Cardano (ADA) Price Alert: Why Crypto Whales Are Gobbling Up the Dip in August 2025

Crypto's smart-contract underdog gets a vote of confidence from deep-pocketed investors—just as retail starts panic-selling.

The whale feeding frenzy

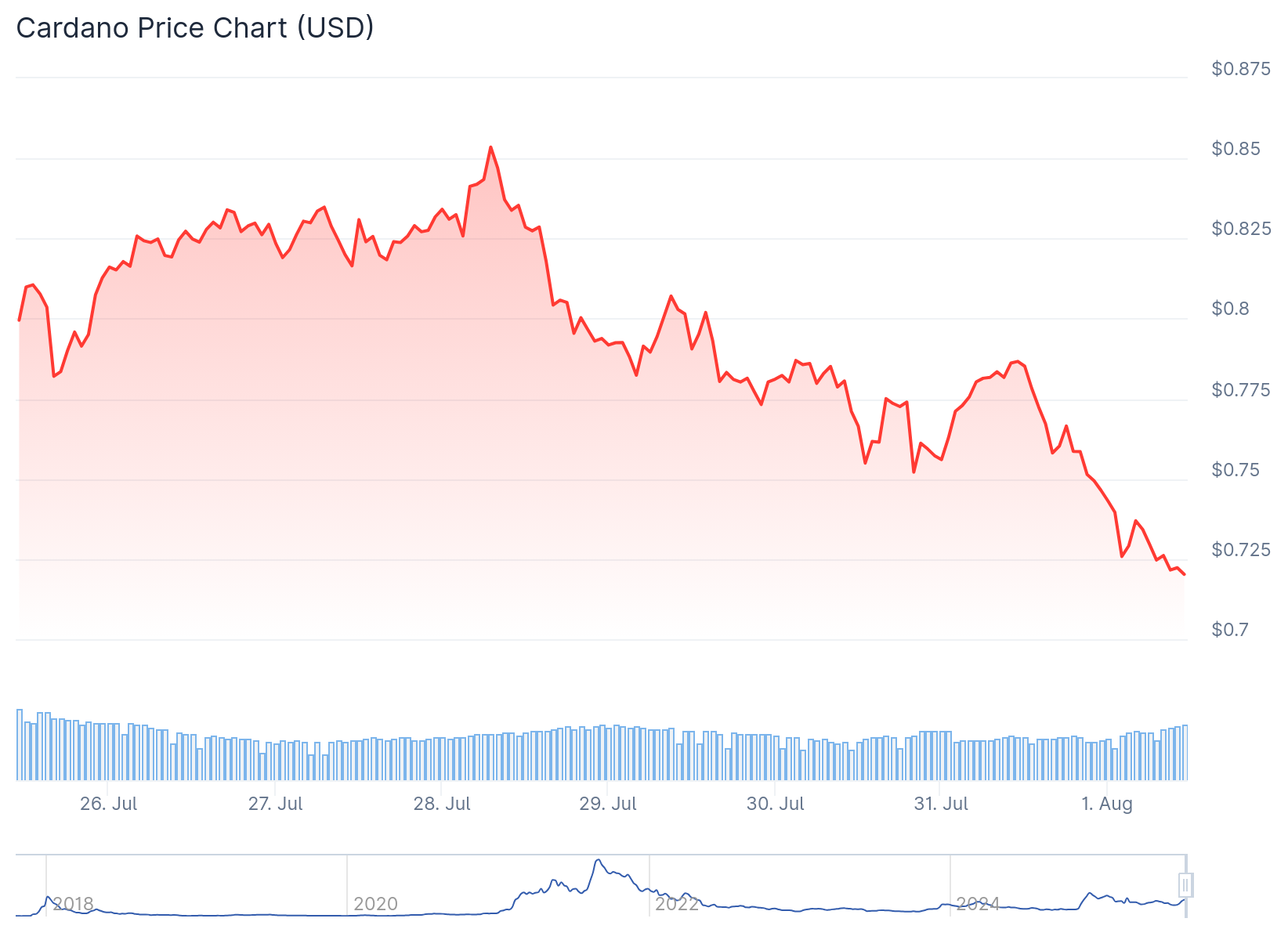

While Main Street traders hyperventilate over ADA's 30% monthly drop, institutional wallets are quietly accumulating. On-chain data shows nine-figure purchases hitting the books this week—the kind of moves that typically precede major reversals.

