BREAKING: Strategy Now Holds $739M Bitcoin—Crowns Itself King of Corporate BTC Hoarders

Move over, MicroStrategy—there's a new alpha whale in town.

In a power play that reshuffles the corporate Bitcoin leaderboard, Strategy just gobbled up $739 million worth of BTC. The move rockets them past legacy holders, proving once again that cold storage beats shareholder meetings for adrenaline junkies.

Why the frenzy? While traditional finance still debates 'digital gold,' forward-thinking firms are busy printing their own bull markets. The acquisition screams conviction—or perhaps just FOMO at institutional scale.

One thing's certain: when the suits start accumulating like degenerate traders, the market's sending smoke signals. Whether this is genius treasury management or a high-stakes game of musical chairs remains to be seen—after all, Wall Street hasn't met a bubble it wouldn't hug.

TLDR

- Strategy has purchased 6,220 BTC for a total of $739.80 million last week.

- The company now holds 607,770 BTC with a total investment value of $43.61 billion.

- The average purchase price for the latest acquisition was $118,940 per bitcoin.

- Strategy achieved a year-to-date Bitcoin yield of 20.8 percent.

- The company funded the recent purchase using proceeds from its common shares and STRK stock.

Michael Saylor’s company Strategy completed a $739.80 million Bitcoin purchase last week, marking its second acquisition in July. The company added 6,220 BTC, pushing its total holdings to 607,770 BTC and increasing its market influence. Meanwhile, Strategy’s stock MSTR rose 2% today in premarket trading, reversing last week’s decline.

Strategy’s Latest Bitcoin Purchase Pushes Total Holdings Beyond 607,000 BTC

Strategy acquired 6,220 BTC at an average price of $118,940 per coin, reaching a cumulative BTC position of 607,770. The purchase raised Strategy’s total bitcoin investment value to $43.61 billion at an average cost of $71,756 per BTC. The transaction was funded through proceeds from the company’s common stock and STRK shares.

The company reported a 20.8% year-to-date return on its Bitcoin portfolio, signaling effective capital allocation amid volatile market conditions. Strategy had crossed the 600,000 BTC threshold in mid-July after buying 4,225 BTC for $472.5 million. This latest acquisition solidifies its position as the largest corporate holder of Bitcoin globally.

While BTC currently trades below its all-time high of $130,000, Strategy continues its weekly buying pattern without interruption. The company paused its purchases briefly in early July before resuming with two consecutive acquisitions. This aggressive accumulation places Strategy far ahead of MARA Holdings, which holds approximately 50,000 BTC.

MSTR Stock Recovers as Market Responds to New Bitcoin Purchase

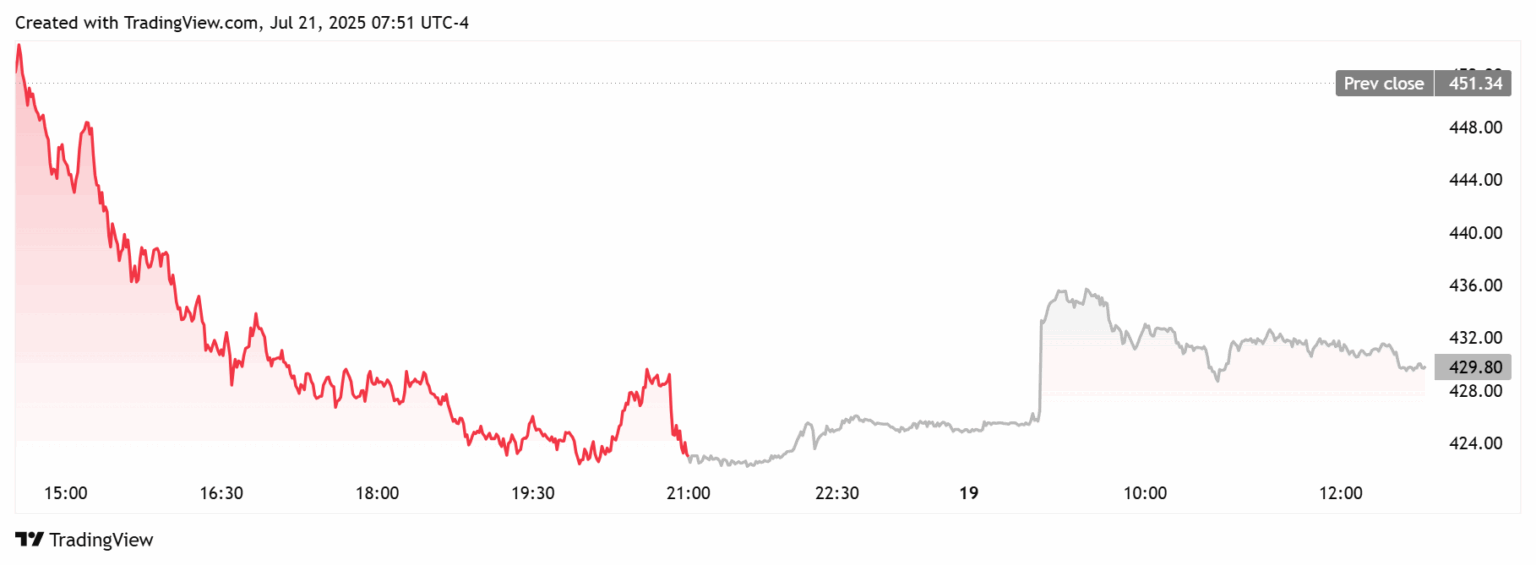

Following the announcement, Strategy’s MSTR stock climbed to $430 in premarket trading, reflecting a 2% gain from previous sessions. This recovery comes after last week’s drop, which aligned with a broader correction in the crypto market. Despite volatility, investors showed renewed interest in Strategy’s stock due to its consistent buying strategy.

TradingView data confirmed the upward movement, indicating a positive response to the company’s expanding BTC portfolio. Although the stock remains slightly down over the last five trading days, today’s gain provides short-term relief. The rise also underscores the market’s reaction to Strategy’s high-conviction Bitcoin approach.

Strategy’s financial positioning also improved with this move, lifting it into the top 10 U.S. corporate treasuries. The company now ranks ninth, overtaking NVIDIA, amid Bitcoin’s rally and its large-scale BTC accumulation.