Solana (SOL) Hits $200 Wall: Long-Term Holders Take Profits Amid Market Tension

Solana's rally slams into a stubborn $200 resistance—turning what looked like a breakout into a battleground between bulls and profit-takers.

Why $200 matters

That triple-digit psychological barrier isn't just round-number psychology. It's where early backers who bought sub-$20 finally see life-changing gains—and apparently, their sell orders.

The institutional shrug

While retail traders obsess over chart patterns, hedge funds are too busy charging 2-and-20 fees on crypto index funds to care about SOL's micro-drama. Some things never change.

What comes next?

Either Solana punches through and confirms its 'Ethereum killer' status, or gets stuck in no-man's land while the next shiny L1 steals its spotlight. Place your bets.

TLDR

- Solana (SOL) briefly broke above $200 but failed to maintain this level, currently trading around $187

- Long-term holders are selling as shown by spiking Liveliness metrics, creating downward price pressure

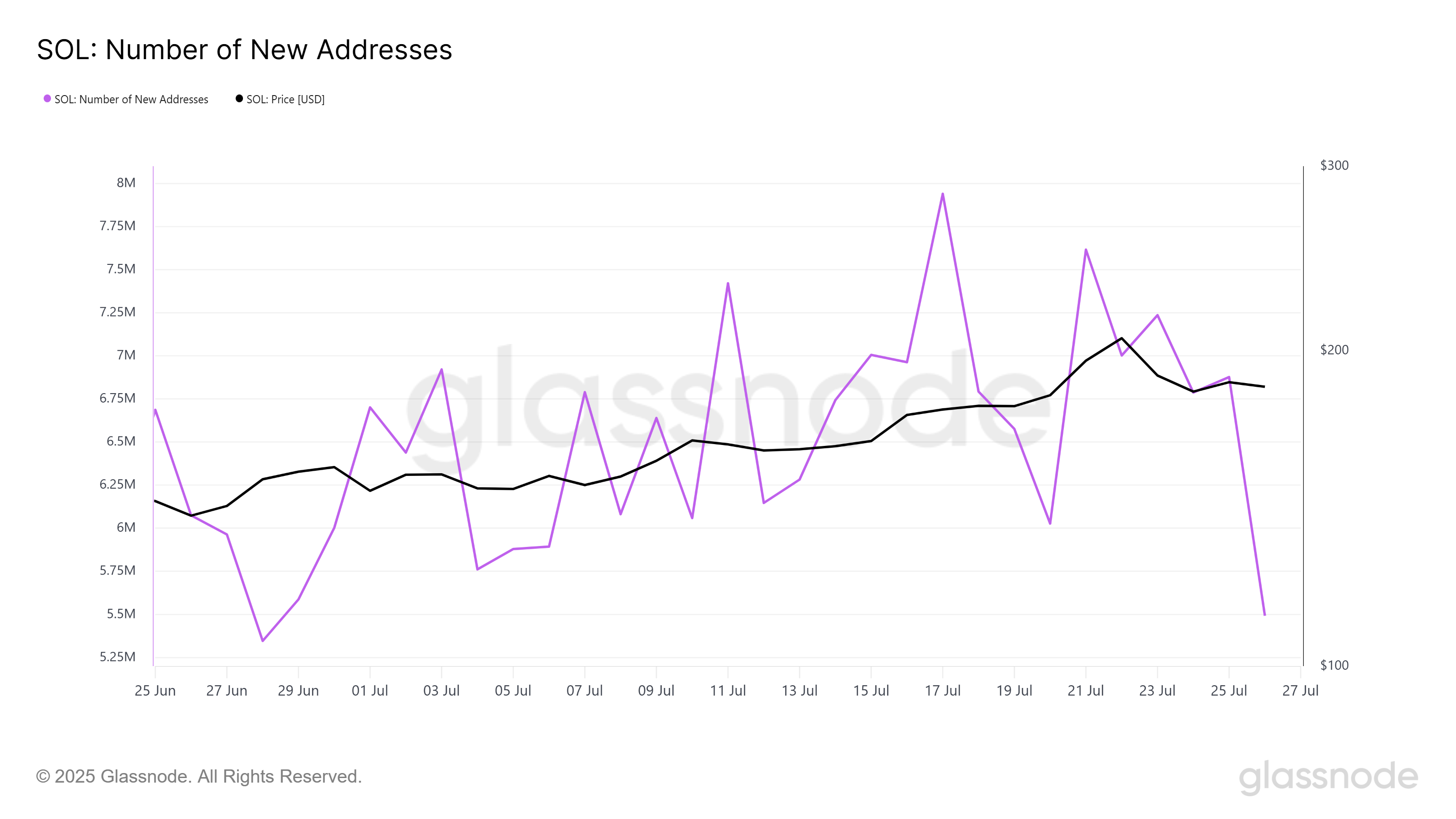

- New address creation dropped by 1.4 million in 48 hours, showing declining investor interest

- Open Interest reset from $12.01 billion to $10.56 billion may create healthier foundation for future moves

- Technical analysis shows thin resistance above $200 but support at $176 remains critical

Solana recently attempted to break through the $200 resistance level but struggled to maintain momentum above this psychological barrier. The cryptocurrency briefly surpassed $200 before retreating to current levels around $187.

The failure to hold above $200 comes as market dynamics shift. Long-term holder behavior shows increased selling activity through rising Liveliness metrics over the past 12 days.

Liveliness measures movement from established holders. When this metric spikes, it typically indicates selling pressure from investors who have held positions for extended periods.

These long-term holders carry weight in price movements. Their selling activity creates downward pressure that makes recovery more challenging.

The selling trend extends beyond established investors. New address creation has declined to monthly lows, with 1.4 million fewer new addresses created in the past 48 hours.

This drop in new investor participation suggests weakening interest in Solana. Fewer fresh investors entering the market reduces buying pressure needed for price recovery.

Open Interest Reset Shows Market Adjustment

Open Interest data reveals recent market adjustments. The metric peaked at $12.01 billion on July 23rd before cooling to $10.56 billion at current levels.

This reduction represents a clearing of excess leverage from the market. Such resets often remove speculative positions that could trigger sharp price movements.

The Open Interest decline may create a healthier foundation for future price action. Reduced leverage typically leads to more stable price movements with less liquidation risk.

Despite the decrease, Open Interest remains elevated compared to historical levels. This suggests continued market engagement even as speculative excess gets cleared.

Technical Levels Define Next Price Direction

Current price action shows solana consolidating between key technical levels. The cryptocurrency trades near $187 with resistance at $188 above.

Support sits at the $176 level below current prices. A break below this support could deepen losses and confirm bearish sentiment.

Technical analysis shows minimal resistance above $200 if Solana can reclaim that level. Token concentration data indicates thin selling pressure beyond the $200 barrier.

The heaviest concentration of tokens sits between $165 and $176. Most selling pressure exists at these lower levels rather than above current prices.

RSI readings have cooled to 60.84 from overbought territory. This cooling suggests momentum has slowed but remains in bullish control territory.

MACD indicators show the signal line above zero with a narrowing gap. Volume has declined following recent price moves, which typically occurs after sharp movements.

Price action represents more of a consolidation than a reversal pattern. The structure remains intact unless Solana breaks below the $180 support level.

Recovery potential exists if broader market sentiment improves. A reclaim of $188 as support could target a return to $201 levels.

Current market conditions show mixed signals with selling pressure from established holders offset by reduced leverage in the system.