Fundamentals vs. fear

Cardano's Hydra upgrade finally delivered real scaling last quarter, yet the price action feels like we're back in crypto winter. Classic market psychology: weak hands fold right before the house reshuffles the deck.

The cynical take

Of course whales are buying—they orchestrated the dip. Nothing moves markets like creating artificial scarcity while CNBC parrots 'crypto is dead' narratives. Rinse and repeat since 2017.

ADA's tech keeps evolving, but the game remains the same. The only question is whether retail will board the lifeboat or keep drowning in leverage.

TLDR

- ADA has broken key resistance levels and formed a bullish “cup and handle” pattern with short-term targets at $1.20

- Polymarket shows 83% odds for Cardano ETF approval in 2025, matching Bloomberg’s 90% estimate ahead of SEC’s October 2025 decision

- Whale accumulation is increasing with on-chain data showing large wallet activity and 46% surge in daily trading volume

- ADA currently trades around $0.75-$0.90 after rebounding over 60% from recent lows near $0.51

- Technical indicators show ADA above key price averages with MACD and RSI in bullish territory, though RSI appears overbought

Cardano (ADA) is experiencing renewed investor interest as technical analysis points to potential breakout momentum. The cryptocurrency has crossed into bullish territory on weekly charts despite some oscillator weakness.

Technical analyst Trend Rider identified ADA’s break above key resistance levels. The analyst set short-term price targets around $1.20, contingent on Bitcoin maintaining upward momentum.

$ADA Mid-Term Analysis: Bullish Signals Returning

Facts:

– Weekly Rider Band is back to bullish

– Price trading above band

– Daily resistances are broken

– Oscillator Line still negative

– Daily Support zone at 0.57 – 0.67 USD

Conclusion:

– Still lacking a bit of… pic.twitter.com/tpx1ifT2WH

— Trend Rider (@TrendRidersTR) July 30, 2025

A classic “cup and handle” pattern is forming on ADA’s chart. This technical formation often precedes major price breakouts. The pattern suggests ADA could reach $4 over the coming months if it develops properly.

ADA currently faces resistance at $0.92. Breaking through this level could trigger the next phase of upward movement. The cryptocurrency is trading NEAR $0.75 with a market cap of $27.21 billion.

Daily trading volume has reached $1.84 billion, representing a 46% increase. This volume surge indicates growing retail and institutional participation in ADA trading.

ETF Speculation Drives Market Interest

Betting platform Polymarket has raised the probability of Cardano ETF approval to 83% for 2025. This matches Bloomberg analysts’ estimate of 90% approval odds.

Here are mine and @EricBalchunas' most recent odds on spot crypto ETF approvals by the end of 2025. We expect a wave of new ETFs in this second half of 2025. pic.twitter.com/H3pxJhqMy3

— James Seyffart (@JSeyff) June 30, 2025

The SEC is currently reviewing delayed spot ETF applications for ADA and Avalanche. Final decisions are expected by October 2025. These regulatory developments are contributing to positive market sentiment.

On-chain metrics show whale accumulation patterns. Large wallet holders are buying during price dips, providing support for ADA’s current levels.

Technical Analysis Points to Consolidation

ADA has rebounded over 60% from recent lows around $0.51. The recovery has brought the token above important price averages including VWAP.

MACD and RSI indicators are in bullish territory, though RSI shows overbought conditions. This suggests potential for short-term consolidation before further gains.

A strong demand zone exists near $0.81. Buyers are expected to provide support above this level during any pullbacks.

Daily trading volume on exchanges has exceeded 62 million ADA tokens. This high activity reflects increased investor participation across the market.

ADA is consolidating within a symmetrical triangle pattern. This formation often precedes major price movements in either direction.

If ADA breaks above $1.05 resistance with strong volume, analysts see potential for rallies toward $1.40-$1.60. However, failure to hold support could lead to retests of lower levels.

The cardano Foundation continues development work on blockchain adoption and technical enhancements. Key initiatives include preparations for the “Chang” update and Inter-Blockchain Communication Protocol capabilities.

Founder Charles Hoskinson has expressed confidence in ADA’s long-term prospects. During a recent livestream, he suggested possible gains of 100x to 1,000x based on ecosystem expansion and upcoming developments like Project Midnight.

Current price action shows ADA down 1.90% over the past 24 hours despite the broader bullish sentiment. The cryptocurrency trades at $0.7500 as investors await the SEC’s ETF decision later this year.