Bold Move: $740M Bitcoin Purchase Hits Right Below All-Time Highs—Here’s Why It Matters

Wall Street's latest crypto play isn't playing it safe. A major strategy just dropped $740 million into Bitcoin—despite prices hovering near record highs. Here's what's really going on.

### The All-Time High Gamble

Most investors panic when assets approach peak valuations. Not this whale. The $740M buy-in signals either reckless FOMO or a calculated bet that institutional demand will keep pushing BTC higher. Spoiler: Wall Street loves both narratives.

### Liquidity or Lunacy?

With Bitcoin's volatility still wilder than a meme stock, the move either secures strategic liquidity... or becomes tomorrow's 'hold my beer' moment. Traders are already side-eyeing the timing—just before the Fed's next rate decision. Classic.

### The Cynical Take

Nothing screams 'bull market' like nine-figure purchases during price plateaus. Either these guys know something we don't, or they've mastered the art of performance art for shareholder letters. Place your bets.

TLDR

- Strategy purchased 6,220 Bitcoin for $739.8 million during the week ending July 21, bringing total holdings to 607,770 BTC

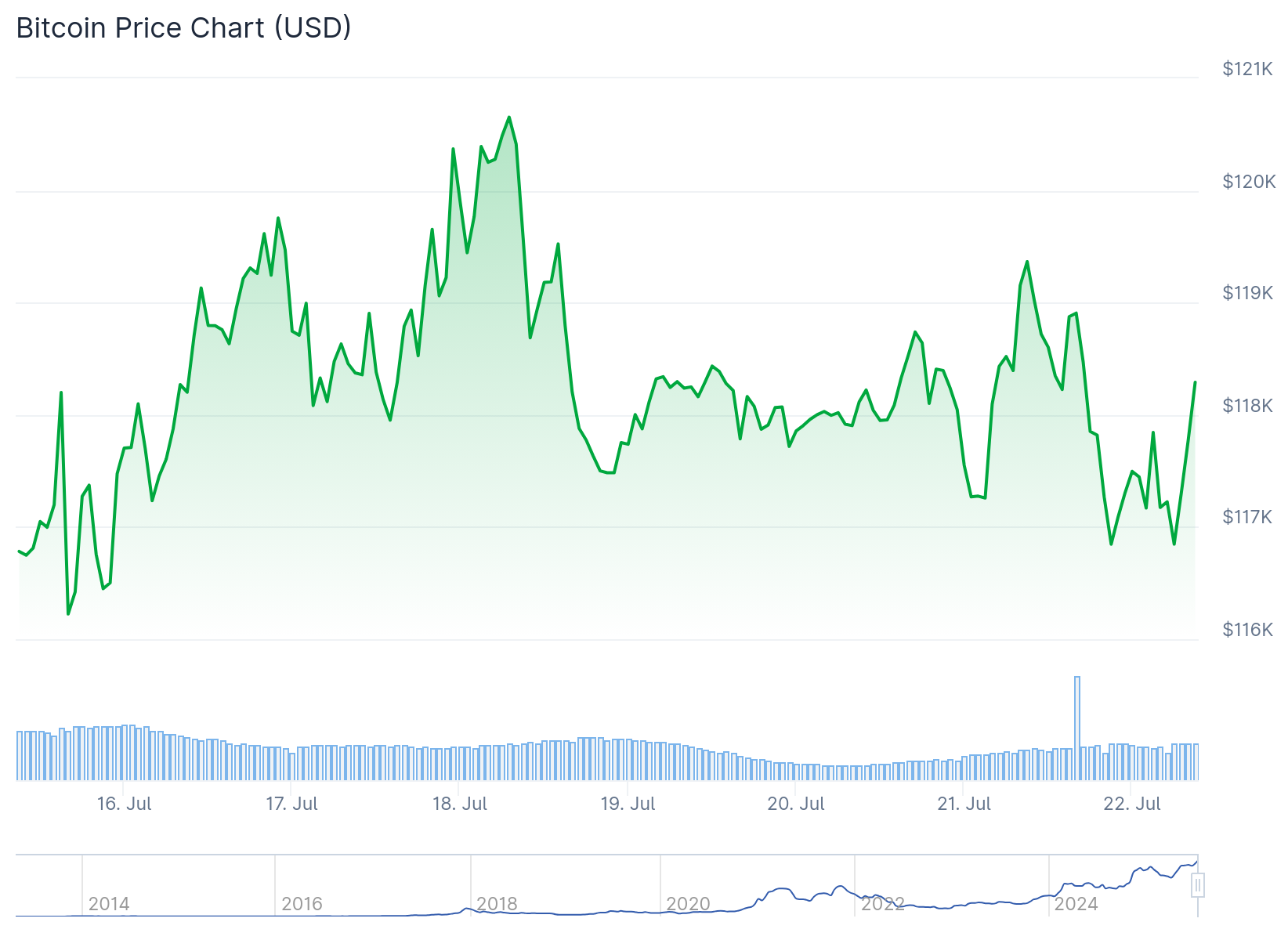

- Bitcoin reached new highs above $122,000 before consolidating around $118,000

- Strategy’s year-to-date Bitcoin yield increased to 20.8%, moving closer to its 25% target

- The company launched STRC Preferred Stock to raise another $500 million for Bitcoin purchases

- Executive Wei-Ming Shao sold 10,900 MSTR shares worth $4.9 million

Strategy has added another $739.8 million worth of Bitcoin to its massive holdings as the cryptocurrency reached new price records. The company purchased 6,220 Bitcoin during the week ending July 21, according to SEC filings released Monday.

Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per Bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 $BTC acquired for ~$43.61 billion at ~$71,756 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/8z5HygrDWs

— Michael Saylor (@saylor) July 21, 2025

The world’s largest public holder of bitcoin made these purchases at an average price of $118,940 per coin. Bitcoin started the week above $122,000 for the first time before dropping to an intraweek low of $116,000 and settling around $118,000.

