TRON (TRX) Surges Past Cardano: Justin Sun’s Nasdaq Play Fuels Rally

TRX just pulled off a power move—leapfrogging Cardano’s market cap after Justin Sun’s latest headline grab. Here’s why traders are flipping bullish.

The Nasdaq Effect: Hype or Game-Changer?

Sun’s relentless PR machine struck again, this time with a Nasdaq-linked announcement (details suspiciously vague, as usual). TRX holders didn’t care—price spiked 18% in 24 hours while ADA stagnated. Classic crypto: narrative beats fundamentals every time.

Chain Wars: TRX’s Scalability Edge

Say what you will about Sun, but TRON’s 2,000 TPS throughput is eating Cardano’s ‘academic rigor’ for lunch. Developers are voting with their feet—dApp deployments on TRON up 40% quarter-over-quarter.

The Cynic’s Corner

Let’s be real: this pumps Sun’s personal bag more than the ecosystem. But in a market where ‘number go up’ is the only theology, TRX might just keep climbing… until the next shiny distraction.

TLDR

- TRON surpassed Cardano to become the 9th largest cryptocurrency by market cap at over $29 billion

- The network has processed over 14 billion transactions and generated more than $2 billion in cumulative fees

- TRON now hosts over $80 billion in USDT, exceeding Ethereum in stablecoin supply and daily transfers

- Justin Sun and Tron Inc rang the Nasdaq opening bell on July 24, marking a corporate milestone

