TRON (TRX) Soars as Tron Inc. Plans $1B SEC Shelf Offering to Buy Back 3.1B Tokens—Bullish or Desperate?

TRON’s parent company just dropped a bombshell—and TRX holders are either celebrating or sweating. Tron Inc. filed a $1 billion SEC shelf offering with one clear goal: scooping up 3.1 billion TRX tokens from the open market. Cue the price speculation.

Why This Move Screams Confidence (Or Panic)

Massive buybacks typically signal bullish conviction—unless they’re a last-ditch effort to prop up a floundering asset. With $1 billion on the line, Tron’s either doubling down on decentralization… or playing Wall Street’s favorite ‘pump-and-disguise’ game. How very crypto of them.

The SEC’s Unlikely New Crypto Client

Irony alert: A blockchain built to ‘cut out middlemen’ is now groveling to the SEC for paperwork. The shelf offering lets Tron Inc. sell securities in dribs and drabs—perfect for quietly offloading equity while the ‘buyback’ headlines do the heavy lifting. Classic finance, meet Web3.

TRX Price: Primed for Volatility

3.1 billion tokens is ~4.5% of TRX’s circulating supply. That kind of demand could send prices rocketing—assuming the market doesn’t see this as a Hail Mary. Either way, buckle up. Nothing moves crypto markets like a nine-figure corporate wallet itching to deploy.

Closing Thought: In crypto, even ‘decentralized’ projects still answer to the oldest master—liquidity. And right now, Tron’s waving $1 billion in its face.

TLDR

- Tron Inc. filed a $1 billion SEC shelf offering to acquire up to 3.1 billion TRX tokens

- This represents an 849% increase from their last purchase of 365 million TRX in June

- TRON has overtaken Ethereum as the leading blockchain for USDT supply with over $80.8 billion

