Domino’s Pizza ($DPZ) Stock: U.S. Sales Soar While Earnings Stumble—Wall Street Left Hungry

Domino’s delivers piping-hot sales growth—but Wall Street wanted a bigger slice.

U.S. sales outperform while earnings miss the mark. Again. Analysts scramble to adjust models, but hey—at least someone’s eating well (hint: not shareholders).

Another quarter, another 'mixed' result. Maybe next time they’ll hit the delivery window—or just blame 'macro conditions' like everyone else.

TLDR

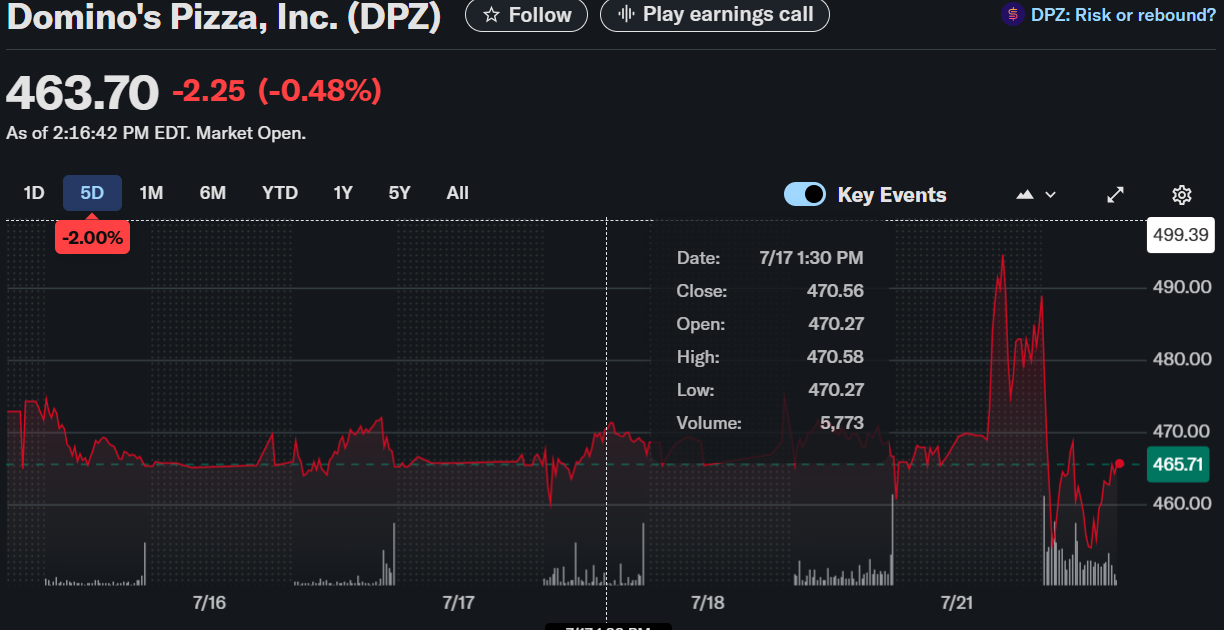

- Domino’s stock traded at $475.95 as of writing after a 2.7% post-earnings jump.

- Q2 EPS was $3.81, missing the $3.94 analyst estimate by $0.13.

- U.S. same-store sales grew 3.4%, outpacing expectations.

- Net income dropped 7.7% due to investment losses and tax impacts.

- Analysts maintain a “Buy” rating with a median 12-month price target of $530.

Domino’s Pizza Inc. (NASDAQ: DPZ) traded at $475.95, up 2.15%, following the release of its second-quarter earnings report on July 21.

Domino’s Pizza, Inc. (DPZ)

The stock gained in reaction to strong U.S. same-store sales growth of 3.4%, which helped offset investor concerns over an earnings miss. While the company reported adjusted earnings per share (EPS) of $3.81, it fell short of the $3.94 Wall Street estimate. Revenue matched expectations at $1.15 billion, representing a 4.3% year-over-year increase.

CEO Russell Weiner credited growth in both delivery and carryout channels for domestic strength, as the pizza giant continues to gain market share within the U.S. quick-service restaurant segment.

Domino’s Pizza, $DPZ, Q2-25. Results:

📊 EPS: $3.81 🔴

💰 Revenue: $1.15B 🟢

📈 Net Income: $131.1M

🔎 Global retail sales ROSE 5.6% with 178 net new stores; U.S. and international same-store sales grew 3.4% and 2.4% respectively. pic.twitter.com/VL2KQeKmAD

— EarningsTime (@Earnings_Time) July 21, 2025

Mixed Profitability Metrics and Shareholder Returns

Despite top-line gains, Domino’s saw net income decline 7.7% to $131.1 million. This was primarily driven by losses related to its investment in DPC Dash Ltd and a higher tax burden. However, income from operations rose 14.8% to $225 million, signaling underlying efficiency.

Domino’s declared a quarterly dividend of $1.74 per share, payable on September 30, translating to an annualized yield of 1.49%. During the quarter, the company also repurchased 315,696 shares worth $150 million. It still has $614.3 million authorized for future buybacks.

Global and International Trends

On the international front, same-store sales rose 2.4% excluding currency impacts. Global retail sales increased 5.6%, highlighting resilience in foreign markets despite broader macroeconomic pressures. The company remains committed to international growth, though domestic operations remain the primary earnings engine.

Forecasts and Analyst Sentiment

Domino’s experienced a mixed trend in analyst revisions over the past 90 days, with 10 upgrades and 14 downgrades to EPS expectations. Six analysts revised earnings downward in the past month, but sentiment remains largely optimistic. Analysts currently maintain an average rating of “Buy” with 21 of 35 offering a positive stance. The median 12-month price target is $530, roughly 12.1% above its current price.

Brokerages such as TD Securities and Citigroup reiterated positive outlooks with targets NEAR $500. Loop Capital raised its target to $564, reflecting confidence in the company’s fundamentals.

Institutional Ownership and Performance Snapshot

Domino’s remains a favored pick among institutional investors, with 94.6% of shares held by funds. Recent buyers include William Allan Corp, which increased its position by 84.3%, and other firms initiating new stakes in Q1 2025.

Despite being down 4.1% over the last three months, the stock is up 12.13% over the past year. Domino’s currently trades at a price-to-earnings ratio of 26.72 and maintains a market cap of $15.95 billion, with financial health rated as “good performance” by analysts.

With strong sales growth and resilient fundamentals, Domino’s remains well-positioned in the competitive QSR space despite short-term profit volatility.