MSFT Soars 8%: Cloud & AI Fuel $27.2B Profit Bonanza as Revenue Jumps 18%

Microsoft just flexed its trillion-dollar muscles again—and Wall Street’s eating it up like a free Azure credit.

Cloud cash machine: Another quarter, another galactic-scale haul. MSFT’s intelligent cloud division? Printing money faster than Satya Nadella can say 'digital transformation.'

AI arms race pays off: Those billions poured into OpenAI and Copilot? Paying dividends as enterprises shove cash into Redmond’s pockets to avoid being left behind.

Wall Street’s love affair continues: Analysts nod sagely while upgrading price targets—because nothing says 'safe bet' like a 48-year-old tech giant growing like a startup. (Cue the hedge funds pretending they saw this coming all along.)

One thing’s clear: When it comes to monetizing the future, Microsoft’s playbook makes crypto traders look like lemonade stand operators.

TLDR

- MSFT surges 8% post-earnings on strong cloud, AI, and full-year results

- Azure, AI boost Microsoft’s Q4 revenue to $76.4B, EPS up 24% YoY

- Microsoft’s cloud and AI push fuel record $27.2B in quarterly net income

- MSFT FY25 revenue hits $281.7B, net income soars to $101.8B

- Productivity, cloud, and Xbox drive Microsoft’s strong Q4, FY25 growth

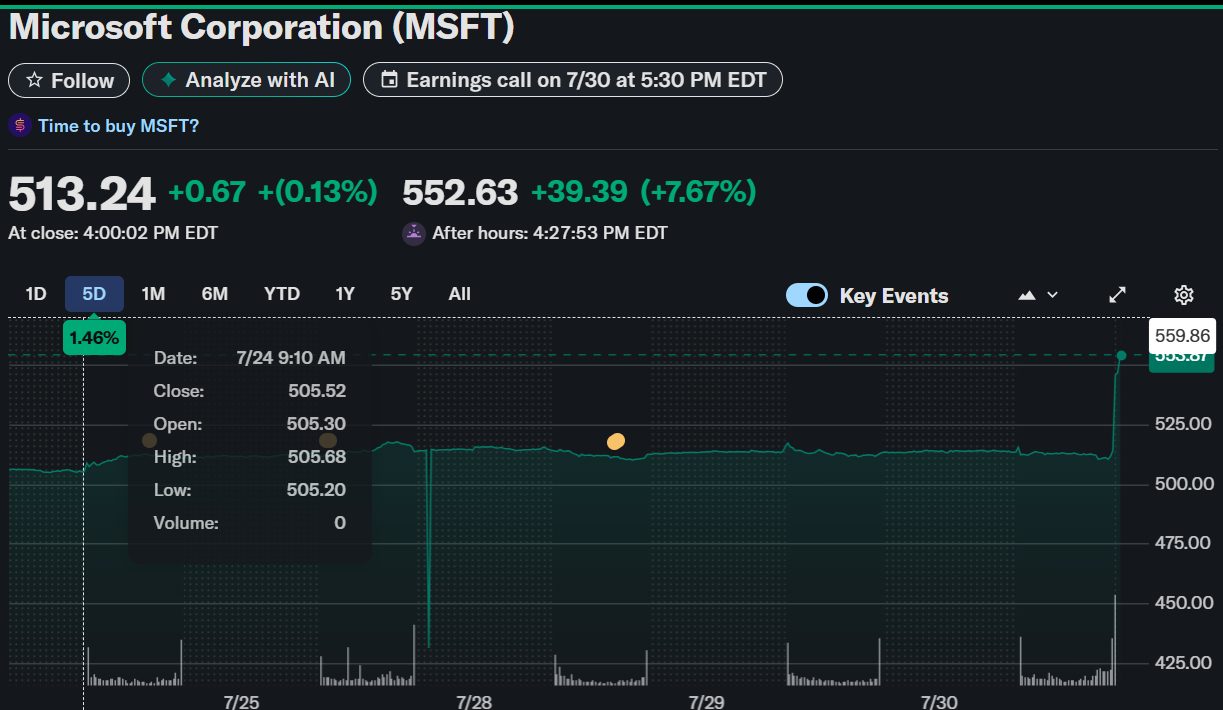

Microsoft Corporation(MSFT) shares surged 8.00% in after-hours trading on July 30, closing at $554.28. The sharp increase followed the release of strong quarterly and full-year financial results. During regular hours, MSFT closed slightly higher at $513.24, reflecting steady interest before the report.

