PUMP.fun Rollercoaster: $600M ICO Triumph Meets 46% Plunge – Where Does It Go From Here?

Memecoin darling PUMP.fun just rode the crypto hype cycle at warp speed – skyrocketing from its $600M ICO to a brutal 46% correction in record time. The degens who FOMO'd in at the top are now sweating their bags, while skeptics smirk at another 'fundamentals optional' crypto spectacle.

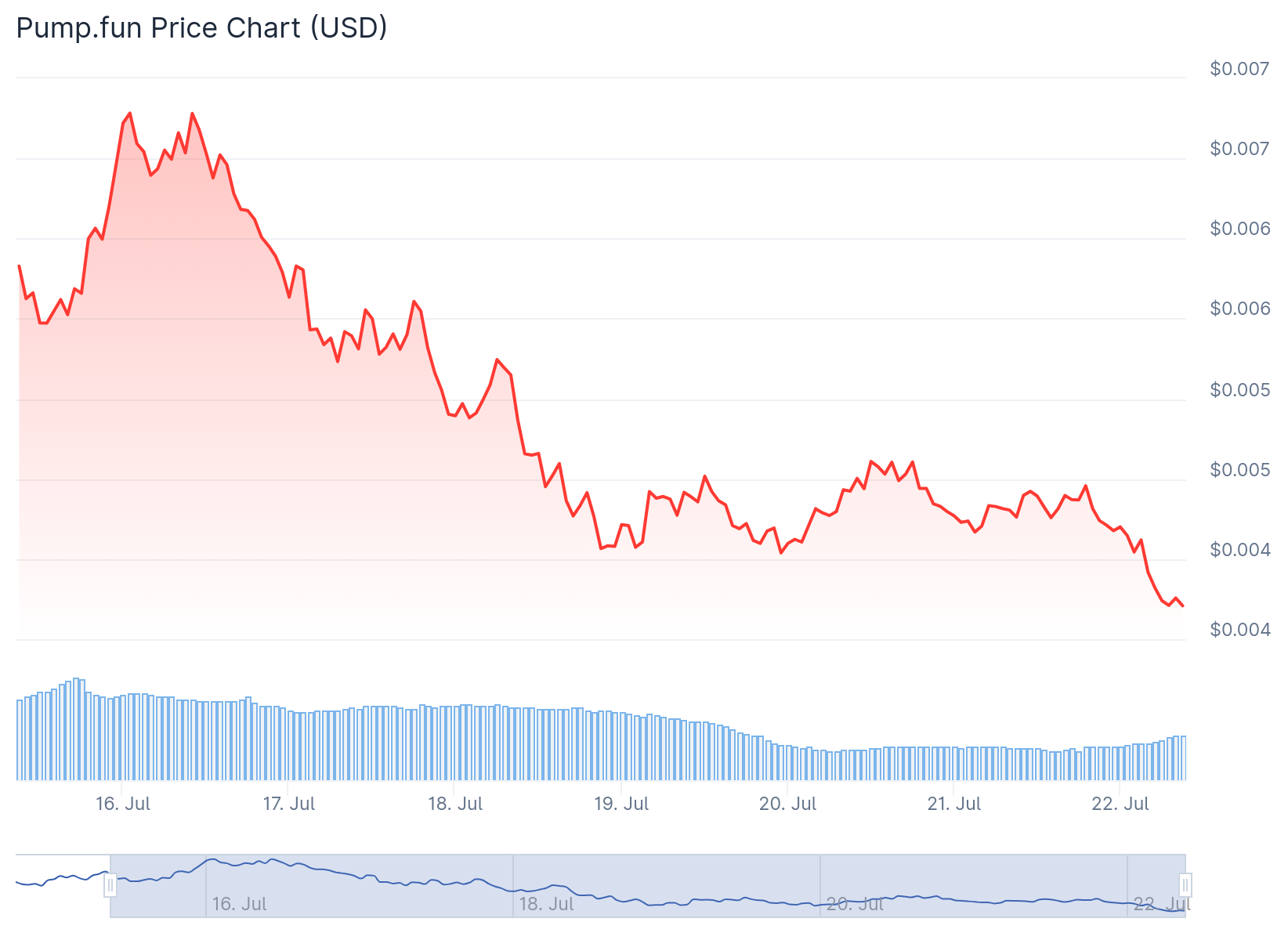

Pump-and-dump or legit contender? The chart tells a messy story. After printing a picture-perfect parabola to its ATH, PUMP got caught in the wider altcoin bloodbath. Liquidation cascades turned paper gains into very real losses.

Technical traders are eyeing key support levels like hawks. A bounce here could signal accumulation – another leg up for the meme machine. But if Bitcoin dominance keeps rising? Watch those 'wen lambo' tweets morph into 'help me' posts real quick.

One hedge fund manager quipped: 'It's the perfect crypto asset – no revenue, no roadmap, just vibes and a community that treats TA like horoscopes.' Ouch. But in a market where dog-themed coins moon regularly, maybe that's all you need.

