PUMP Token Plummets 56% From ATH: Post-ICO Selloff Rattles Crypto Traders

Just another day in crypto paradise—PUMP's brutal correction proves even the juiciest ICOs can't defy gravity forever.

After skyrocketing to record highs, the token now faces a classic 'buy the rumor, sell the news' reckoning. Traders who FOMO'd in late are left holding bags heavier than a central banker's conscience.

Key details:

- 56% nosedive from all-time peak

- Sell pressure triggered by ICO unlock events

- Classic crypto volatility on full display

Will PUMP recover or join the graveyard of abandoned projects? Either way, the house always wins—especially when retail traders treat token launches like lottery tickets.

TLDR

- Nearly 60% of PUMP presale participants sold or transferred tokens to exchanges within one week

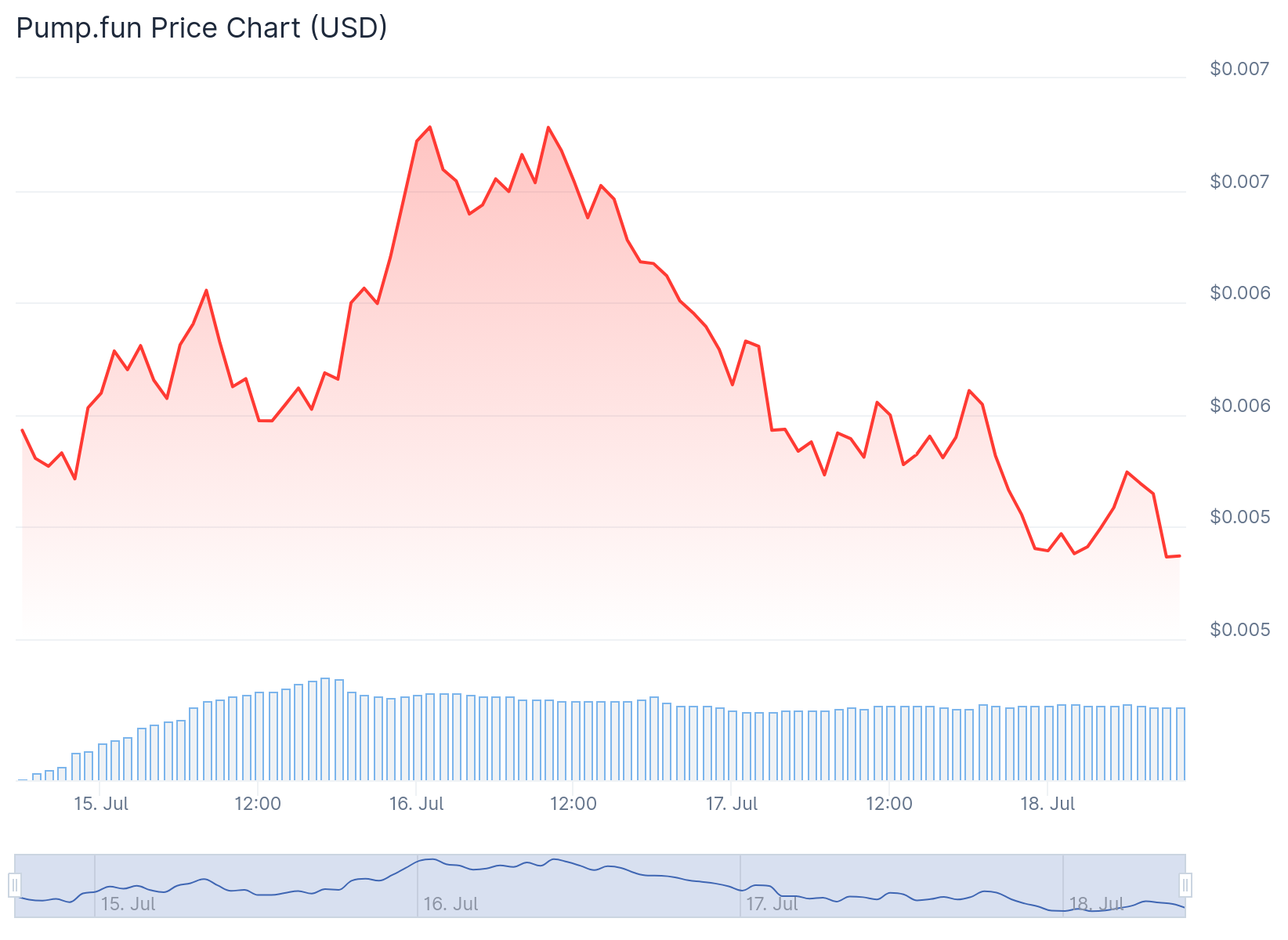

- Token dropped 56% from all-time high of $0.006812 to around $0.0053 as of July 18

