Ethereum (ETH) Price Alert: Retail Traders Pile In as Whales Cash Out – What’s Next?

The Ethereum market’s playing a twisted game of tug-of-war—retail traders are loading up on ETH while the whales quietly slip away. Here’s why the little guys are betting big.

### The Retail Rush: FOMO or Smart Money?

Small-time investors are snapping up Ethereum like it’s Black Friday—ignoring whale-sized warning signs. Either they know something the big players don’t, or this is the latest chapter in 'How to Lose Money Crypto.'

### Whale Exodus: Profit-Taking or Panic?

Meanwhile, Ethereum’s mega-holders are dumping bags faster than a centralized exchange during a flash crash. Are they locking in gains… or bailing before the next leg down?

### The Cynic’s Take

Of course, Wall Street’s old guard would call this 'irrational exuberance.' But since when did traditional finance ever understand a market that doesn’t close at 4 PM?

The ETH price saga continues—retail’s conviction versus whale skepticism. Place your bets.

TLDR

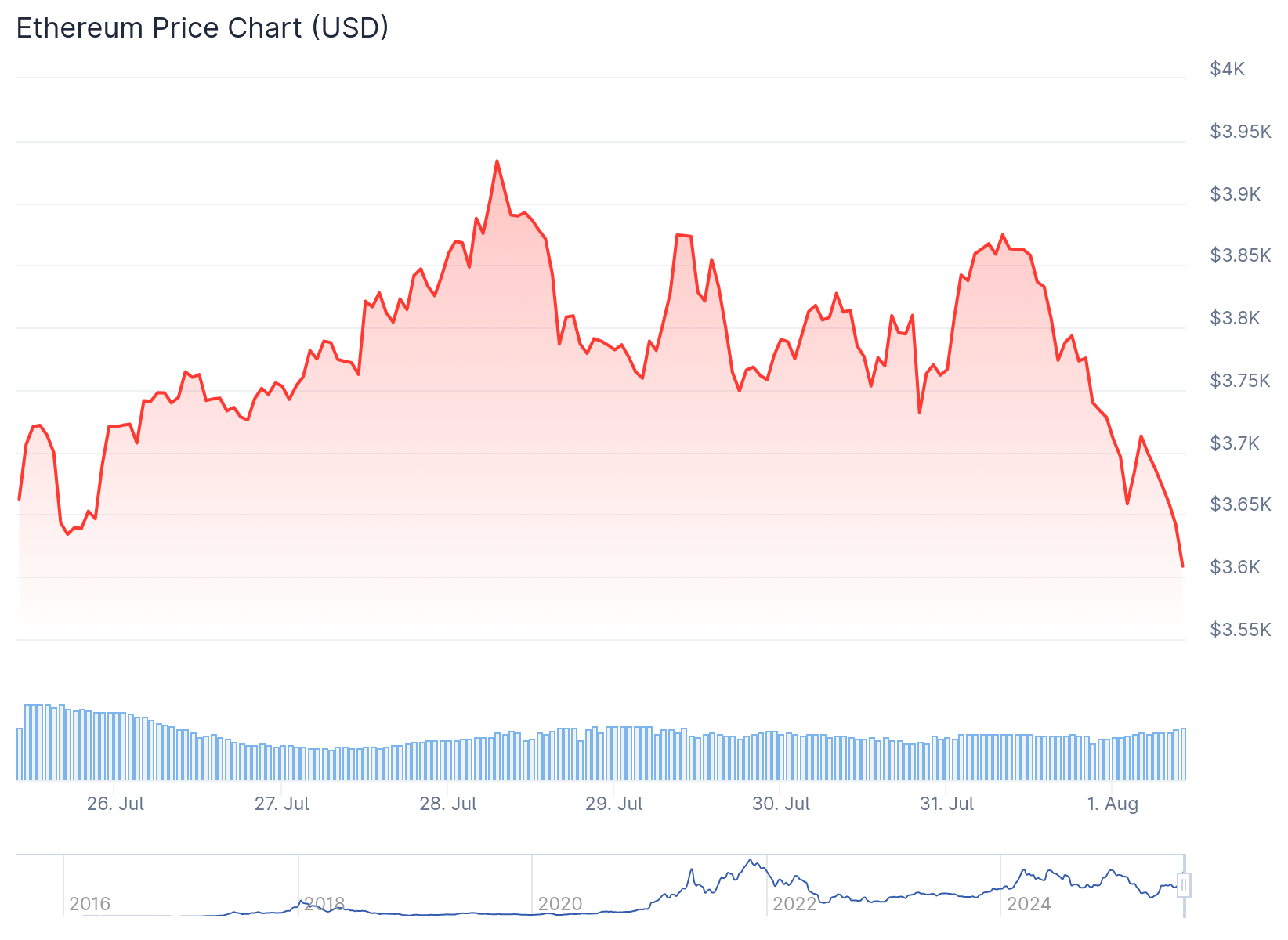

- Ethereum price faced selling pressure near $4,000 but rebounded from $3,600 support level

