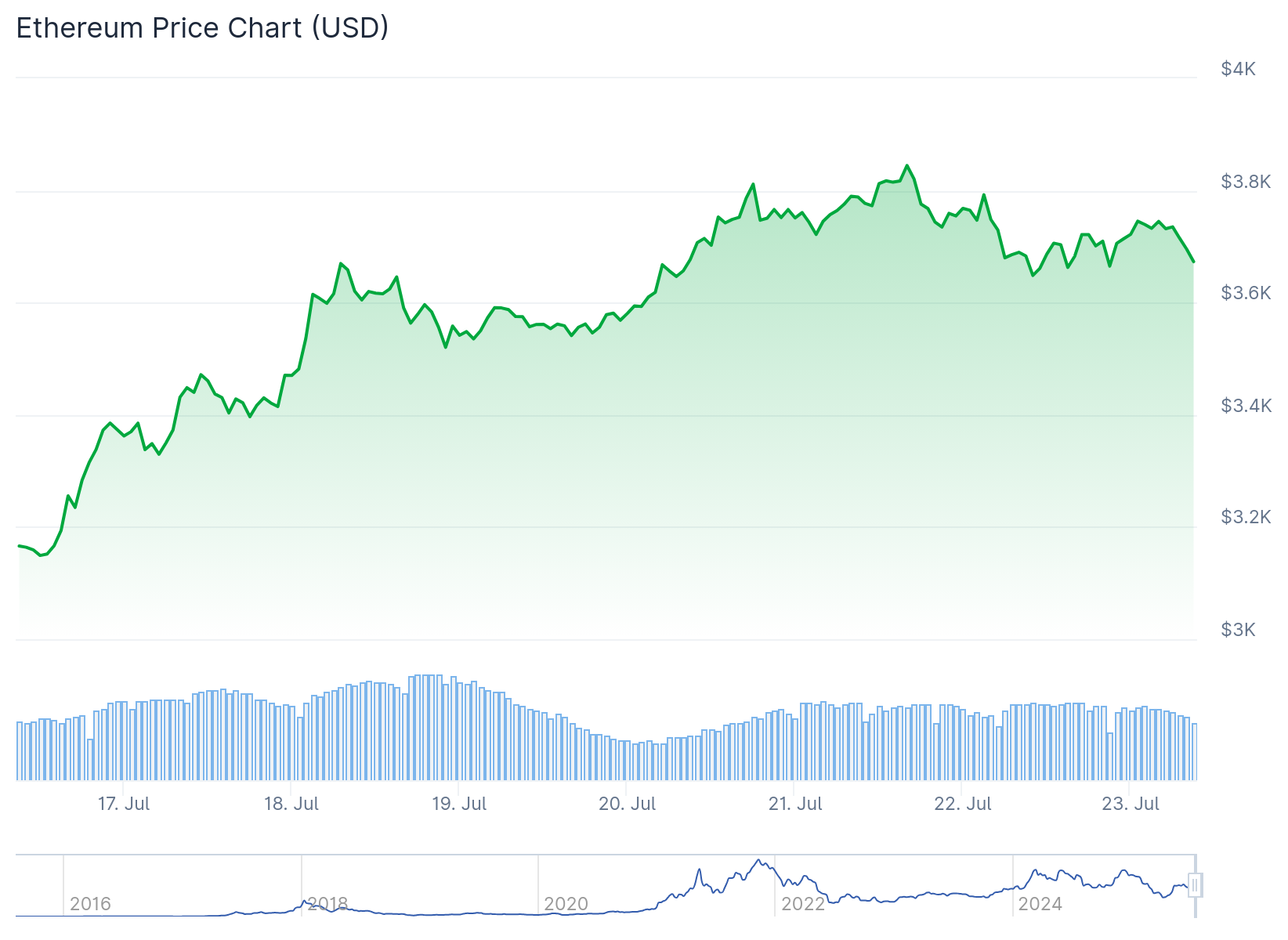

Ethereum (ETH) Soars to $3,800: Institutional FOMO Fuels Six-Month High

Wall Street's crypto cravings just sent Ethereum into overdrive—$3,800 isn't a price target anymore, it's yesterday's closing number. Institutional money floods in like clockwork, proving even hedge funds get FOMO.

Who needs bonds when you've got gas fees?

The smart money's betting on ETH like it's the new Nasdaq—except with 24/7 trading and memes that actually move markets. This isn't decentralist fantasy anymore; it's Bloomberg Terminal reality.

Watch the suits try to front-run retail this time. Spoiler: they're already late.

TLDR

- ETH trades at $3,727.22, up 0.38% daily, hitting six-month highs

- Ethereum ETF inflows reached $296.5 million in one day on July 21

- Daily transactions hit yearly high of 1.47 million based on 7-day average

- DeFi Total Value Locked grew 40.43% month-on-month, leading all blockchains

- Institutional buyers like BitMine accumulated over 300,000 ETH tokens

Ethereum has surged to over $3,800 marking its highest price in six months. The rally comes as institutional investors pour money into the cryptocurrency through multiple channels.

