PUMP.fun (PUMP) Price: Bulls Battle to Defend Make-or-Break Support Zone

Crypto's latest meme darling PUMP.fun teeters on the edge—will buyers step up or let gravity take over?

The line in the sand

Traders are glued to charts as PUMP tests a critical demand zone. Lose this level, and the next stop might be 'where Lambo?' memes turning into 'my bags hurt' reality.

Market mechanics at play

Order books show concentrated bids at current levels—typical last stand before either a violent squeeze or capitulation. Whales appear to be playing chicken with retail traders' emotions.

Sentiment swings wilder than a DeFi yield farm APY

Social volume spikes as crypto Twitter divides between 'generational buying opportunity' hot takes and 'dead cat bounce' doomers. Meanwhile, VC funds quietly accumulate positions while publicly tweeting bearish charts—classic Wall Street playbook, now with more emojis.

Will PUMP become the next cult asset or just another casualty in crypto's endless cycle of hype and heartbreak? The market's about to vote with its wallet—and as always in finance, the house wins either way.

TLDR

- PUMP token rallied 30% in 24 hours, breaking out past key resistance at $0.003

- The token is retesting support between $0.0028-$0.0029 after previous 66.58% drawdown from July highs

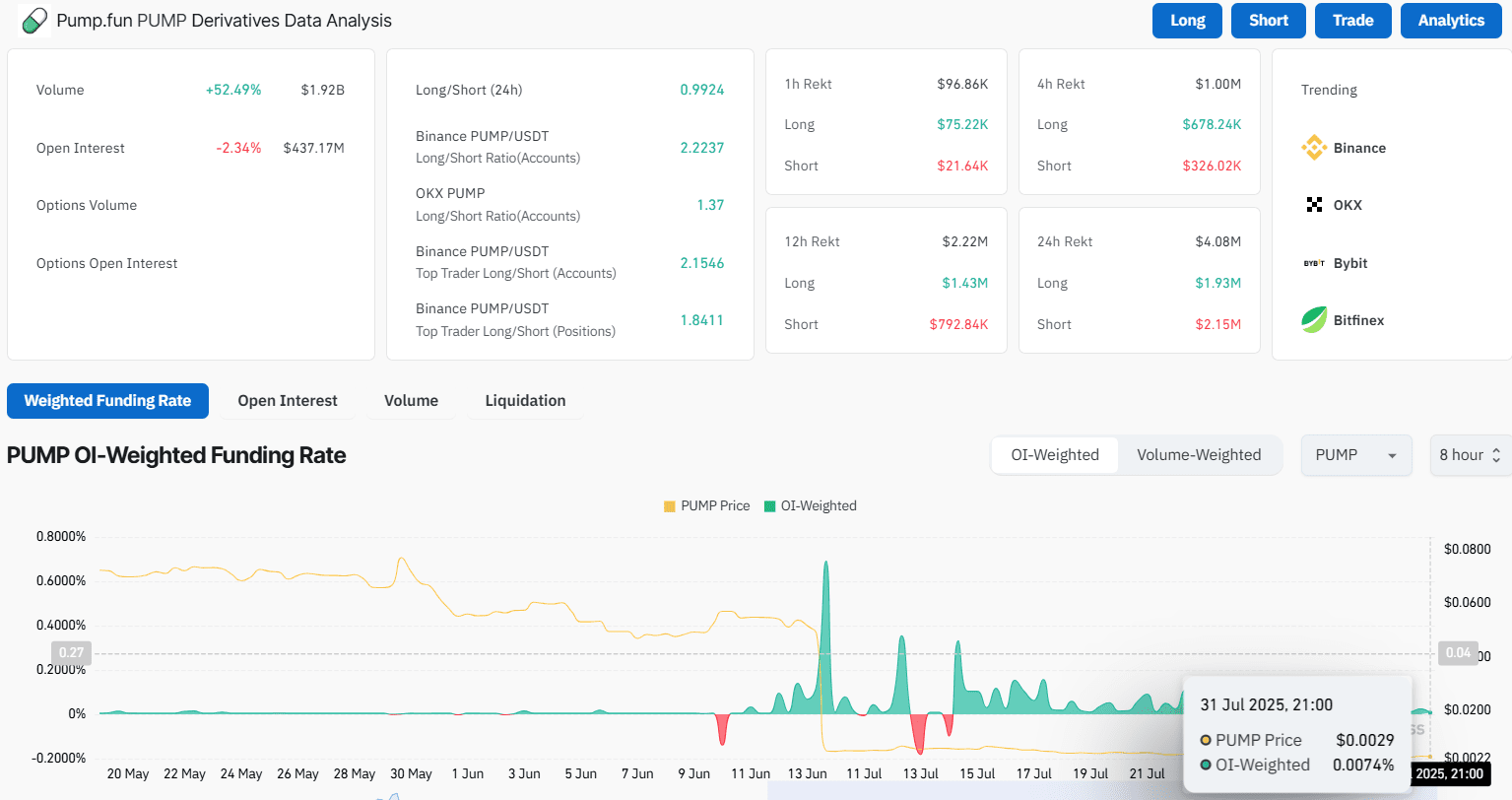

- Trading volume surged 52.49% to $1.92 billion while Open Interest dropped 2.34% to $437.17 million

- Technical indicators show mixed signals with RSI at 42.84 and MACD below signal line

