XRP Plummets 10% as Ripple Co-Founder Moves $140M – What’s Brewing?

XRP just got sucker-punched with a double-digit drop—and whale-sized transactions are fueling the frenzy. Here's the breakdown.

Whale Alert: $140M On the Move

Blockchain trackers spotted two massive XRP transfers (we're talking nine figures) tied to a Ripple co-founder's wallet. The market reacted like you'd expect—by dumping first and asking questions later.

Price Carnage

XRP/USD charts show a 10% nosedive within hours of the transfers. Traders are split: some see panic selling, others spy institutional accumulation. Either way, liquidity's getting a stress test.

The Ripple Effect

This isn't just about one token. The sell-off's rippling through altcoin markets—because when crypto's favorite courtroom drama token stumbles, everyone feels the tremor.

Finance's Dirty Little Secret

Remember: in traditional markets, this would trigger SEC alarms. In crypto? Just another Tuesday with extra volatility. Buckle up.

TLDR

- The XRP price dropped over 10% within 24 hours, falling below critical technical support levels.

- A wallet linked to Ripple co-founder Chris Larsen transferred $140 million in XRP to exchanges since July 17.

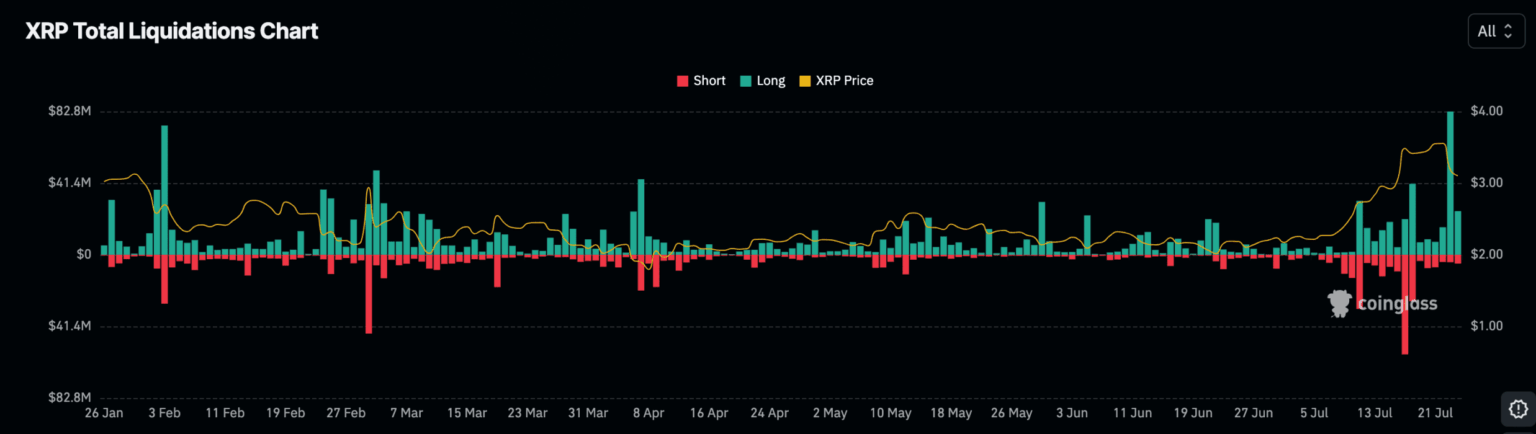

- These transfers triggered $81.7 million in XRP futures liquidations, according to data from Coinglass.

- Trading volume surged by 149.8% as bearish pressure intensified and stop-loss orders were activated.

- South Korea’s Upbit exchange contributed to the sell-off, with over 75 million XRP sold on the platform.

A series of large XRP transfers linked to Ripple’s co-founder triggered a steep 10% drop in the XRP price. The sell-off erased significant market value and pushed trading volume sharply higher. Market data confirmed that heavy liquidations followed, intensifying bearish momentum across the broader altcoin sector.

Ripple-related wallets transferred large sums of XRP, prompting speculation and concerns about a coordinated MOVE to sell holdings. Blockchain investigator ZachXBT identified transactions from a wallet tied to Ripple’s co-founder, Chris Larsen. These transfers included $140 million worth of XRP moved to exchanges and services.

Since July 17, 2025 an address linked to Ripple co-founder Chris Larsen transferred out 50M XRP ($175M) to four addresses.

~$140M ended up at exchanges/services

30M XRP recipient

rPS9kVPbgZF4vXq2hs6s9Xv2754qdRau98

rnQXgGAjqbF4KoBpcBK5YBHyZEL7nGWWoi

10M XRP recipient…

— ZachXBT (@zachxbt) July 24, 2025

The xrp price broke below key technical levels and attracted stop-loss orders, resulting in forced liquidations across major platforms. Data from Coinglass reported $81.7 million worth of XRP futures were liquidated. This cascade of events increased selling pressure and contributed to the loss in market value.

XRP Price Falls Below Key Support Zones as Volume Spikes

The XRP price fell below the $3.27 pivot and the 23.6% Fibonacci retracement at $3.28 during the correction. These breakdowns led to further selling as traders exited Leveraged positions. Stop-loss triggers contributed to forced selling and widened losses.

Trading volume surged by 149.8% in the past 24 hours as panic intensified. Liquidations from major exchanges added to the volatility and drove sharp intraday price changes. This rapid shift in volume confirmed the strong bearish sentiment surrounding the XRP price.

Meanwhile, the MACD histogram reflected reduced bullish momentum as it narrowed from +0.06 to +0.041 over the past week. The technical indicator reinforced the loss in strength and trend reversal signs. Analysts continue to monitor momentum indicators for signs of recovery or further declines.

Exchanges Drive Down XRP Price Amid Sell-Off

South Korea’s Upbit exchange recorded over 75 million XRP sold during the sell-off. These exchange-based transactions directly impacted the XRP price as order books thinned quickly. Heavy volumes concentrated on one exchange raised concerns about further downside pressure.

The XRP price responded immediately as Ripple-linked wallets dispersed funds across multiple addresses. Two new wallets each received 5 million XRP, adding to speculation about the intent behind these moves. Some community members interpreted this as a decentralization effort, while others feared more sales ahead.

The price decline occurred as Bitcoin’s market dominance briefly increased. As altcoins lost ground, XRP led the losses with notable market cap erosion. Following the sharp XRP correction, the total loss across altcoins reached nearly $100 billion.

Legal Outcome Could Influence XRP Price Recovery

The Ripple lawsuit with the SEC approaches a key deadline for a joint status report on August 15. Market watchers expect a resolution soon, with settlement talks gaining traction. Speculation points to a possible $50 million penalty and no formal injunction.

Analysts suggest the XRP price rebound if the legal outcome favors Ripple. Optimism remains strong, with some predicting a continuation of the previous uptrend from $1.90. Despite the sharp correction, technical patterns still show potential support levels.

Well-known trader CrediBULL crypto highlighted a completed “triple tap” structure in XRP’s chart. The setup suggests a retest of support, with room for an upward move. Many believe the correction was temporary and that the market may regain its strength.