🚀 BNB (BNB) Shatters $800 Barrier: Institutional FOMO Fuels Record-Breaking Rally

BNB just mooned past its all-time high—no brakes on this bull train.

Why Wall Street's late to the party (again)

Institutions are scrambling for bags after retail called the bottom. Classic hedge fund timing—buy high, panic higher.

The $800 breakout that broke traders

Liquidity vanished faster than a DeFi exploit when BNB punched through resistance. Now the suits want in—just as the smart money starts taking profits.

Another day, another ATH. Welcome to crypto, where the fundamentals are made up and the TA doesn't matter.

TLDR

- BNB reached a new all-time high of $804 on July 23, ending a seven-month wait for new records

- Chinese firm Nano Labs increased BNB holdings to 120,000 tokens worth approximately $90 million

- Trading volume surged 42% to over $3.2 billion while futures open interest climbed 19.16%

- Historical patterns from 2021 suggest BNB’s new high could trigger broader altcoin season

- Technical indicators show overbought conditions with RSI at 87.54, well above the 70 threshold

BNB reached a new all-time high of $804 during early Asian trading hours on July 23. The milestone marks the end of a seven-month period without new record highs for the fifth-largest cryptocurrency by market cap.

The token gained 4% over the past 24 hours and 16% over the past week. BNB’s market capitalization now exceeds $110 billion, reinforcing its position among the top cryptocurrencies.

Trading activity around BNB has surged across multiple metrics. Daily trading volume ROSE 42% to over $3.2 billion, indicating increased investor interest.

Futures markets also showed heightened activity. According to Coinglass data, BNB futures open interest climbed 19.16% to $1.23 billion.

Derivatives volume jumped 33.3% to $2.18 billion. These figures point to increased speculative activity around the token.

Institutional Investment Drives Growth

Institutional interest appears to be driving the recent price breakout. On July 22, Nano Labs Ltd disclosed it had raised its BNB holdings to 120,000 tokens.

The Chinese Web3 infrastructure firm valued its holdings at approximately $90 million. Nano Labs executed over-the-counter purchases at an average cost of $707 per BNB.

The company stated it views BNB as a Core strategic reserve asset. Nano Labs plans to continue building its BNB reserves through further acquisitions.

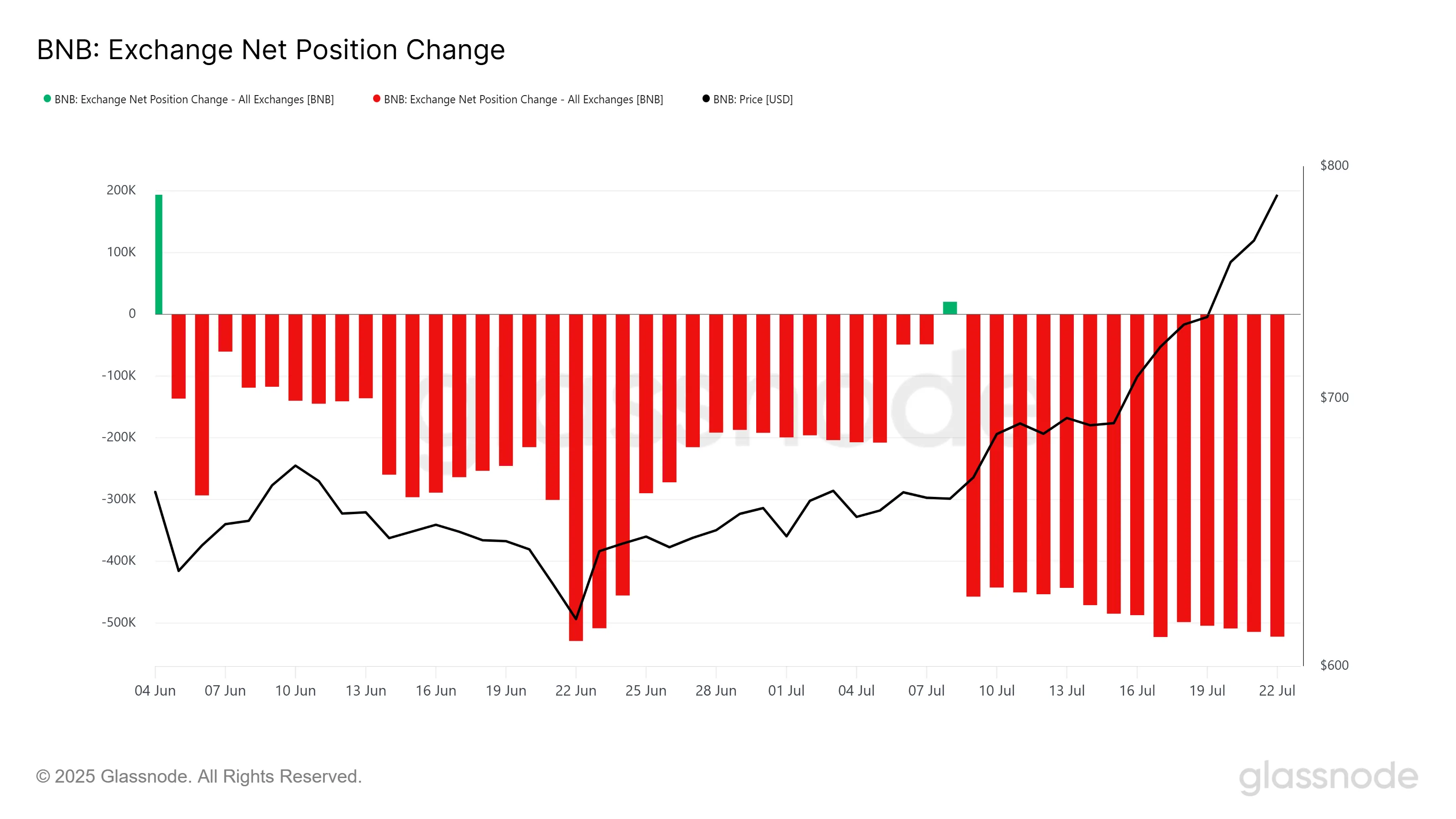

Exchange net position change data shows consistent accumulation over nearly seven weeks. This trend reflects growing investor interest in holding BNB long-term rather than trading it.

The steady increase in holdings has been a key driver of the recent rally. Investor confidence suggests a positive long-term outlook for the token.

Historical Patterns Point to Altcoin Season

Looking at historical data from 2021, BNB’s formation of a new all-time high marked the beginning of a broader altcoin rally. This precedent suggests BNB’s current record high could signal an approaching altcoin season.

The overall macro momentum supports continuation of the bullish trend. BNB’s performance will likely influence the broader cryptocurrency market in coming weeks.

Technical analysis shows BNB trading above the upper Bollinger Band on the daily chart. This indicates strong bullish momentum and high volatility.

The relative strength index sits at 87.54, well above the overbought level of 70. While this shows buyer control, it also raises the possibility of a short-term pullback.

BNB continues to hold above the 20-day simple moving average at $704. This indicates a strong uptrend structure remains intact.

According to CoinCodex analysts, BNB may reach $1,100 by November 2025 if momentum continues. This forecast depends on sustained institutional support and market conditions.

If current momentum persists, BNB may target the psychological $850 level next. The $900 mark WOULD serve as the following resistance level.

Should a pullback occur, BNB may find support NEAR $741 or the 20-day moving average around $705. A drop below $741 could invalidate the current bullish outlook and signal a market correction.