XRP (XRP) Soars to Record Highs as Open Interest Hits $10 Billion—Here’s Why Traders Are FOMOing

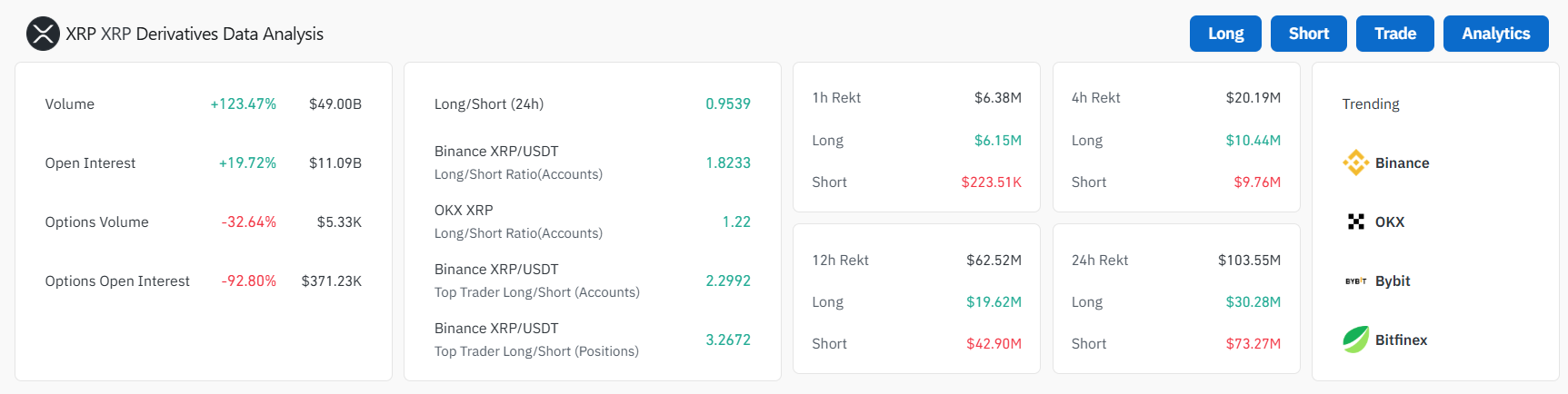

XRP just ripped past its all-time high—again. With open interest surging to $10 billion, the token's rally has traders scrambling for position. Here's the breakdown.

### The Liquidity Tsunami

Derivatives markets are flashing green as leveraged bets pile into XRP. No fancy narratives here—just pure, unfiltered capital chasing momentum.

### The Institutional Whisper

Behind the retail frenzy? OTC desks report stealth accumulation by hedge funds who suddenly remember blockchain exists when price charts go vertical.

### The Cynic's Corner

Let's be real—half these positions will unwind faster than a DeFi rug pull when volatility hits. But for now? Enjoy the dopamine hit.