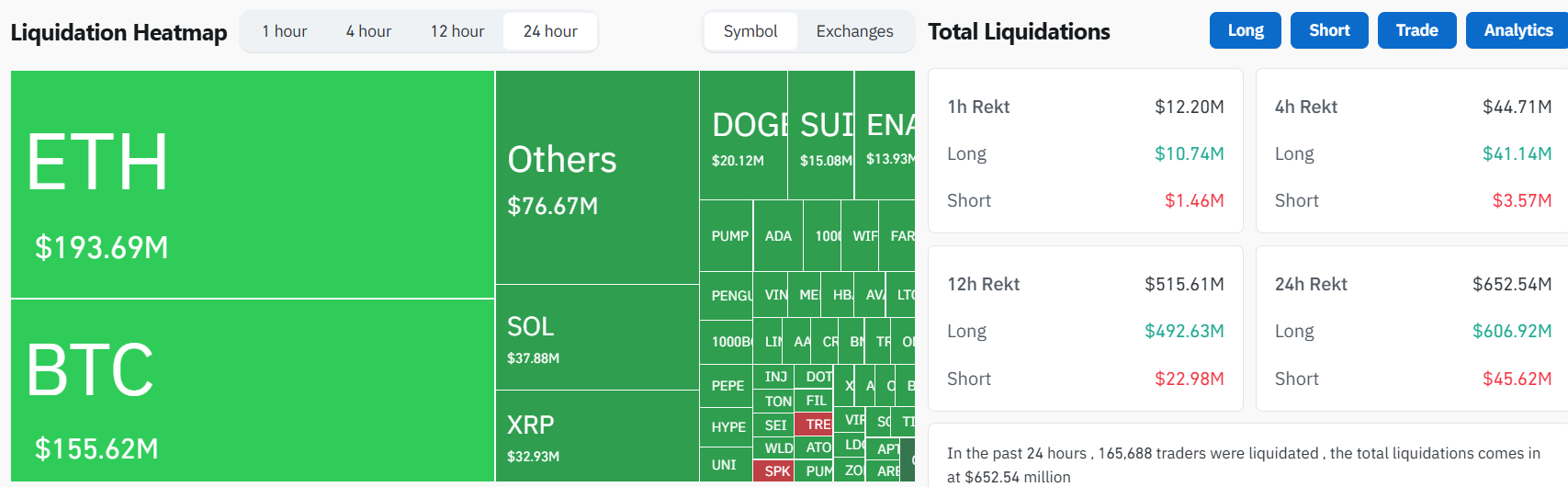

- ETH funding rate turned negative for first time since June 25 as $115.8 million in long positions were liquidated

- Retail investors bore the brunt of liquidations but stepped in to buy the dip at lower prices

- Current price sits at $3,858 with key resistance at $4,500 acting as critical reversal zone

- 47% of active Ethereum addresses are currently in profit, creating potential selling pressure

Ethereum price continues to face resistance NEAR the $4,000 level. The altcoin has struggled to break through this barrier despite strong institutional support.

ETH dropped to $3,600 following Bitcoin’s negative response to new tariffs. President TRUMP announced tariffs against Canada, Taiwan, South Korea, Vietnam and other countries on July 31.

The selling pressure led to heavy liquidations across the market. Over $115.8 million in ETH long positions were liquidated in just five hours.

Retail investors faced the worst of these liquidations. Data shows smaller traders with positions between 100 to 1,000 tokens bore the brunt of the sell-off.

Despite the liquidations, retail traders stepped in to buy the dip. This buying interest helped ETH recover from the $3,600 low.

The funding rate for ethereum turned negative during the drop. This marked the first time funding rates went negative since June 25.

Many traders view negative funding rates as a buy signal. The metric indicates that short positions are paying long positions to maintain their trades.

Market Structure Shows Resilience

ETH currently trades at $3,858 above key support at $3,742. The Parabolic SAR indicator sits below the price candles, showing a bullish trend.

The recovery has outpaced Bitcoin’s performance. While ETH rebounds toward its average trading range, Bitcoin continues facing heavy selling below $116,000.

Ethereum holds above local support levels despite the recent volatility. The price action suggests moderate bullish momentum in the short term.

The altcoin could target the $4,000 level again. If successful, ETH might flip this resistance into support and push toward $4,200.