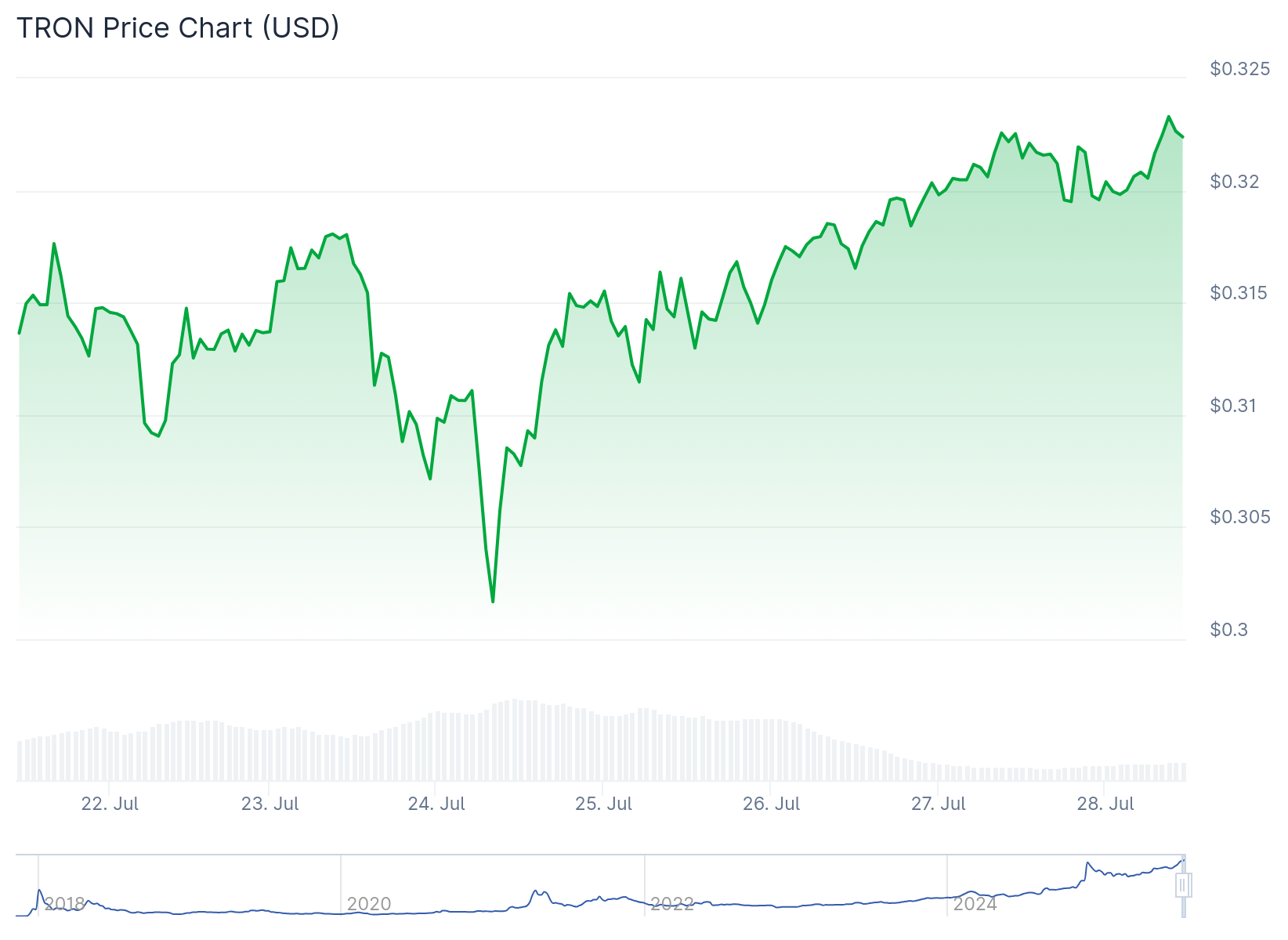

- TRX price is showing steady upward movement with analysts targeting $0.40-$0.45 by September

TRON has reached several key milestones as its founder Justin Sun celebrated the network’s achievements at the Nasdaq stock exchange. The blockchain platform has overtaken Cardano in market capitalization to become the ninth-largest cryptocurrency.

On July 24, Justin Sun and TRON Inc rang the opening bell at the Nasdaq stock market in Times Square. This ceremony marked a transformation for the company following SRM Entertainment’s name change to Tron Inc in mid-June.

The corporate restructuring included a $100 million equity investment to establish a TRX treasury strategy. The company also announced a $210 million strategic investment to build its tron treasury holdings.

Network Performance Shows Strong Growth

TRON’s blockchain has processed more than 14 billion transactions throughout its operation. Daily transaction activity averages between 8 to 9 million transactions, nearly double the activity seen during previous market downturns.

The network has generated over $2 billion in cumulative fees. This growth has occurred steadily throughout 2024 rather than in sudden bursts during HYPE cycles.

Most network fees are paid in TRX tokens. This creates direct demand for the native cryptocurrency as network usage increases.

Stablecoin Dominance Drives Usage

TRON has become the preferred platform for stablecoin operations. The network hosts over $80 billion in USDT, surpassing ethereum in both stablecoin supply and daily transfer volume.

More than $22 billion in USDT has been minted on TRON in 2025 alone. This shows strong demand for the network’s cheap and fast stablecoin transfer capabilities.

The platform processes over $20 billion in USDT transfers daily. This exceeds Ethereum’s $16 billion in daily USDT transfer volume.

Market Position Strengthens

TRON’s market capitalization has reached over $29 billion. The cryptocurrency flipped cardano during recent market volatility when TRX fell less than ADA’s 8% decline.

TRX price made a 2025 high last week during continued network growth. The token is currently trading around $0.31 with steady upward movement on hourly charts.

Trading volume increased by 70% in recent 24-hour periods. This indicates growing trader interest in the cryptocurrency.

Futures market data shows buying pressure for TRX tokens. Total futures open interest increased 1.76% to $500.92 million in a four-hour period.

The network implemented a gas-free feature in early 2025. This reduced average weekly transaction fees by over 70%, from 2.47 TRX to 0.72 TRX per transaction.

Stablecoin issuers continue choosing TRON for new token launches. USDT supply on TRON represents over 50% of all circulating USDT tokens.

The U.S. Securities and Exchange Commission dropped its fraud investigation into Sun’s companies. This helped improve investor sentiment toward TRON-related projects.

The passing of the GENIUS Act supports U.S. government efforts to strengthen dollar dominance through stablecoins. This regulatory development benefits TRON as a major stablecoin settlement layer.

Analysts have set price targets of $0.40 to $0.45 for TRX by September. These projections are based on continued network growth and corporate developments.

TRON stock price closed 53.27% higher at $10.30 on Wednesday following the Nasdaq bell ceremony.