Square’s 2026 Bitcoin Bomb: 4 Million US Merchants Go Crypto

Jack Dorsey’s fintech empire just dropped its biggest crypto play yet—Square’s rolling out Bitcoin payments to every mom-and-pop shop, food truck, and overpriced avocado toast vendor in America.

The Mainstream Money Cannon

By 2026, that clunky iPad at your local bakery could moon as hard as a degenerate’s altcoin portfolio. Square’s targeting 4 million merchants—roughly the same number of times finance bros will say 'hyperbitcoinization' unironically during rollout.

Why This Time’s Different

No more 'BTC accepted here' stickers gathering dust next to the expired health permits. Square’s baking crypto into its existing POS systems—forcing adoption faster than a Wall Street analyst backpedaling on a 'Bitcoin is dead' take.

The Fine Print (Because There Always Is One)

Volatility? Hedged. Compliance headaches? Outsourced to lawyers who bill more per hour than Bitcoin’s 2010 price. The real winner here? Square’s stock—because nothing pumps shares like pretending you understand blockchain.

TLDR

- Square launched Bitcoin payments for merchants on July 22, 2025, using the Lightning Network for faster, cheaper transactions

- The rollout targets 4 million Square merchants across the US, with full availability planned by 2026

- Merchants can choose to keep Bitcoin or convert to dollars instantly, potentially saving 50% on processing fees compared to credit cards

- The feature is currently limited to select merchants and won’t be available in New York State or outside the US due to regulatory requirements

- Block joined the S&P 500 on July 23, with its stock rising over 14% in the past week as the Bitcoin payment system launched

Square has started accepting Bitcoin payments for merchants through its point-of-sale systems, marking one of the largest cryptocurrency payment integrations in retail history. The rollout began July 22, 2025, with plans to serve all 4 million Square merchants by 2026.

boom.

today we're onboarding our first few @Square sellers for the new native Bitcoin acceptance experience

this is the way!

— OBJ (@owenbjennings) July 22, 2025

Owen Jennings, a Block executive, confirmed the launch on social media. He stated the company is “onboarding our first few Square sellers for the new native bitcoin acceptance experience.” Block first announced this initiative at the Bitcoin 2025 conference in Las Vegas on May 27.

The timing coincides with Block’s addition to the S&P 500 index on July 23. The company’s stock has risen more than 14% over the past week. Block shares closed up 0.5% on the announcement day.

Jack Dorsey’s payment company is using Bitcoin’s Lightning Network for the integration. This secondary LAYER processes transactions faster and cheaper than the main Bitcoin blockchain. Customers scan QR codes at checkout to complete payments.

The system builds on Square’s existing Bitcoin Conversions feature from 2024. That service already allows qualified merchants to convert daily sales into Bitcoin automatically. The new payment option gives customers another way to spend cryptocurrency.

How the Payment System Works

The Lightning Network handles transaction processing while Square manages exchange rates and confirmations. Merchants receive flexibility in how they handle Bitcoin payments. They can keep the cryptocurrency or convert it to dollars immediately.

