Ethereum ETFs Surge with $534M Inflows as Bitcoin ETF Bleeds $68M – The Flip You Didn’t See Coming

Crypto's old guard stumbles while the new kid eats its lunch.

Ethereum ETFs just vacuumed up half a billion dollars in a week—meanwhile, Bitcoin's golden goose is laying rotten eggs. Traders aren't just rotating, they're sprinting toward smart contract exposure while OG crypto plays defense.

Wall Street's latest flavor shuffle proves even digital gold gets tarnished. Maybe those 'store of value' pitch decks need a software update.

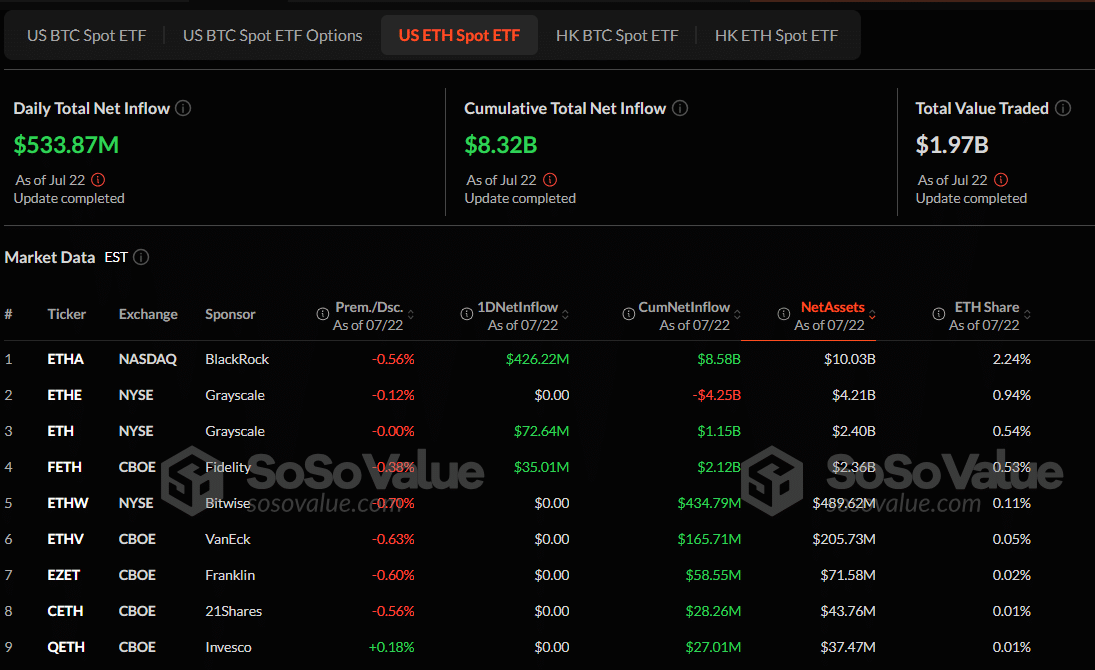

US ETH Spot ETF, Source: SoSoValue

US ETH Spot ETF, Source: SoSoValue

Major players like Fidelity, Grayscale, and VanEck have also boosted Ethereum’s numbers. Grayscale’s ETH trust saw $72.64 million, while Fidelity’s FETH added $35.01 million to the mix.

Ethereum Supply Tightens Amid Surging Demand

Ethereum’s total ETP assets now sit at $19.85 billion. That’s 4.44% of ETH’s total market cap. With trading volumes nearing $2 billion daily, ETH liquidity remains healthy. However, fewer tokens are hitting the market. The demand is outpacing available supply, creating a potential supply crunch.

Most ETH products have seen a small decline in price, with daily losses ranging from -1.77% to -1.91%. Even so, institutional demand is still high. Although there have been no fresh inflows, Bitwise’s ETHW is trading at $434.79 million. In the meantime, VanEck’s ETHV has amassed assets totaling about $205 million.

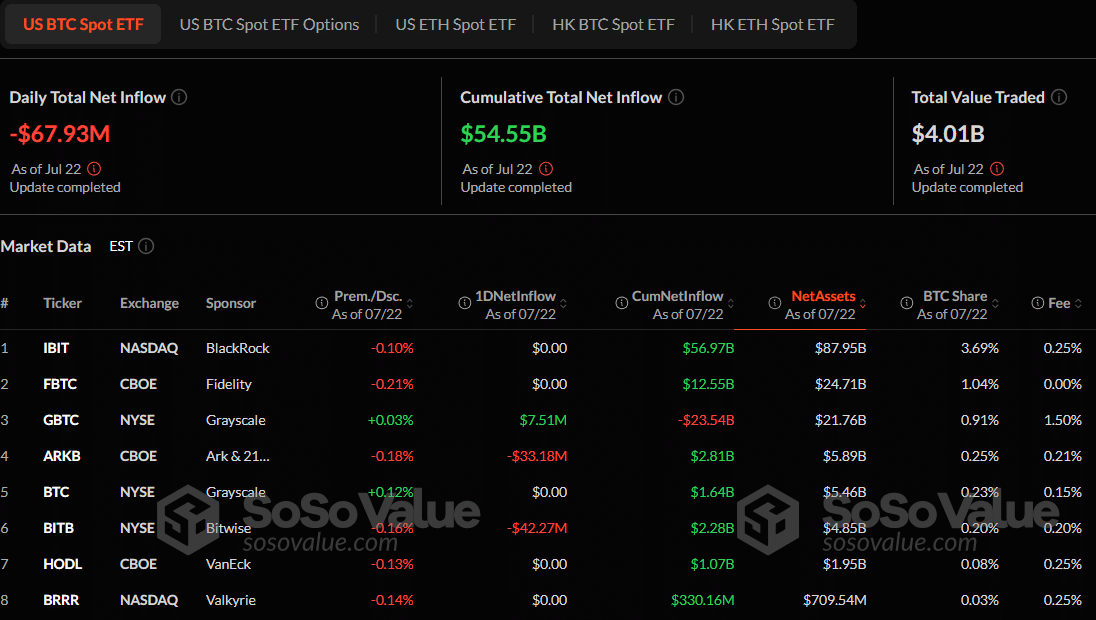

Bitcoin Holds Strong Despite Temporary Outflows

Bitcoin’s ETPs remain dominant in overall size. BlackRock’s IBIT holds $87.95 billion in assets. Still, it saw no new inflows on July 22. Bitwise’s BITB led in outflows with $42.27 million and ARKB followed with $33.18 million withdrawn.

Despite the outflows, Bitcoin ETPs still hold $154.77 billion in total. That’s 6.5% of Bitcoin’s market cap.

Also Read: