the squeeze is real.

The Ugly: Street’s Verdict

Investors cheered the earnings pop but kept exits clear. Because nothing says 'faith' like hedging your bets with consumer staples. Classic defensive play—how thrilling.

TLDR:

- Q2 2025 adjusted EPS came in at $0.92, beating the $0.89 consensus

- Net sales rose 1.0%, with 1.8% organic sales growth despite pet sales drag

- Gross margins fell 70 basis points to 60.1% on a base business basis

- Market leadership maintained: 41.1% share in toothpaste, 32.4% in toothbrushes

- Shares rose 1.4% post-earnings; full-year organic sales forecast trimmed

Colgate-Palmolive Co. (NYSE: CL) reported better-than-expected second-quarter 2025 earnings on August 2, with adjusted EPS of $0.92 versus analysts’ consensus of $0.89. GAAP EPS grew 2% year-over-year to $0.91. Revenue for the quarter reached $5.11 billion, a modest 1.0% increase, beating the expected $5.03 billion.

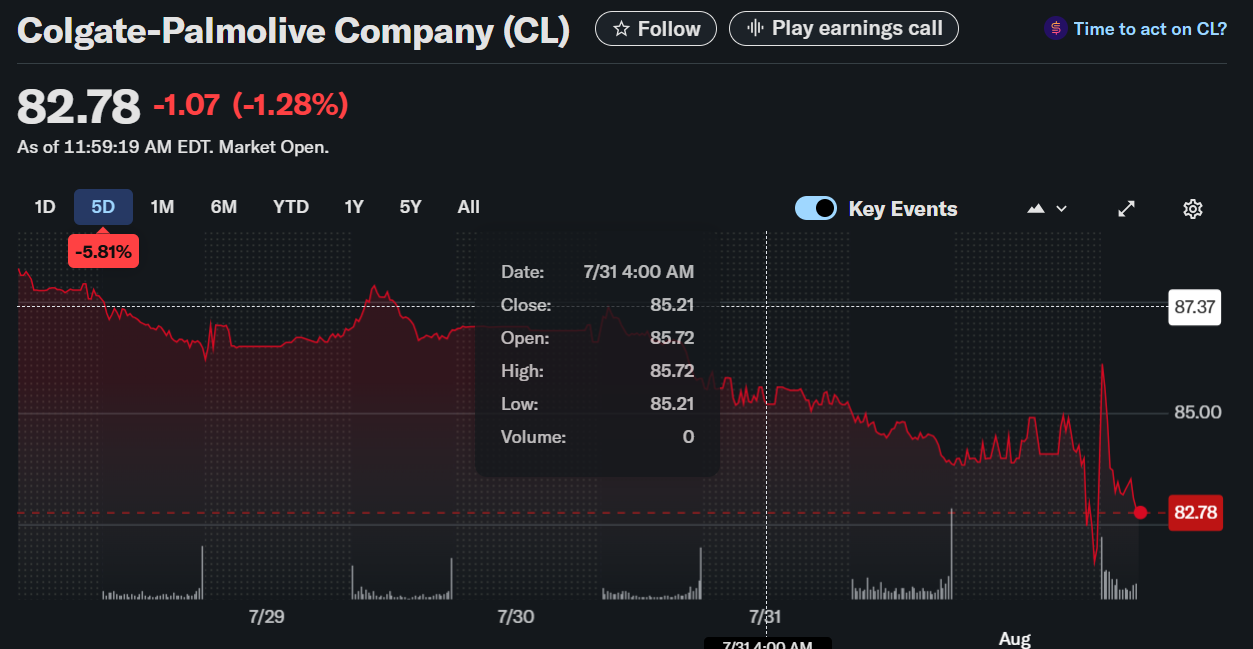

As of 11:32 AM EDT, CL stock was trading at $83.48, down 0.44% intraday, but shares gained 1.4% in premarket trading following the earnings release.

Colgate-Palmolive Company (CL)

Performance and Segment Highlights

Organic sales ROSE 1.8%, with a 0.6% drag from lower private label pet sales. Colgate retained its global oral care leadership with a 41.1% share in toothpaste and 32.4% in manual toothbrushes. By geography, Africa/Eurasia saw the strongest organic growth at 7.7%, followed by Latin America at 3.4%. Hill’s Pet Nutrition, which contributes 23% of total revenue, grew 2.0% organically.

However, margins came under pressure. Base Business gross profit margin fell 70 basis points to 60.1%. Net cash from operations totaled $1.48 billion in the first half of the year.

Colgate-Palmolive, $CL, Q2-25. Results:

📊 Adj. EPS: $0.92 🟢

💰 Revenue: $5.11B 🟢

📈 Net Income: $743M

🔎 Organic sales grew 1.8% despite continued weakness in private label pet food sales. Global toothpaste market share remains strong at 41.1%. pic.twitter.com/I3zfWuOo97

— EarningsTime (@Earnings_Time) August 1, 2025

Guidance and Productivity Measures

Colgate slightly revised its full-year 2025 organic sales growth guidance to the low end of its 2% to 4% range, citing ongoing weakness in the pet category. Net sales are still expected to grow in low single digits, with EPS projected to rise modestly. Gross margin and ad spending are forecasted to remain roughly flat as a percentage of net sales.

To support long-term growth, the company unveiled a new three-year productivity initiative. The program aims to streamline global operations, cut overhead costs, and improve supply chain agility. Pre-tax charges from the initiative are estimated between $200 million and $300 million, to be mostly realized by the end of 2028.

Total Return Snapshot

Despite short-term results beating expectations, Colgate-Palmolive’s stock performance has lagged. As of August 1, 2025, the year-to-date return stood at -6.58%, while the S&P 500 gained 6.04%. The stock is also down 15.43% over the past year. Longer-term returns show some resilience: 10.52% over three years and 21.50% over five, versus 51.43% and 90.67% respectively for the benchmark.

CEO Outlook

CEO Noel Wallace emphasized Colgate’s global execution, portfolio strength, and innovation focus. “We feel well-positioned to deal with year-to-date volatility in category growth and uncertainty in global markets,” he noted, affirming confidence in achieving 2025 financial targets.