Microsoft Corporation (MSFT)

The company reported revenue of $76.4 billion for the quarter ended June 30, 2025, up 18% year-over-year. Net income reached $27.2 billion, marking a 24% increase compared to the same quarter last year. Diluted earnings per share rose to $3.65, also up 24%, signaling strong profitability across Core segments.

Cloud growth and AI integration supported Microsoft’s strong performance during the quarter. Operating income ROSE to $34.3 billion, reflecting a 23% jump from the previous year. This steady income expansion aligned with consistent demand across enterprise services and platforms.

Azure Pushes Cloud Revenue to New Heights

Microsoft’s cloud segment generated $46.7 billion in revenue, up 27% from the prior year. Azure and other cloud services grew 39%, outpacing broader server product growth of 27%. The Intelligent Cloud segment overall delivered $29.9 billion, rising 26% year-over-year.

Microsoft, $MSFT, Q4-25. Results:

📊 Adj. EPS: $3.65 🟢

💰 Revenue: $76.4B 🟢

📈 Net Income: $27.2B

🔎 Microsoft Cloud hit $46.7B in revenue, fueled by Azure growth and strong demand across the stack. pic.twitter.com/GdZS8iXSEu

— EarningsTime (@Earnings_Time) July 30, 2025

The company attributed this expansion to broad adoption across industries and increased cloud migration demand. Strong workload growth in Azure continues to reinforce its central role in Microsoft’s ecosystem. Cloud and AI capabilities remain a key focus for sustained momentum.

The segment’s performance also reflects rising customer spending on scalable and secure infrastructure. Enterprises deepened reliance on Microsoft’s platforms for digital transformation. Strategic investments in AI and infrastructure supported this uptick and improved service breadth.

Productivity and Business Services Drive Broad Expansion

Microsoft’s Productivity and Business Processes segment earned $33.1 billion, increasing 16% year-over-year. Microsoft 365 Commercial products and services rose 16%, driven by commercial cloud growth of 18%. Consumer versions of Microsoft 365 also saw a 21% revenue boost.

LinkedIn revenue grew by 9% while Dynamics products rose by 18%, including a 23% increase in Dynamics 365 services. These gains show stable demand for digital business solutions across commercial and consumer markets. The segment reflects a balanced mix of recurring and new revenue streams.

Microsoft saw strong software suite renewals and new customer acquisitions. Business platforms continue to offer integrated services for communication, data management, and workflow. Enhanced capabilities and seamless updates likely supported ongoing user engagement.

More Personal Computing Shows Moderate Gains

The More Personal Computing segment generated $13.5 billion, increasing 9% from the year-ago quarter. Windows OEM and Devices revenue rose 3%, while Xbox content and services climbed 13%. Advertising revenue, excluding traffic acquisition, rose 21% during the same period.

These figures suggest stable consumer engagement across hardware, entertainment, and digital content services. Xbox growth likely benefited from new titles and subscription offerings. Search and news advertising gains highlight continued user activity and monetization improvements.

Microsoft balanced platform upgrades and customer experience enhancements in this segment. Steady revenue from Windows and increased demand in gaming contributed to overall growth. As a result, the company maintained a competitive edge in consumer computing.

Annual Performance Highlights Strategic Strength

For the full fiscal year, Microsoft reported $281.7 billion in revenue, up 15% from the previous year. Net income rose to $101.8 billion, reflecting a 16% increase. Diluted earnings per share for the year reached $13.64, also up 16%.

Operating income for the year totaled $128.5 billion, growing 17% compared to fiscal 2024. The company returned $9.4 billion to shareholders during the fourth quarter through dividends and share repurchases. These results showcase Microsoft’s continued execution and capital discipline.