$ADP Crushes Q4 2025 Earnings—FY26 Guidance Signals Bullish Momentum for Automatic Data Processing

Payroll giant beats expectations—again. Wall Street yawns.

Another quarter, another earnings beat for Automatic Data Processing ($ADP). The legacy fintech player just posted Q4 2025 results that smashed analyst estimates, proving that even dinosaurs can adapt when money's on the line.

The Numbers Don't Lie (But Analysts Do)

While the suits on Wall Street lowballed their projections—again—ADP's core payroll processing engine kept churning out profits like clockwork. The company's FY26 outlook suggests this isn't just pandemic-era luck, but actual sustained growth.

Steady as She Goes

No flashy blockchain pivots or AI rebrands here—just old-school enterprise software doing what it's done for decades: printing money while tech startups burn VC cash trying to 'disrupt' them.

Funny how the 'boring' stocks keep outperforming crypto portfolios, isn't it? Maybe there's something to be said for actual revenue streams after all.

TLDR

- Q4 adjusted EPS of $2.26 beats estimates by 1.8% and rises 8.1% YoY

- Revenue climbs 7.5% YoY to $5.13 billion, topping consensus by 1.5%

- FY26 EPS projected to grow 8-10%; revenue growth forecast at 5-6%

- Adjusted EBIT margin expanded 50 bps; Employer Services up, PEO Services steady

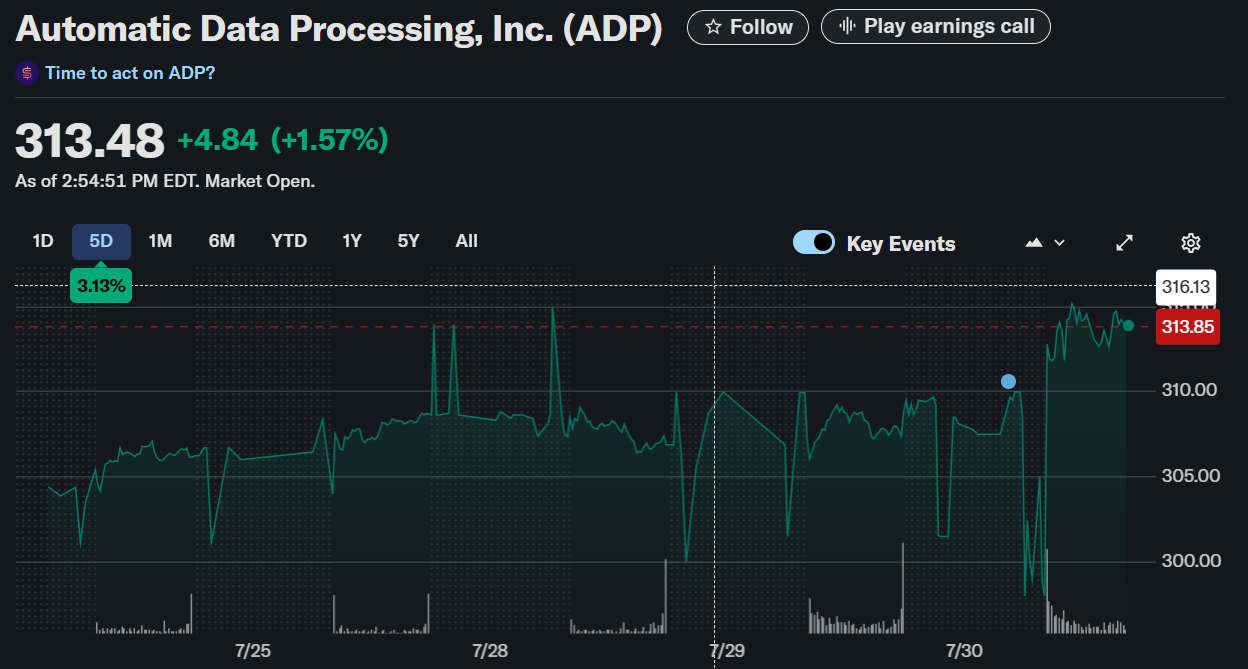

- ADP stock trades at $313.69, up 1.64% midday post-earnings

Automatic Data Processing, Inc. (NasdaqGS: ADP) reported fourth-quarter fiscal 2025 results on July 30, 2025, that beat Wall Street expectations on both earnings and revenue. The stock traded at $313.69 as of 1:28 PM EDT, reflecting a 1.64% intraday gain following the strong results and improved margin guidance.

Automatic Data Processing, Inc. (ADP)

Automatic Data Processing, Inc. (ADP)

Q4 Financial Highlights

ADP posted adjusted earnings of $2.26 per share, surpassing the Zacks Consensus Estimate of $2.22 and growing 8.1% from the $2.09 recorded a year ago. Net income came in at $910.6 million on a GAAP basis. Total revenue ROSE 7.5% year over year to $5.13 billion, outpacing analyst projections of $5.05 billion.

This marks the fourth consecutive quarter in which ADP has exceeded earnings and revenue estimates. Strong performances across Core services contributed to the beat.

ADP, $ADP, Q4-25. Results:

📊 Adj. EPS: $2.26 🟢

💰 Revenue: $5.13B 🟢

📈 Net Income: $1.21B

🔎 Strong revenue and EPS growth driven by client funds interest and record sales in PEO segment. pic.twitter.com/93r4eXnNsj

— EarningsTime (@Earnings_Time) July 30, 2025

Segment Performance

Employer Services brought in $3.5 billion in revenue, a growth of 8% YoY, though slightly below internal estimates of $3.8 billion. Pays per control rose 1% compared to last year.

PEO Services posted 9% revenue growth, reaching $1.2 billion. However, this fell short of the $1.7 billion estimate. Worksite employees under PEO Services rose 3% year over year to 761,000.

Interest on client funds climbed 11% to $308 million, as ADP benefited from a higher average client fund balance of $38.1 billion and a 20-basis point improvement in interest yield to 3.2%.

Margins and Cash Flow

Adjusted EBIT rose 9% year over year to $5.3 billion. The margin improved by 50 basis points to 26%, supported by margin expansion in Employer Services, though PEO Services experienced a slight margin contraction.

ADP ended the quarter with $3.3 billion in cash and equivalents and $4 billion in long-term debt. Operating cash FLOW came in at $1.4 billion.

FY26 Guidance

Management now expects FY26 earnings per share to grow between 8% and 10%. Revenue growth is forecast in the range of 5% to 6%. The adjusted EBIT margin is anticipated to increase by 50 to 70 basis points. The company also projects an effective tax rate of 23%.

Employer Services revenue growth expectations have been revised to 5-6%, down from the prior 6-7%. PEO Services guidance has also been trimmed to 5-7% from the earlier 6-7% outlook.

Performance Overview

As of July 30, 2025, ADP’s stock has returned 8.27% YTD and 24.23% over the past year. The 3-year return stands at 38.64%, and its 5-year return of 161.97% significantly outperforms the S&P 500’s 96.65% over the same period.

Despite modest underperformance versus the market YTD, ADP remains a solid performer with a strong long-term track record and reliable earnings growth. Investors will be closely watching how revised guidance translates into performance in the coming quarters.