TLDR

- PUMP token has fallen over 46% from its peak of $0.0068 to around $0.0042–$0.0053 after raising nearly $600 million in 12 minutes during its July 2025 ICO-

- Pump.fun is losing market share to competitor LetsBONK, which has surpassed it in memecoin generation volumes

- The platform committed to using 25% of protocol revenues for token buybacks, including a recent $31.3 million buyback that temporarily boosted the price 17%

- PUMP token currently lacks utility beyond buybacks, though the team has announced plans for fee rebates and governance features

- Current market cap sits near $1.88 billion with 1 trillion total token supply

Pump.fun’s PUMP token launched in July 2025 with one of the most successful initial coin offerings of the year. The platform raised nearly $600 million in just 12 minutes, selling 125 billion tokens at $0.004 each. The ICO sold out completely within this brief window.

The token initially surged after listing on major exchanges including Kraken, KuCoin, Bybit, and MEXC. PUMP reached a peak above $0.0068 shortly after launch. Trading volume exceeded $508 million in the first 24 hours.

However, the token’s performance has deteriorated since its initial success. PUMP has fallen more than 46% from its peak. As of July 21, 2025, the token trades between $0.0042 and $0.0053. The price drop included a sharp 37% decline in a single 24-hour period.

Early investors and major holders contributed to the selling pressure. Many liquidated their positions quickly after the token became available for trading. The rapid sell-off created downward pressure on the price.

Platform Competition Intensifies

Pump.fun previously held the dominant position as Solana’s leading meme token platform. The platform allowed users to easily create and launch new cryptocurrencies using a bonding curve model. It earned over $677 million in revenue from its launch in early 2024 through July 2025.

LetsBONK has recently emerged as a strong competitor. The platform has surpassed Pump.fun in memecoin generation volumes. This shift represents a challenge to Pump.fun’s market leadership position.

The increased competition comes during a period of declining activity. Pump.fun’s token minting volumes have decreased. Overall protocol activity has also shown signs of weakening. These trends could impact the platform’s future revenue generation.

The platform generates revenue through fees for launching new tokens. It also collects trading fees from initial token transactions. This revenue model depends on maintaining high user activity and token creation volumes.

Buyback Program Provides Support

Pump.fun committed to using 25% of protocol revenues for token buybacks. This mechanism aims to support PUMP’s price by reducing the circulating supply. The platform views buybacks as a way to reward token holders.

A recent buyback involved 187,770 SOL tokens worth $31.3 million. This buyback temporarily pushed PUMP’s price up by approximately 17%. The price increase demonstrated the potential impact of these support mechanisms.

However, the effectiveness of buybacks depends on sustained protocol revenue. Weakening fee revenue could undermine future buyback programs. The platform needs to maintain high activity levels to generate sufficient funds for meaningful buybacks.

The buyback program represents the primary value proposition for PUMP holders currently. Without other utility functions, buybacks serve as the main driver of potential returns for investors.

PUMP currently has a total supply of 1 trillion tokens. The ICO distributed 33% of the supply, with 18% going to institutional investors and 15% to public participants. Tokens were immediately unlocked at the $0.004 ICO price.

The token lacks specific utility beyond the buyback mechanism. Critics have pointed to this limitation as a weakness in PUMP’s value proposition. The absence of clear use cases makes the token primarily dependent on buyback programs and speculation.

Pump.fun has announced plans to introduce new utility mechanisms. These include fee rebates for PUMP holders who launch or trade tokens on the platform. The team also discussed governance utility that WOULD give PUMP holders voting rights on platform changes.

The platform acquired Kolscan, a wallet tracker for Solana, as part of efforts to expand its ecosystem. Pump.fun also announced a “community takeover” mechanism for abandoned projects. These developments aim to increase platform value and user engagement.

Security concerns emerged regarding the ICO funds. Rumors suggested that $500 million in presale funds were “locked” in smart contracts. Security firm Hacken investigated these claims and found them to be false. The contract follows standard solana protocols with no unusual restrictions.

Current market conditions present challenges for PUMP’s recovery. The token remains highly volatile with significant price swings. Analyst sentiment reflects concern about the platform’s economic model and long-term sustainability.

The cryptocurrency market’s overall performance could influence PUMP’s future trajectory. Bullish market conditions typically drive increased activity on platforms like Pump.fun. Conversely, market downturns can reduce user engagement and revenue generation.

PUMP’s current market capitalization stands NEAR $1.88 billion based on its recent trading range. The fully diluted valuation reaches approximately $5.97 billion when considering the total token supply. These valuations reflect the market’s assessment of the platform’s future potential despite recent challenges.

Final Thoughts

Pump.fun’s PUMP token has seen a sharp decline of over 46% from its peak following a successful July 2025 ICO. While its buyback program provides short-term support, increasing competition from LetsBONK and declining platform activity could limit its long-term potential. The token’s future hinges on the success of upcoming utility features like fee rebates and governance rights. With a current market cap of $1.88 billion, the outlook for PUMP remains uncertain but could improve if the platform adapts to the changing market.