Key Resistance Remains at $4,500

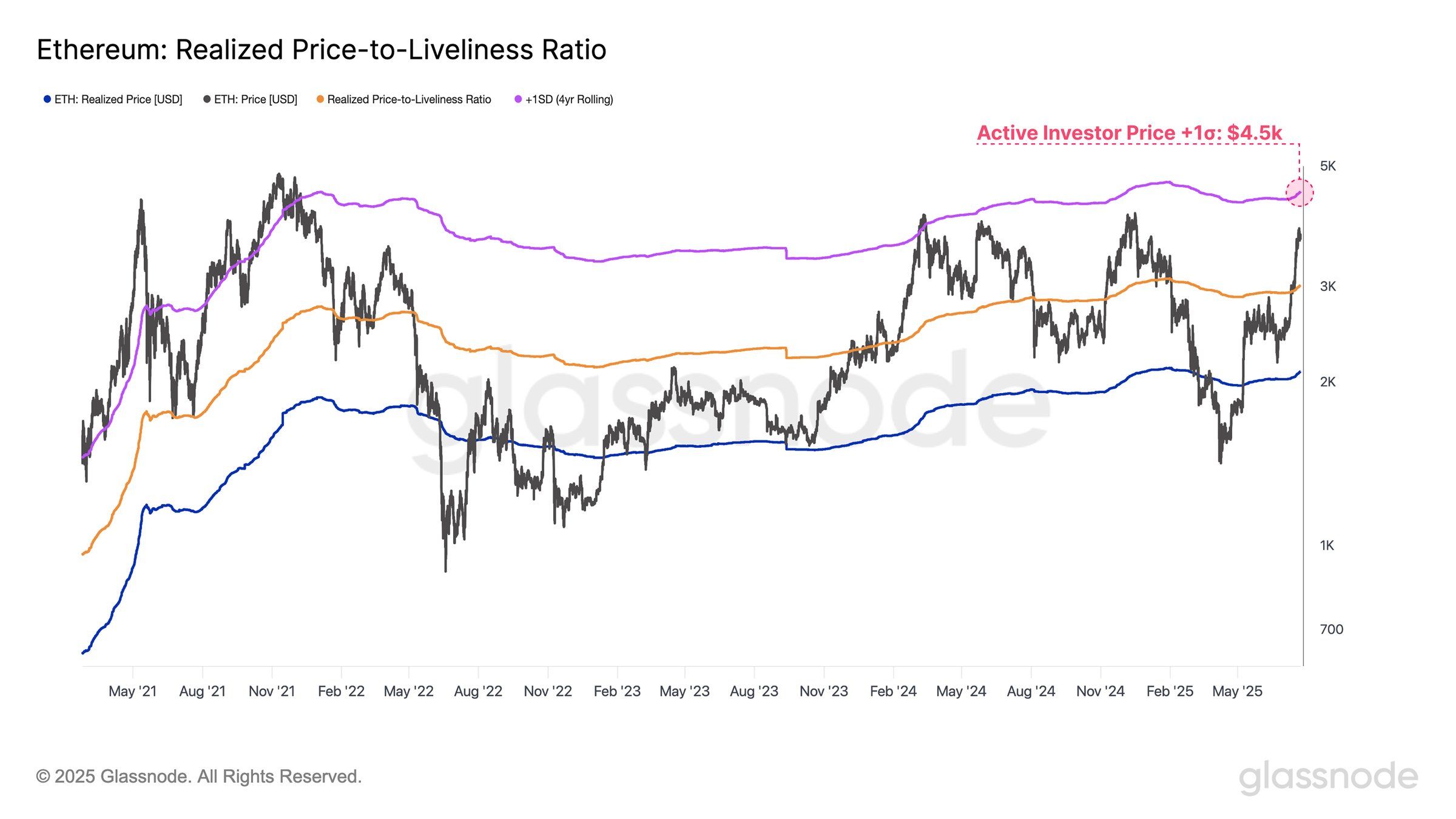

The Realized Price to Liveliness ratio shows important threshold levels. Current data indicates upside resistance sits at $4,500 for this market cycle.

This price level has acted as resistance before. ETH faced similar barriers at $4,500 during March 2024 and the 2020-2021 cycle.

Breaking above $4,500 historically signals market euphoria. This level represents a critical structural pivot for Ethereum’s next major move.

Nearly 47% of active Ethereum addresses are currently in profit. This concentration could create selling pressure as investors book gains.

Profit-taking behavior typically increases when many holders sit in positive territory. This dynamic could slow ETH’s upward momentum in coming sessions.

The current support at $3,530 remains crucial for the bullish case. A break below this level WOULD invalidate the positive price structure.

ETH price sits at $3,858 as of the latest data with the Parabolic SAR confirming the uptrend remains intact.