Solana (SOL) Surges: Institutional Whales Gobble $367M as Price Battles at $170

Solana's SOL isn't just holding the line—it's drawing blood. Institutional players just dumped $367 million into the token while retail traders white-knuckle the $170 support level. Who said smart money doesn't chase momentum?

Big Money Moves In

While your neighborhood crypto bro was panic-selling memecoins, hedge funds were quietly loading up on SOL like it was a Black Friday sale. The $367 million inflow marks the largest institutional buy-in since May—back when your 'diversified portfolio' was still 80% dog tokens.

The $170 Crucible

All eyes on that make-or-break $170 level. Break through, and we're looking at a clear runway toward previous ATHs. Crumble here, and suddenly that 'generational buying opportunity' starts smelling like last week's sushi.

Finance's Dirty Little Secret

Let's be real—the same suits calling crypto 'too volatile' are the ones front-running retail with nine-figure buys. Solana's latest pump isn't tech adoption—it's capital realizing the fastest horse in this rigged race.

TLDR

- Solana holders accumulated $367 million worth of SOL tokens over the past week as exchange balances dropped by 2.03 million SOL

- DeFi Dev Corp added over 181,000 SOL to its holdings, bringing their total to more than $218 million with an average purchase price of $155.33

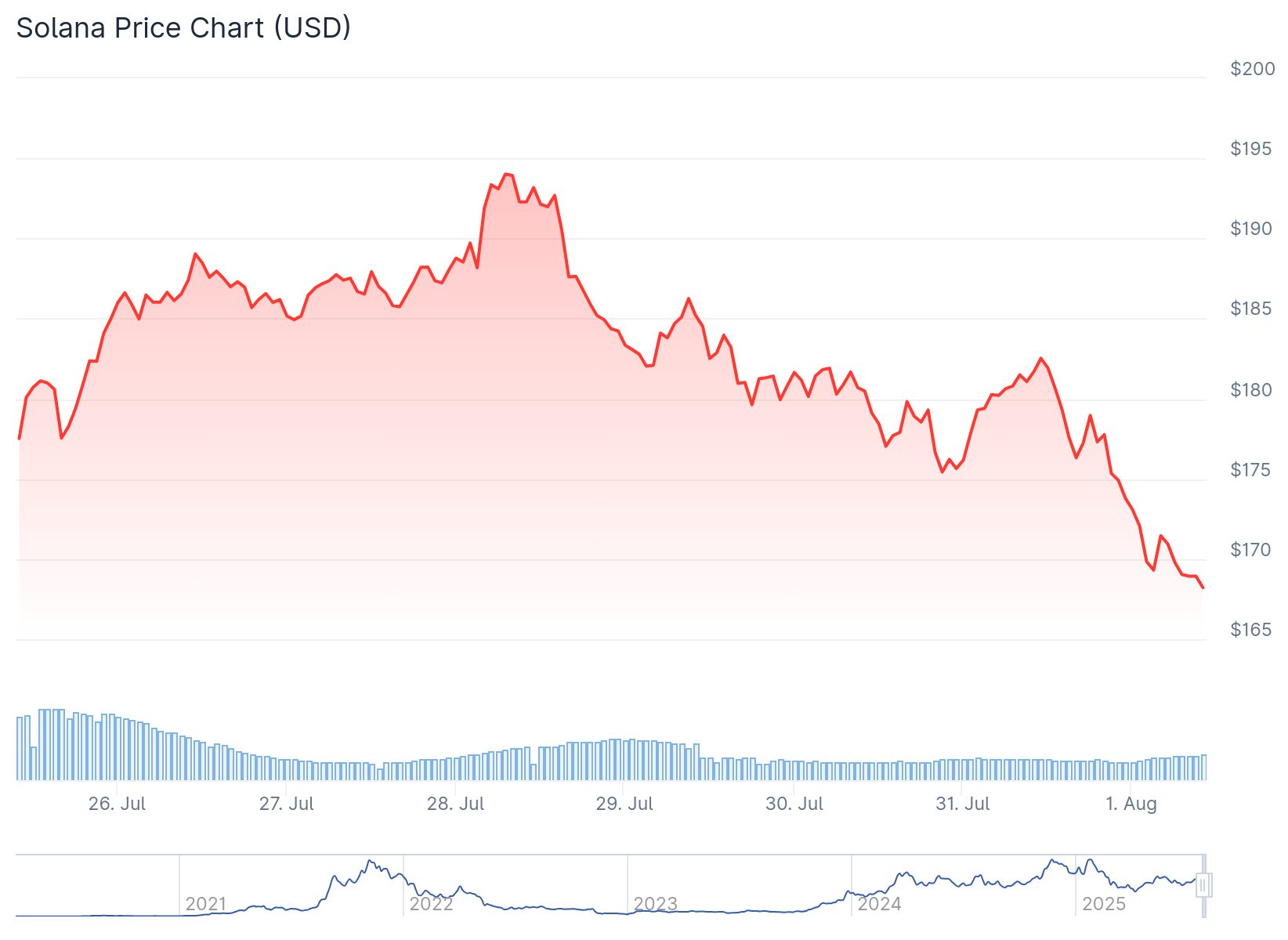

- SOL price currently trades around $178-$181, testing key support levels between $170-$175 after breaking below its 20-day moving average

- Short liquidation pressure builds near $185-$190 zone, where a 5% price increase could trigger forced buybacks

- Technical analysis shows mixed signals with bullish accumulation patterns contrasting against bearish short-term momentum indicators

Solana faces a critical juncture as institutional accumulation clashes with bearish technical signals. The cryptocurrency currently trades around $178-$181, having recently broken below its 20-day simple moving average.

Major institutional interest continues despite price weakness. DeFi Dev Corp has expanded its solana holdings by over 181,000 SOL tokens, bringing their total position to more than $218 million. The firm maintains an average purchase price of $155.33 and reported double-digit weekly growth in SOL per share for two consecutive weeks.

This institutional buying spree reflects broader accumulation trends across the market. Exchange balance data shows 2.03 million SOL tokens left exchanges during the past week. This represents approximately $367 million worth of tokens moving into private wallets.

The exchange outflow pattern typically indicates investor confidence in future price recovery. Many traders appear to be positioning for potential gains by removing tokens from trading platforms. This accumulation occurred as Solana’s price declined from higher levels.