Strategy’s latest acquisition brings its total Bitcoin holdings to 607,770 BTC. The company has spent approximately $43.6 billion on these holdings at an average price of $71,756 per coin.

The new purchases boosted Strategy’s year-to-date Bitcoin yield by 0.6%. The metric increased from 20.2% to 20.8%, moving the company closer to its 25% annual target.

Strategy originally set its Bitcoin yield target at 15% but raised it to 25% as performance exceeded expectations. The company now sits just 4.2% away from reaching this revised goal.

Bitcoin Yield Performance Tracking

Strategy introduced its Bitcoin yield metric in August 2024. The measurement represents the percentage change in the ratio between BTC holdings and the company’s assumed diluted shares outstanding.

In 2024, Strategy’s Bitcoin yield peaked at 74.3%. The metric helps investors track how effectively the company is accumulating Bitcoin relative to share dilution.

Strategy has maintained an active Bitcoin acquisition schedule throughout 2025. The company bought 10,455 BTC in July compared to 17,075 BTC in June, 26,695 BTC in May, and 25,370 BTC in April.

Prior to the latest Bitcoin purchase, Strategy filed paperwork for additional securities sales. Executive Vice President Wei-Ming Shao sold 10,900 MSTR shares worth approximately $4.9 million on July 14.

This sale followed a previous $25.7 million MSTR share sale by the same executive the week before. The combined sales total over $30 million in MSTR stock disposals.

New Fundraising Vehicle Launched

Strategy announced the launch of its STRC Preferred Stock series to fund future Bitcoin acquisitions. The company plans to sell 5 million shares at $100 each for a total of $500 million.

The STRC series, nicknamed “Stretch” by the company, carries an initial dividend rate of 9%. These proceeds will go directly toward additional Bitcoin purchases.

STRC joins Strategy’s existing preferred stock series including STRK, STRF, and STRD. The company also operates a common stock at-the-market program that raised $736 million last week.

Strategy maintains its position as the dominant corporate Bitcoin holder with over 600,000 coins. At current prices, the company’s Bitcoin holdings are valued at approximately $72 billion.

The company’s Bitcoin accumulation strategy continues under the leadership of Executive Chairman Michael Saylor. Strategy has consistently added to its Bitcoin position regardless of price fluctuations.