- Whale activity surged 526% with unrealized profits hitting all-time highs

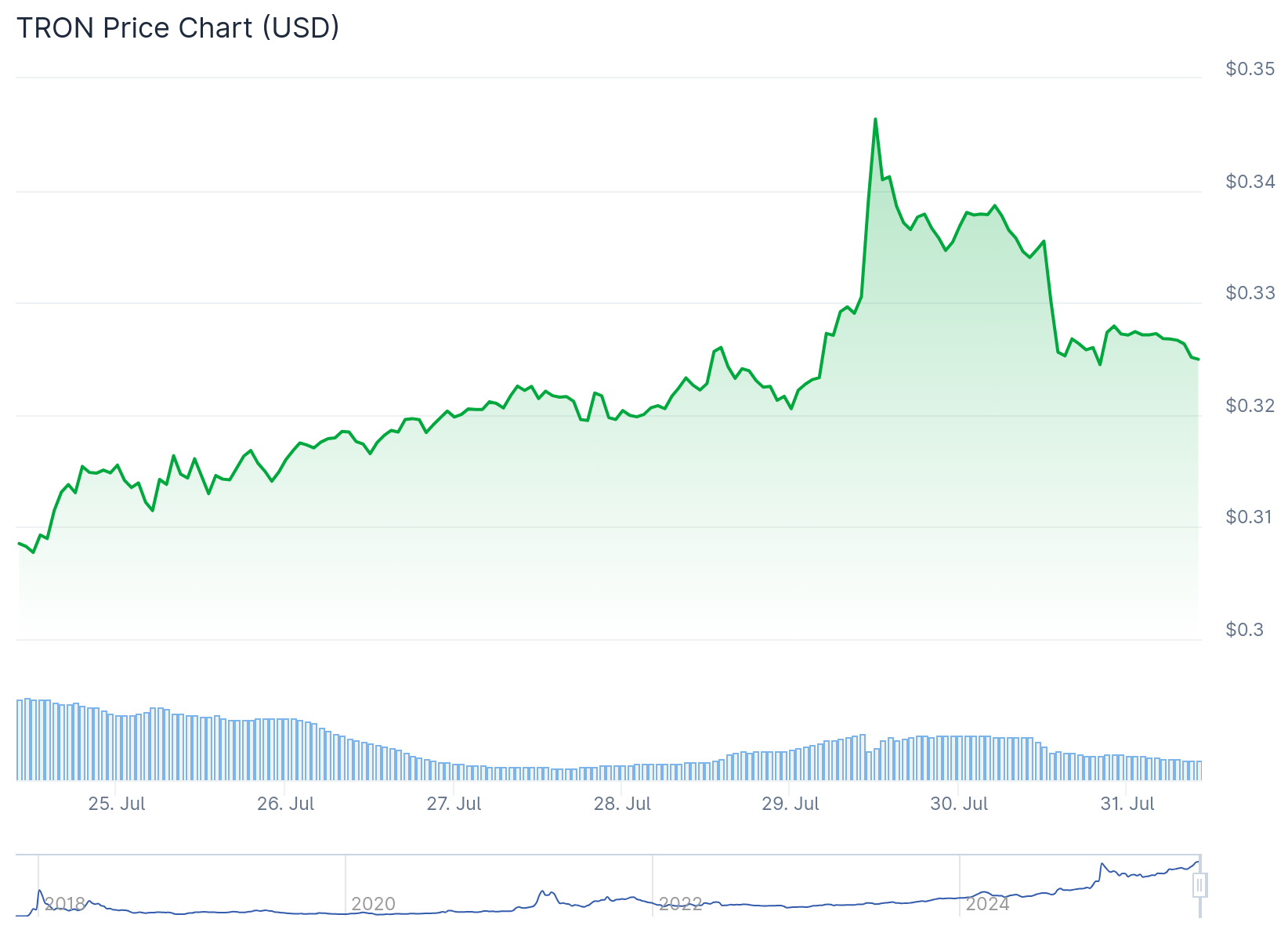

- TRX currently trades at $0.33 with resistance levels at $0.35 and $0.40

Tron Inc. has filed a $1 billion shelf offering with the SEC to acquire up to 3.1 billion TRON tokens. The filing represents one of the most aggressive token acquisition moves by any crypto-aligned entity in recent quarters.

The planned purchase WOULD mark an 849% increase from Tron Inc.’s last known acquisition of 365 million TRX in June. That previous purchase coincided with the beginning of a strong upward move in TRX’s price.

TRX currently trades around $0.33, showing a minor 2.94% decline over 24 hours. Traders are watching resistance levels at $0.35 and $0.40, with the all-time high standing at $0.44.

The shelf offering gives tron Inc. flexibility to sell securities over time rather than all at once. This structure provides the company with ammunition to scale up its TRON holdings over an extended period.

Whale activity has surged dramatically with a 526% increase in large transactions. On-chain activity remains high as unrealized profits on the Tron network have reached all-time highs.

Tron Inc. recently debuted on Nasdaq following a $100 million reverse merger with SRM Entertainment. The listing has attracted increased institutional attention and brought additional legitimacy to TRON in broader financial markets.

Stablecoin Dominance

TRON has overtaken ethereum as the leading blockchain for Tether supply. The network now hosts over $80.8 billion in USDT compared to Ethereum’s $73.8 billion.

TRON processes more than $20 billion in USDT transfers daily. The network’s low-fee, high-speed infrastructure has made it increasingly popular for stablecoin transactions.

Tether recently minted $1 billion USDT on TRON, further cementing the network’s leadership in stablecoin hosting. This development has strengthened TRON’s position in cross-border finance and payments.

The stablecoin dominance provides a steady foundation of network activity. Daily transaction volumes continue to grow as users prefer TRON’s cost-effective transfer fees.

Growing Scrutiny

Several Tron Inc. board members have close ties to founder Justin Sun. This has raised questions about oversight and governance transparency within the organization.

The company faces ongoing regulatory scrutiny following past SEC charges. These charges related to unregistered securities sales involving TRX tokens.

Despite governance concerns, TRON continues supporting a growing DeFi and dApp ecosystem. Regular community events and hackathons drive developer engagement across the platform.

The network maintains expanding partnerships in stablecoin payments and cross-border finance. These partnerships help diversify TRON’s use cases beyond basic token transfers.

Market participants await confirmation of when Tron Inc. will begin deploying the shelf offering capital. The timing and pace of token purchases will likely influence TRX price movements in coming months.