- Pump.fun launched $19.2 million buyback campaign purchasing 3.2 billion tokens

- Platform volumes declined from $11.6 billion in January to $3.65 billion in June

- Over 2,400 fake PUMP tokens and 6,700 scam attempts detected since launch

The PUMP token from memecoin launchpad Pump.fun has experienced steep declines following its record-breaking initial coin offering in July 2025. The token launched after a presale that raised $500-600 million in just 12 minutes.

PUMP reached an all-time high of $0.006812 on July 16 before falling to approximately $0.0053 by July 18. This represents a decline of over 56% from its peak price.

The token’s initial success was short-lived as profit-taking began almost immediately. According to BitMEX data, 6,042 wallets out of 10,145 ICO participants (59.6%) had already sold or transferred their tokens to centralized exchanges within the first week.

It's been almost 1 week since the @pumpdotfun ICO💊

From 10,145 participants who contributed $448.5M:

➡️59.6% sold or transferred

➡️37.4% continue to HODL

➡️3% increased their holdings

Our Quant reveals traders are still BULLISH on $PUMP. Read on👇https://t.co/mIH0MN8Tby pic.twitter.com/pFdAa2FXfH

— BitMEX (@BitMEX) July 17, 2025

Only 3,791 wallets (37.4%) continued holding their tokens. A small group of 312 wallets (3%) actually increased their holdings during this period.

The selling pressure came despite the token debuting at $0.0056, which was 40% above its presale price of $0.004. The ICO set a fully diluted valuation of around $4 billion with a total supply of 125 billion coins.

Mass Exodus Drives Price Down

The widespread selling activity has created downward pressure on PUMP’s price. BitMEX analysts noted that such conditions typically lead to aggressive hedging and strong negative funding rates in derivatives markets.

However, the token’s funding rates have remained positive. This suggests some market confidence that the token may still increase in value despite the recent declines.

The price drop accelerated on July 17, with the token falling nearly 20% in a single day. This prompted Pump.fun to launch a major buyback campaign.

The platform repurchased $19.2 million worth of tokens, buying back approximately 3.2 billion PUMP tokens. This action temporarily boosted the price by 20%, though these gains proved short-lived.

Platform Volumes Decline

Beyond the token’s price struggles, Pump.fun itself faces challenges with declining platform activity. Trading volumes on the memecoin launchpad have dropped from $11.6 billion in January to $3.65 billion in June.

This decline in platform usage raises questions about the sustainability of PUMP’s current valuation. BitMEX analysts warned that if volume trends continue, the token’s price may be difficult to justify.

The platform also faces increased competition from new rivals like LetsBonk. This competition threatens Pump.fun’s dominant position in solana memecoin launches.

Security concerns have also emerged since the token’s launch. Over 2,400 fake PUMP tokens and 6,700 scam attempts have been detected, including wallet-draining malicious applications.

The PUMP token lacks inherent utility features such as governance rights, staking options, or platform fee-sharing mechanisms. This has drawn criticism given the high concentration of tokens among large holders.

Roughly 60% of the total supply is held by approximately 340 wallets, creating concerns about market manipulation. The token’s structure as a meme token without fundamental use cases adds to investor uncertainty.

Despite the challenges, some positive developments have occurred. On-chain data shows recent smart money inflows of about $3.7 million into PUMP.

Some public figures have increased their holdings by around 24% in the last 24 hours, indicating ongoing speculative interest in the token.

OKX exchange listed PUMP/USDT trading pairs on July 18, potentially increasing the token’s exposure to more traders. However, this listing has not reversed the overall downward price trend amid continued selling pressure.