- Price targets are set at $0.0032, $0.0034, and $0.0036 if support levels hold

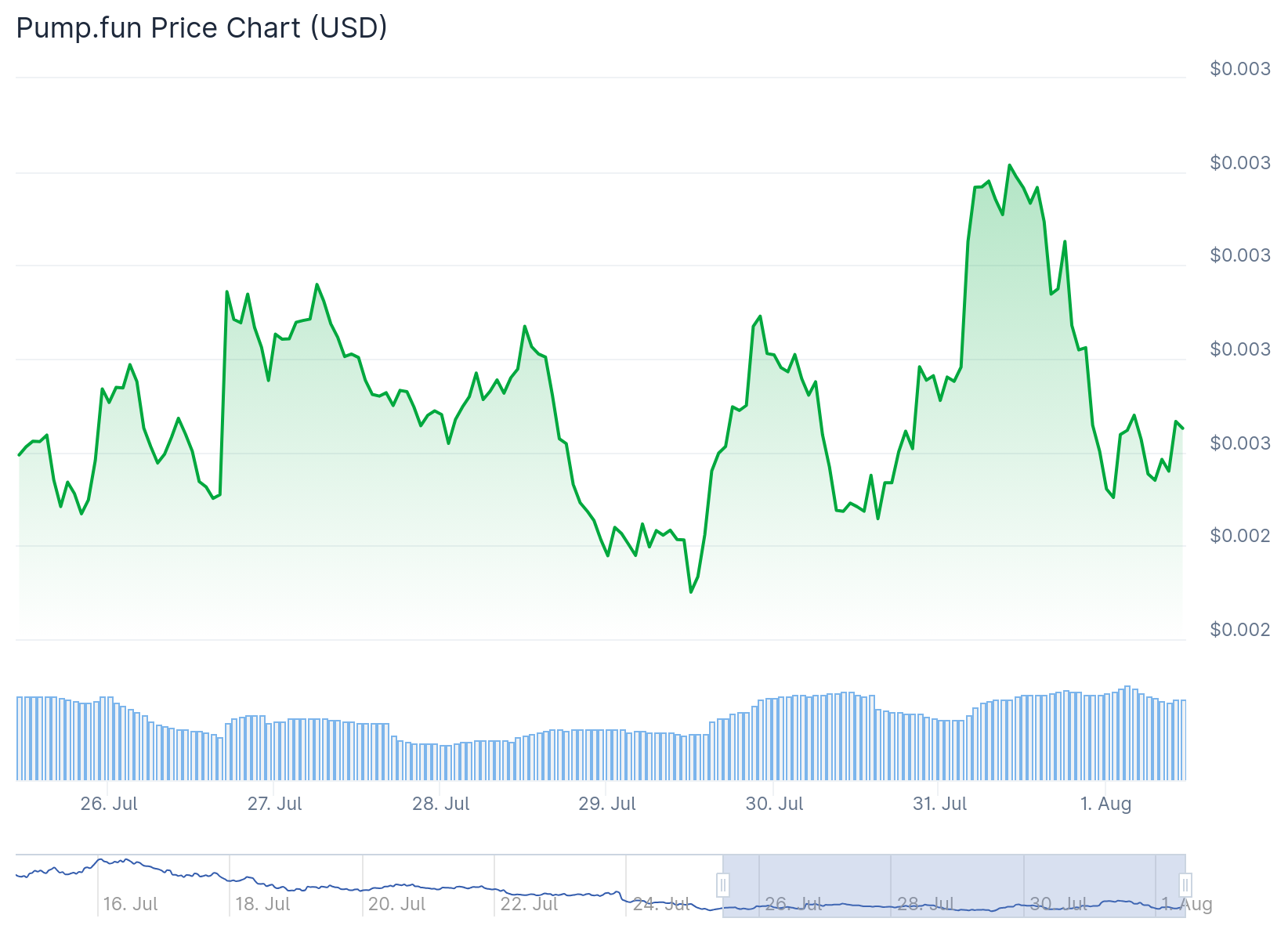

Pump.fun token has gained 1.24% in the past 24 hours, trading at $0.002831. The token experienced a major breakout yesterday with a 30% surge that pushed prices beyond the critical $0.003 resistance level.

The recent rally comes after PUMP suffered heavy losses following its July 15 peak of $0.00689. The token dropped 66.58% over ten days, falling to $0.0023 before entering a week-long consolidation phase.

PUMP’s recovery coincides with broader market strength. Bitcoin pushed higher from $116.7K support after dipping to $115.8K on July 30. ethereum also jumped 1.47% after retesting local support at $3.7K.

Trading volume has increased dramatically, jumping 52.49% to $1.92 billion according to CoinGlass data. This surge in activity indicates renewed market interest in the meme coin launchpad token.

Technical Analysis Shows Mixed Momentum

The RSI currently sits at 42.84, indicating weak momentum after retreating from higher levels earlier this week. While not oversold, the indicator suggests caution among traders. A break above 50 WOULD signal the return of bullish strength.

MACD indicators show decelerating momentum with the MACD line at 0.000032 sitting below the signal line at 0.000082. The histogram reads -0.000050, indicating weakening pressure without a bullish crossover.

Despite mixed momentum indicators, the On-Balance Volume has made a higher high. This divergence between price action and volume suggests underlying strength in the token.

Crypto analyst Kamran Asghar notes that PUMP is retesting a major resistance-turned-support area between $0.0028 and $0.0029 on the 4-hour chart. The broken trend line now serves as support for potential upward movement.

$PUMPF is retesting a previous resistance flip zone around $0.0028 – $0.0029 on the 4-hour timeframe, after a strong breakout! 📷 The current price is approximately $0.0029.

