Dogecoin (DOGE) Skyrockets 52% in Q3—ETF Buzz Fuels the Meme Coin Frenzy

Dogecoin’s Q3 rally isn’t just barking—it’s biting. With a 52% surge, the meme coin’s ETF hype has traders flipping from 'lol' to 'LFG.'

The ETF Effect: More Than Just a Dog Whistle?

Speculation around a potential Dogecoin ETF has turned the joke into a juggernaut. Wall Street’s sudden interest in crypto’s shiba mascot? Ironic, but not surprising—where there’s FOMO, there’s fee-hungry intermediaries.

The Punchline? It’s Still a Gamble.

DOGE’s volatility hasn’t gone anywhere. Whether this rally is the start of a bull run or another pump before the dump depends on how seriously the market takes a coin born from a literal meme. (Spoiler: the 'market' has made dumber bets.)

TLDR

-

Dogecoin (DOGE) is up over 52% this quarter, breaking a four-year Q3 downtrend.

-

Volume tripled on July 21, with institutional wallets buying over 1 billion DOGE (~$250M).

-

$0.25 acts as key support; resistance lies at $0.277, with short-term targets up to $0.315.

-

Open interest doubled, showing increased leverage, but most traders are long, raising wipeout risk.

-

Speculation around a DOGE ETF and corporate treasury adoption is fueling optimism.

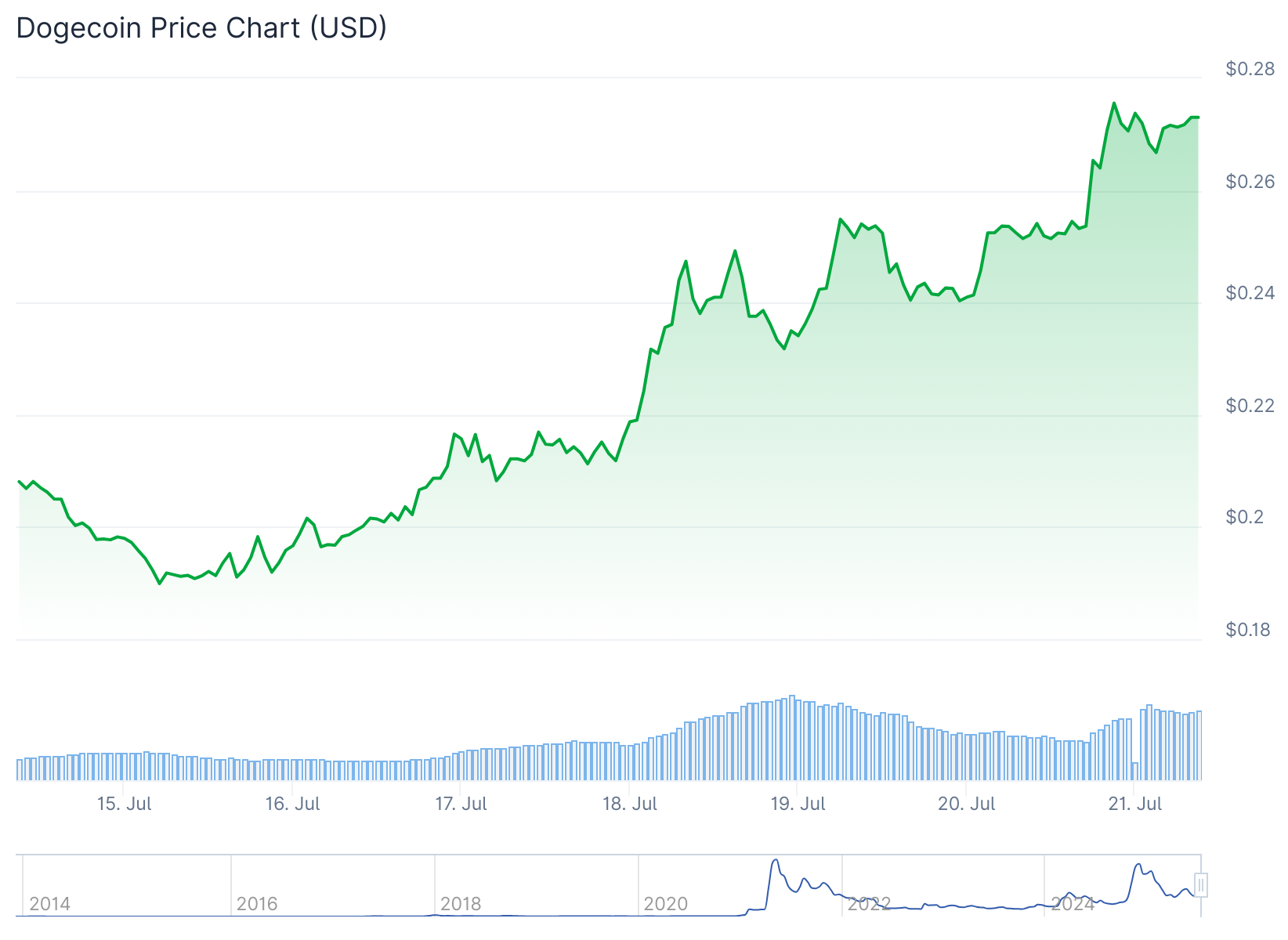

Dogecoin has posted its strongest quarter of the year so far. Prices have risen more than 52% in Q3, reversing a four-year pattern of Q3 losses.

As of July 21, Doge is trading around $0.271, gaining more than 8% in the last 24 hours.

This price increase followed a breakout from $0.254, with strong buying seen in a short 90-minute window.

Institutional Demand Drives Volume Spike

Trading volume hit 2.01 billion DOGE during the surge. This is nearly three times the usual daily average of 724 million DOGE.

Institutional wallets accumulated more than 1.08 billion DOGE during a 48-hour span. That amounts to roughly $250 million at current prices.

Some companies are reportedly considering DOGE as a liquid treasury asset. They view it as a diversification tool during uncertain global conditions.

At the same time, speculation about a potential DOGE ETF is gaining momentum. Prediction markets have priced in an 80% chance of approval.

Technical indicators support the bullish structure. DOGE has been making higher lows with volume support at every leg up.

DOGE traded between $0.254 and $0.277 on July 21. Price consolidated above $0.264 for the rest of the session.

Crowded Long Positions Add Risk

Open interest has doubled in the past week. Over $2 billion in new capital has flowed into DOGE derivatives, pushing OI to $4 billion.

More than 70% of Binance traders are holding long positions. This crowded setup could be vulnerable to fast liquidations if the price drops.

Liquidity clusters have formed around $0.24, totaling about $5 million. This is now a key short-term floor.

One high-profile trader has rotated into a 10x long on 84 million DOGE, with a liquidation level at $0.19.

This suggests many players are betting on continued upside, but the setup is getting riskier.

On-chain flows are still showing strength. However, some analysts say DOGE may be running out of momentum.

Price action in recent sessions has shown tight consolidation between $0.266 and $0.274.

A daily close above $0.277 could open the path toward $0.295 and even $0.315, based on current resistance levels.

Support has held firm at $0.264, which was previously a resistance zone.

At press time, DOGE is holding above $0.27 and showing no major pullback yet.