ETF inflows hit $296.5 million on July 21 alone. Products from Franklin, Bitwise, and BlackRock saw the largest investments. Total ETF allocations now exceed $7.8 billion over the past two weeks.

Large-scale buyers are making their presence felt. BitMine Immersion Technologies accumulated over 300,000 ETH tokens. SharpLink Gaming increased their holdings by 29% to reach 360,807 ETH.

Individual whale wallets withdrew $267 million worth of ETH from FalconX over three days. Another wallet took $72 million from Binance. These transactions show big players are betting on long-term price growth.

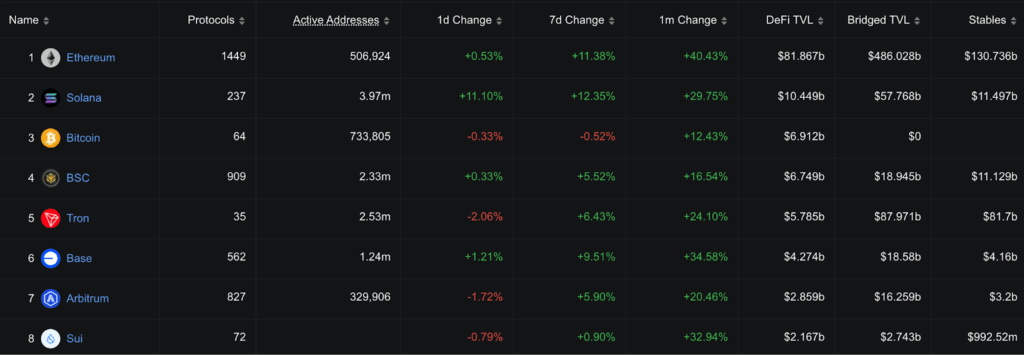

Ethereum saw $1.4 billion in net inflows over seven days. This beats every other blockchain. Net flows track money moving into a blockchain from major investors.

$ETH ETF inflow + $296,500,000 yesterday.

Smart money is accumulating the current ethereum dip. pic.twitter.com/g0kha7LwhO

— Ted (@TedPillows) July 22, 2025

The price surge comes despite a 2% daily decline in some recent sessions. This shows institutional demand remains strong even during short-term price drops.

Network Activity Reaches New Heights

Daily transactions on Ethereum hit a yearly high of 1.47 million based on the 7-day average. This marks the highest activity since last year. The network is seeing real usage, not just speculation.

High-value transactions over $100,000 totaled $100 billion last week. This represents the highest level since 2021. Big institutions and whales are moving ETH around again.

Whales keep accumulating $ETH!

Fresh wallet 0x8eEa received another 25,213 $ETH($94.67M) from #FalconX 3 hours ago, with a total of 72,333 $ETH($267M) in the past 3 days.

Fresh wallet 0xD479 withdrew another 5,309 $ETH($19.96M) from #Binance 1 hour ago, with a total of 19,391… pic.twitter.com/ogXvLiNbEq

— Lookonchain (@lookonchain) July 22, 2025

These large transactions often happen before major price moves. ETH currently trades in a range between $3,600 and $3,800. The surge in big transactions could push it past $4,000.

First-time buyers increased 16% since early July. New money is entering the Ethereum ecosystem. This combines with institutional buying to create strong demand.

The network activity boost aligns with other positive signals. ETF inflows, whale accumulation, and rising net flows all point to growing interest.

DeFi Revival Powers Growth

Ethereum’s Total Value Locked in DeFi grew 40.43% month-on-month. This growth rate exceeds all other blockchains, including Layer-2 chains like Arbitrum and Base.

TVL measures how much money is locked into DeFi applications. Fast growth means more people trust the chain to run financial apps. Ethereum is leading this category again.

Capital is rotating back into the Ethereum ecosystem. Even with newer blockchains promising faster speeds, Ethereum’s DeFi is growing faster. Users still trust its security and developer tools.

President TRUMP signed the GENIUS Act on July 21. This created a regulatory framework for U.S.-dollar-pegged stablecoins. While the law prohibits yields on regulated stablecoins, it drives investors toward DeFi alternatives on Ethereum.

Technical indicators show mixed signals. Ethereum’s RSI sits at 84.35, well above the 70 threshold that indicates overbought conditions. However, the MACD histogram shows positive momentum at 65.11.

The current price trades above all major moving averages. The 7-day moving average provides support at $3,658.32. Immediate resistance sits at $3,860, with the 52-week high at $4,004.15.

Ethereum faces resistance at the psychological $3,900 level. A break above could target the yearly high around $4,000. Support levels lie much lower at $2,474.24 and $2,111.89.

The wide gap between current prices and support zones shows how aggressive the recent rally has been. Profit-taking could emerge at these elevated levels.

BitMine’s accumulation of 300,000 ETH tokens targets roughly 5% of the total supply. This institutional buying creates upward pressure on prices. Other large holders continue adding to their positions.

Ethereum’s surge to $3,727.22 reflects genuine institutional adoption and regulatory clarity, with daily transactions hitting yearly highs and DeFi growth leading all blockchains at 40.43% monthly expansion.