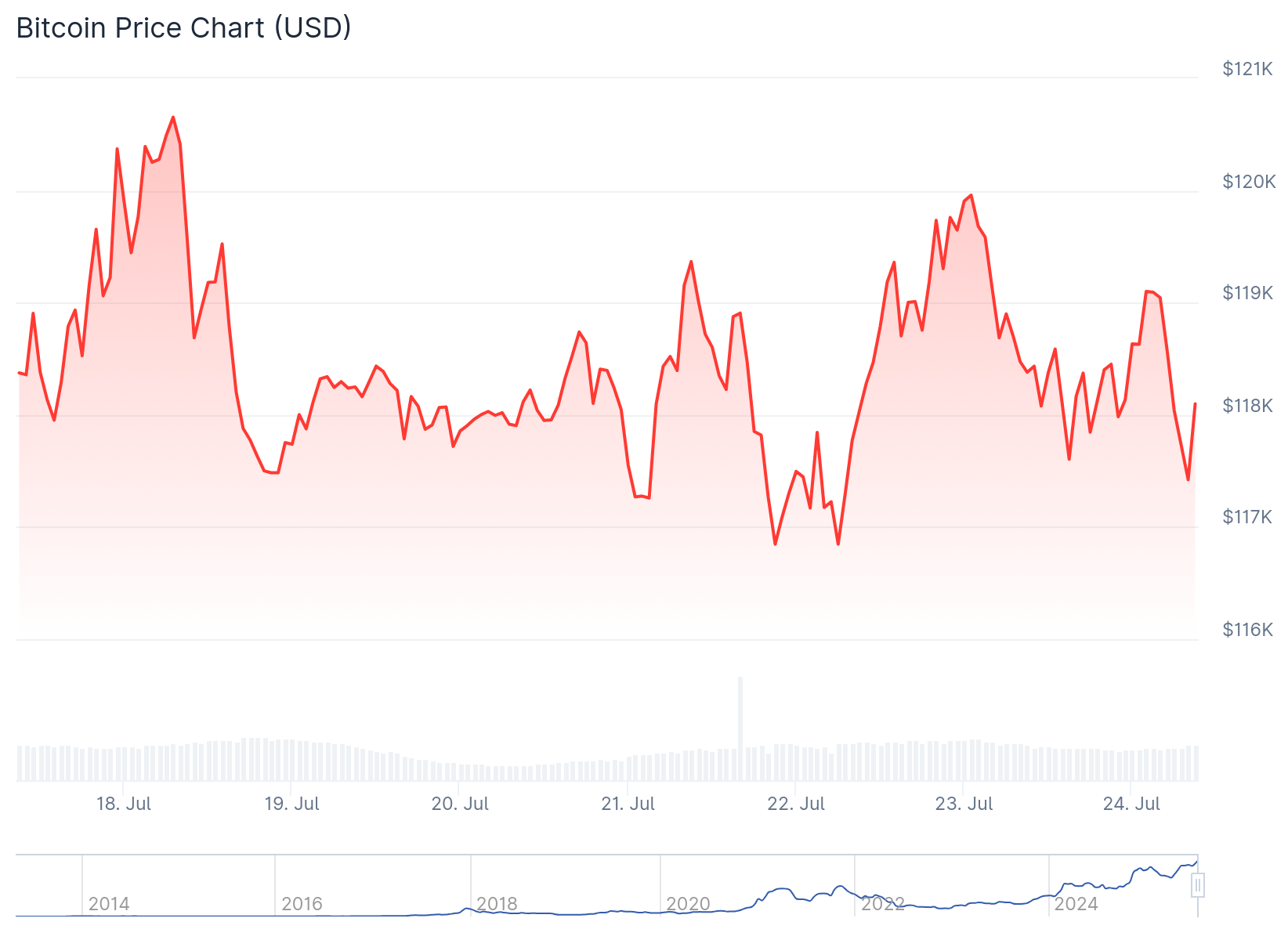

This conversion option helps businesses avoid Bitcoin’s price volatility. The cryptocurrency recently hit new highs above $123,000 but can experience sudden price swings. Instant conversion protects merchants from these fluctuations.

Traditional credit card transactions charge merchants between 1.5% and 3.5% in fees. Bitcoin payments through Square settle in minutes at lower rates. This could save businesses money on each transaction.

Dan Edwards from Steak ‘n Shake restaurant chain reported cutting payment processing fees in half. “When customers choose to pay in Bitcoin instead of credit cards, we are saving about 50% in our processing fees,” Edwards said at Bitcoin 2025.

The cost savings appeal to businesses looking to reduce operational expenses. Lower processing fees can improve profit margins for retailers. This economic benefit drives merchant interest in Bitcoin payments.

Regulatory Hurdles Limit Expansion

The rollout faces regulatory challenges that restrict its scope. The feature will not be available to sellers in New York State initially. International expansion also requires additional regulatory approvals.

Block’s official statement notes the Bitcoin payments feature “is subject to change and may not be available in all locations.” The company must obtain approvals in various jurisdictions before expanding. These regulatory requirements could slow the rollout timeline.

Block operates under a VIRTUAL currency business activity license from New York’s Department of Financial Services. However, the Bitcoin payments feature may need separate approvals. This adds complexity to the expansion process.

The company expects broader rollout in the second half of 2025. Full availability to all eligible Square sellers is targeted for 2026. This timeline depends on regulatory approvals and successful technology scaling.

Square competes with other Bitcoin payment providers like PayPal, Coinbase, and BitPay. However, Square’s non-custodial approach gives users full control over their Bitcoin. This aligns with cryptocurrency’s decentralized principles.

Block ranks as the tenth-largest corporate Bitcoin holder with 8,584 BTC worth approximately $935 million. The company reinvests 10% of Bitcoin-related profits back into Bitcoin purchases monthly. Over 1,700 merchants already use Square’s Bitcoin Conversions feature to convert sales to Bitcoin automatically.