Ethereum (ETH) at Crossroads: Smart Money Exits While Network Activity Hits Record Highs

Smart money's walking out the back door just as Ethereum's party gets started. Whale wallets are quietly lightening their loads while retail traders flood the gas fees pool—classic Wall Street meets crypto irony.

Network metrics scream adoption. Transaction volumes punching through resistance levels, decentralized apps seeing record traffic, and that sweet sweet yield farming renaissance. All while institutional players 'strategically rebalance' their portfolios (read: take profits).

The blockchain doesn't lie—activity's up 300% since last quarter. But those pesky on-chain analytics show exchange inflows spiking too. Somebody's building positions while somebody else unloads theirs. Place your bets wisely.

Here's the kicker: ETH's price action looks suspiciously stable considering the frenzy. Somebody's propping this market—for now. Remember what happened last time VCs and degens played tug-of-war with a top-five crypto asset? Grab your popcorn.

TLDR

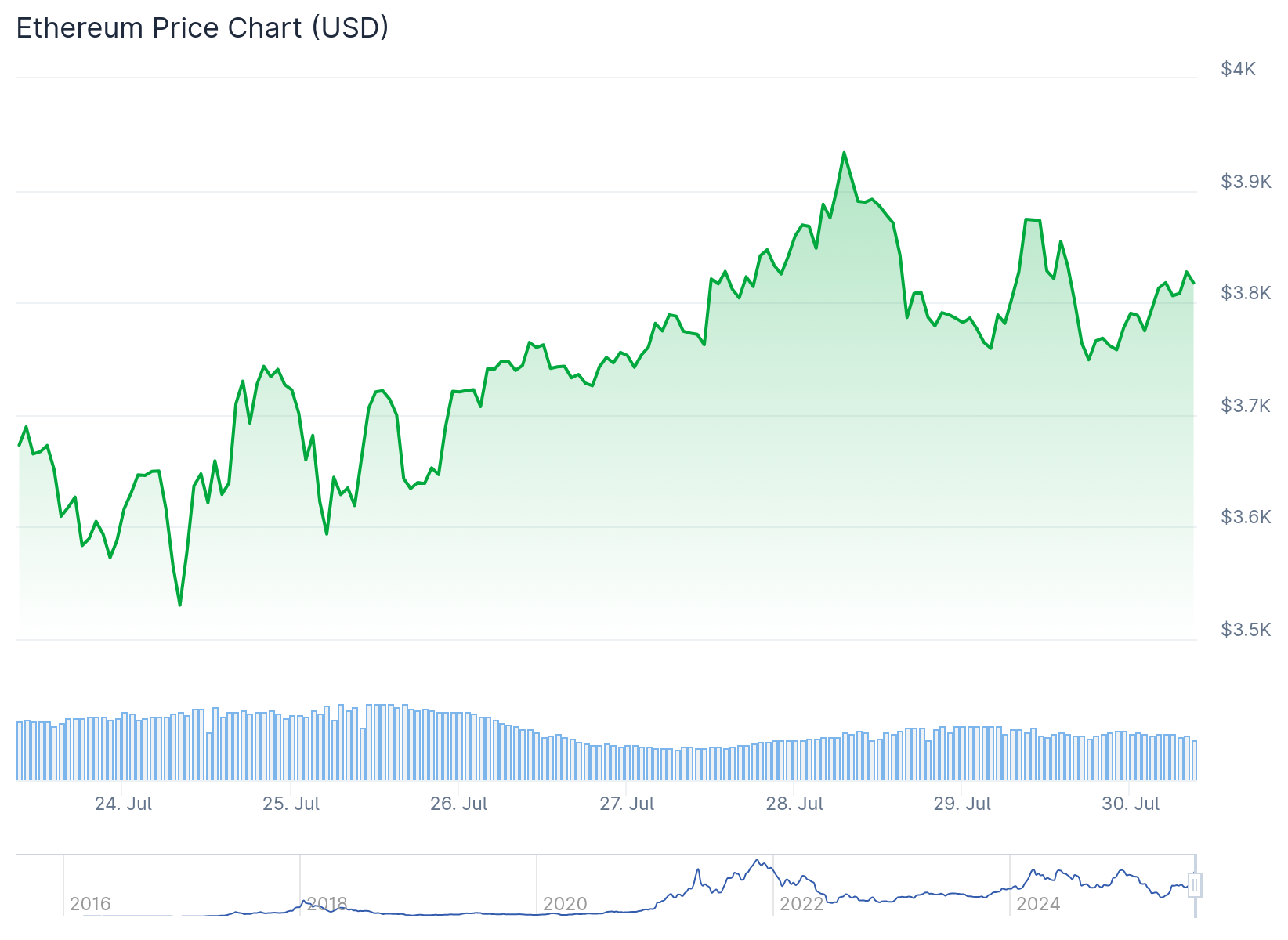

- Ethereum (ETH) price reclaimed $3,800 after briefly dropping to $3,700 in early Asian trading