After breaking above its descending trendline, Pump Fun is now confirming this level as new support. A… pic.twitter.com/T8ayaPhxik

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) July 31, 2025

Support Levels Critical for Future Direction

The current retest of the $0.0029-$0.003 demand zone could provide buying opportunities for traders. This level represents the previous range high that acted as resistance before yesterday’s breakout.

Open Interest has declined 2.34% to $437.17 million, suggesting some traders are closing long positions. The OI-weighted funding rate stands at 0.0074%, indicating neutral sentiment in Leveraged positions.

If the support zone holds, price targets are positioned at $0.0032, $0.0034, and $0.0036. A fair value gap at $0.0036 represents an attractive target for bulls in the coming days.

The resistance level at $0.00378 provides another potential target if momentum continues. Market structure remains bullish on lower timeframes despite recent consolidation.

PUMP has formed a bullish market structure on the 2-hour chart after breaking out from its recent range. The token spent a week consolidating between $0.00245 and $0.003 before the breakout occurred.

Volume patterns support the technical setup with the 26.72% increase in trading volume to $657.5 million over 24 hours. This activity level suggests institutional and retail interest in the current price levels.

The weekly performance shows a 1.45% decline, indicating some profit-taking after recent gains. This correction appears normal following the token’s recovery from July lows.

Current market conditions favor continuation of the upward trend if key support levels maintain. The combination of increased volume and technical breakout provides a foundation for further gains.

Trading activity remains elevated with the 52.49% volume increase representing one of the highest levels seen recently. This surge in participation indicates market confidence in current price levels.