TLDR

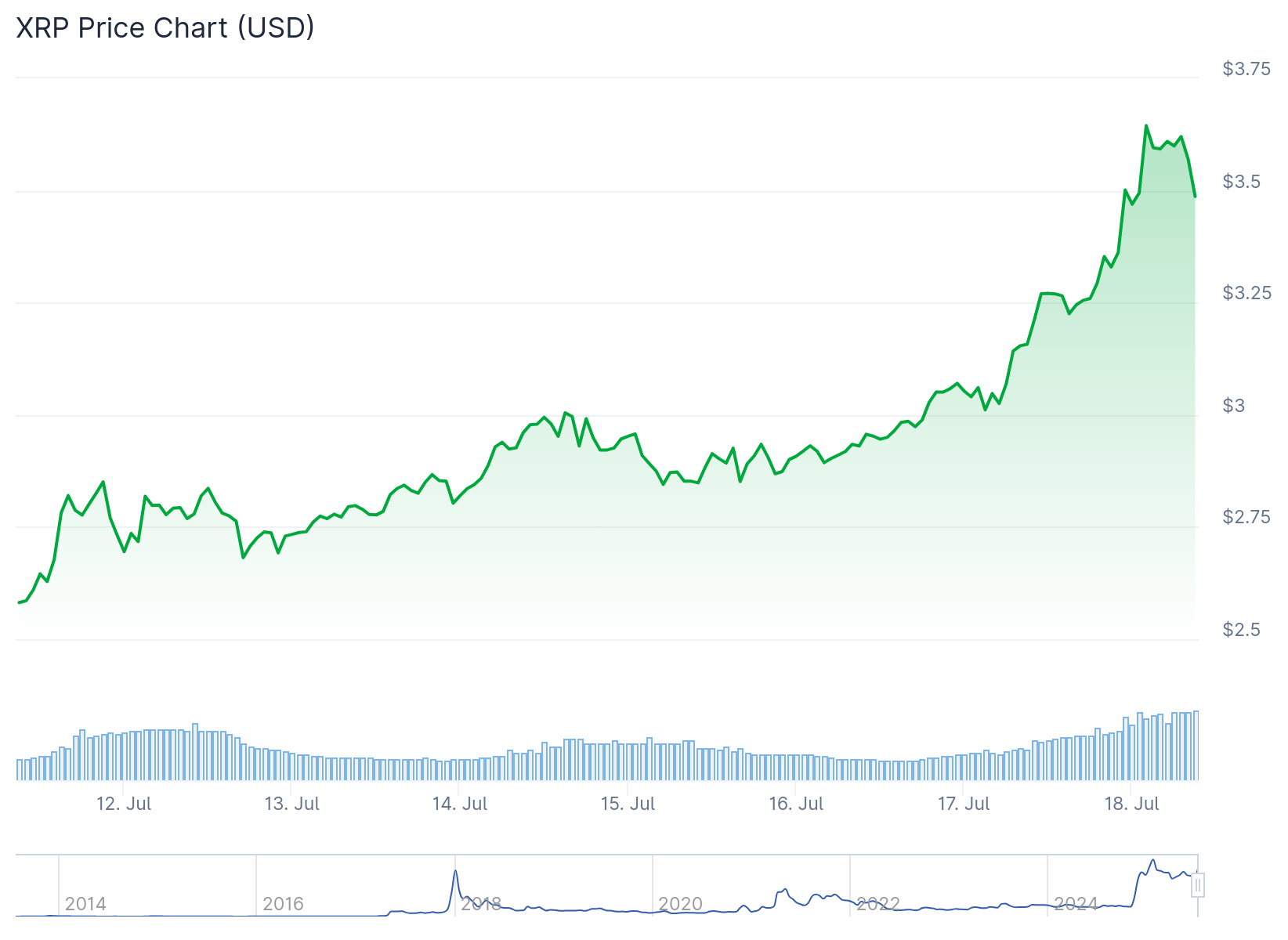

- XRP surged over 20% in 24 hours to reach $3.61, its highest level in over six years

- Institutional buyers and breakout traders drove the rally with three massive volume surges during the session

- Over 200 million XRP changed hands during key breakout windows at specific UTC times

- Open interest in XRP derivatives topped $10 billion for the first time since 2021

- Analysts predict long-term price targets ranging from $4.20 to $10+ by 2030

XRP climbed more than 20% in the past 24 hours to hit $3.61. This marks the token’s highest level in over six years.

The rally was driven by institutional buyers and breakout traders. Price volatility reached nearly 20% during the session.

The move followed weeks of accumulation NEAR the $3 mark. Strong conviction backed the rally as trading volume surged.

CoinDesk Analytics shows over 200 million XRP changed hands during breakout windows. These occurred at 05:00, 08:00, and 21:00 UTC.

The token pushed past key resistance at $3.52 to $3.53. Bulls defended the $3.29 to $3.30 zone throughout the session.

This area served as a high-volume base. Sellers repeatedly met buying pressure in this range.

XRP is now trading above $3.50 and the 100-hourly Simple Moving Average. A bullish trend line formed with support at $3.450.

The price tested the $3.650 zone during the rally. A high formed at $3.660 before consolidation began.

Price Target Analysis

Ryan Lee from Bitget outlined potential price targets for XRP. Short-term targets range from $2.00 to $2.17 on the downside.

Upside targets sit between $2.65 and $3.00 in the near term. Medium-term trajectory could extend to $5.89.

Long-term forecasts suggest $4.20 to $10+ by 2030. This depends on Ripple capitalizing on payment adoption.

The $2.50 level remains pivotal for the next breakout or breakdown. ETF approvals and regulatory clarity could influence medium-term targets.

Technical Indicators Show Mixed Signals

Technical indicators present a mixed picture for XRP. The RSI remains neutral while the MACD shows bearish signals.

These indicators point to potential near-term consolidation. The hourly MACD for XRP/USD is gaining pace in the bullish zone.

The hourly RSI now sits above the 50 level. This suggests continued bullish momentum in the short term.

Major support levels sit at $3.450 and $3.350. Key resistance levels are at $3.660 and $3.80.

If XRP clears $3.660 resistance, the price could target $3.750. Further gains might push toward $3.80 or even $3.880.

The next major hurdle for bulls sits near the $4.00 zone. A break above this level could open higher targets.

Open interest in XRP derivatives topped $10 billion for the first time since 2021. Funding rates across major exchanges flipped positive.

This suggests aggressive long positioning among traders. XRP has gained nearly 70% in the past 30 days.

The token emerged as the strongest performer among all major cryptocurrencies. Current consolidation occurs above the $3.60 level after reaching $3.661.