Funding rates tell a different story about trader sentiment. Throughout July, Solana maintained positive funding rates, indicating trader optimism. However, these rates now approach turning negative, which would signal waning confidence among derivatives traders.

Technical Pressure Points

Short liquidation data reveals concentrated pressure zones above current price levels. Analysis shows heavy short positions clustered between $185 and $190. A mere 5% price increase from current levels could trigger cascade liquidations, potentially fueling upward momentum.

A massive short position WOULD be liquidated if $SOL rise by just 5%. pic.twitter.com/6BNxTHKpye

— CW (@CW8900) July 30, 2025

The liquidation wall creates an interesting dynamic. If SOL breaks through this resistance cluster, forced buybacks could accelerate price movement. This setup contrasts with the current bearish momentum indicated by technical indicators.

Solana recently broke below an ascending broadening wedge pattern. The token now tests horizontal support between $170 and $175, a zone that has provided multiple bounces over the past two months. This level represents a make-or-break point for near-term price action.

Current Market Structure

Recent chart analysis shows Solana breaking above $200 with minimal resistance, forming what analysts describe as a stair-step continuation pattern. This structure suggests potential sequential moves higher, with targets extending toward $260, $300, and possibly $400 if momentum sustains.

$SOL isn’t just back — it’s setting the pace.

Broke $200 with zero resistance.

Now it’s targeting $260, $300, maybe even $400.

Ignore the noise.

This isn’t hype, it’s a shift in momentum.

Smart money isn’t chasing later — it’s positioning now.

Solana season is real 🔥 pic.twitter.com/B3IdB6svp9

— RJT. WAGMI (@RJTTheOG) July 30, 2025

However, the breakdown below the 20-day moving average introduces caution. This technical level often acts as dynamic support during uptrends. The break below it suggests short-term momentum has shifted bearish despite broader accumulation patterns.

The cryptocurrency faces mixed signals from different market segments. Spot market activity shows continued accumulation, while derivatives markets display increasing bearish positioning. This divergence creates uncertainty about immediate price direction.

Solana’s current price of $181 maintains position above crucial support at $171. If bearish pressure continues, the token could decline toward $165 or enter consolidation between $189 and $177. Market participants await clearer directional signals.

The funding rate approaching negative territory would indicate traders expect further price declines. This shift could increase short position concentration and create additional downward pressure in the NEAR term.

Exchange balance data from Glassnode confirms the $367 million accumulation figure over the past week, representing one of the largest weekly inflows in recent months.