- ETH futures open interest hit a record high of $58 billion, more than doubling since June 22

- Network activity shows strength with 7.2% increase in active addresses and 16% rise in monthly transactions

- Stablecoin supply reached all-time high of $132.5 billion, indicating increased liquidity demand

- Whale activity suggests potential manipulation with 100 high-cap holders exiting while maintaining price below $4,000 resistance

Ethereum price bounced back to $3,800 on Tuesday after falling to $3,700 during early Asian trading hours. The recovery comes as multiple onchain metrics show increased network activity and market participation.

ETH futures open interest reached a record high of $58 billion on Tuesday. This represents more than double the level seen on June 22. The metric has increased 10% over the past two days alone.

For comparison, Ethereum’s open interest was $20.75 billion on April 29 when the price traded around $1,800. When ETH reached $4,000 in December 2024, futures open interest was only $31.5 billion.

ETH open interest dominance has climbed to nearly 40%, its highest level in over two years. This marks a shift in speculative focus with capital rotating from Bitcoin to ethereum at the margin.

#Ethereum open interest dominance has climbed to nearly 40%, its highest level since April 2023. Only 5% of days have seen a higher reading. This marks a clear shift in speculative focus, with capital rotating from $BTC to $ETH at the margin. pic.twitter.com/yNKLe9gJKt

— glassnode (@glassnode) July 29, 2025

Crypto trader Merlijn The Trader noted the open interest milestone. He said this level of leverage stacking creates fuel for vertical price movement rather than a normal breakout pattern.

Network Metrics Show Increased Activity

Ethereum’s onchain activity continues to strengthen across multiple measures. Active addresses increased by 7.2% over the last 30 days according to Nansen data.

Average monthly transaction count ROSE 16% over the same period to 43.3 million transactions. Weekly DEX volume hit a 4-month high of $22.6 billion according to DefiLlama data.

Weekly app revenue reached a 6-month high of $89.8 million. Stablecoin supply on Ethereum reached an all-time high of $132.5 billion on Tuesday.

Analyst Elja described the network activity as “going through the roof.” He expects these metrics to drive ETH to new all-time highs as a matter of time.

The current ethereum price trades around $3,800, representing a 6% gain over the past seven days. Breaking the $4,000 level remains key for upside potential toward new all-time highs.

Whale Activity Raises Questions

However, whale behavior suggests a different picture beneath the surface metrics. Whale wallet count holding 1,000+ ETH dropped from 4,897 to 4,797 over the past seven days.

This represents a net loss of 100 high-capacity holders during a period of supposed strength. Weekly funding rates on Binance show -0.21%, indicating net short positioning in perpetual futures.

ETH ETFs have attracted close to $1.9 billion in inflows since July 21. Exchange reserves dropped from 8.9 million to 8.7 million ETH, creating a 200,000 ETH supply squeeze through spot venues.

Despite this supply reduction and ETF demand, Ethereum price remains unable to break the $4,000 resistance level. Over $100 million in Ethereum long positions were liquidated in a 24-hour period.

$ETH Slowly creeping its way up to those cycle highs.

Going to be a very interesting spot when it gets there.

I still think it WOULD be a bit healthier if price consolidates below it for some time before breaking it, as the current rally has been very sharp already.

That way… pic.twitter.com/JjRfxfkIEe

— Daan crypto Trades (@DaanCrypto) July 29, 2025

Trader Daan Crypto Trades suggests ETH is “slowly creeping” toward cycle highs around $4,000. He notes this resistance level has rejected price multiple times since February 2024.

Market analysts Bitcoinsensus believe ETH is “ready to explode to the upside” above a multi-year trendline. They expect sufficient momentum could lead to much higher prices in the upcoming cycle phase.

ETH sits 3.3% below the $4,000 breakout zone with macro catalysts emerging as the FOMC prepares policy updates. Bitcoin dominance cooled to 61.25% after reaching 62%+ this week, potentially supporting altcoin rotation.