TRON (TRX) Price Explosion Imminent as Institutional Billions Flood the Network—Analysts Predict Mega Breakout

Wall Street’s whales are dumping truckloads of cash into TRON—and the market’s starting to twitch. Forget ‘quiet accumulation.’ This is a full-scale capital invasion.

Why TRX? Because smart money’s betting against legacy finance’s clunky rails. (That, and hedge funds finally realized yield farming beats golfing in the Hamptons.)

Technical signals scream bullish: A textbook ascending triangle on the weekly chart, RSI curling up from mid-range, and volume spikes that look like EKG flatlines suddenly jolting to life. The last time TRX saw this much institutional attention? Never.

Meanwhile, Bitcoin maxis are sweating through their ‘Number Go Up’ t-shirts. TRON’s scaling solutions—coupled with its borderline-obsessive developer activity—are eating Ethereum’s lunch in Asia’s high-frequency trading corridors.

Cynical footnote: Nothing unites billionaires faster than the scent of retail investors about to FOMO in. The ‘institutional endorsement’ press releases write themselves.

TLDR

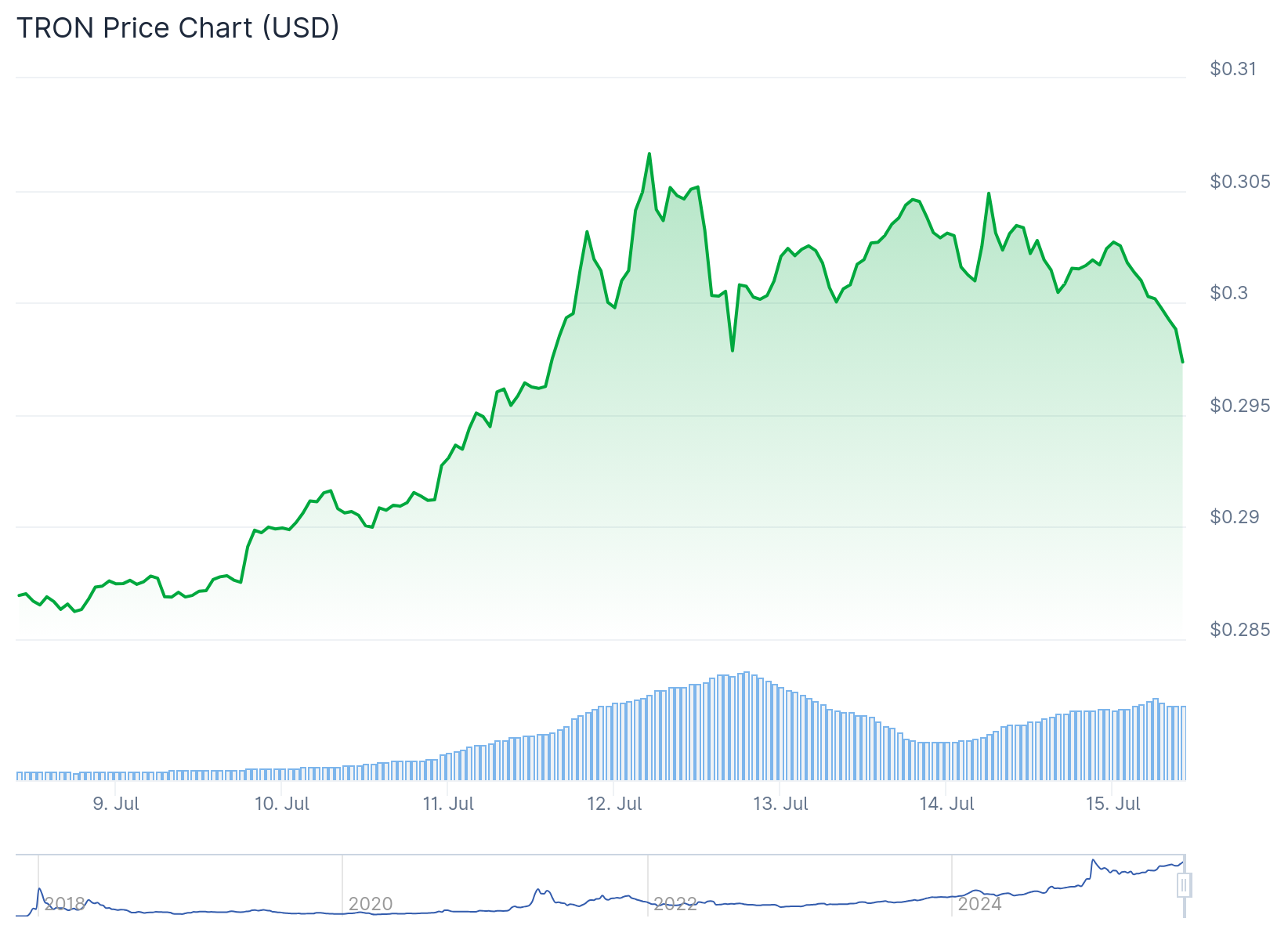

- TRX currently trades at $0.30 with bullish technical indicators showing strong upward momentum

- USDT supply on Tron network has surpassed $80 billion, with over $22 billion minted in first half of 2025

- Three separate $2 billion USDT mints occurred on Tron in 2025, showing institutional-scale demand

- TRX broke above $0.30 resistance level in early July and maintains position above key moving averages

- RSI at 69.39 approaching overbought territory while MACD remains positive at 0.0071

TRON (TRX) is trading at $0.30 after posting a minor 24-hour decline of 0.76%. The cryptocurrency maintains strong bullish momentum supported by robust technical indicators and record stablecoin activity on its network.

The TRON blockchain has become a dominant force in stablecoin infrastructure. USDT supply on the network has now exceeded $80 billion, marking a new milestone for the platform.

In the first half of 2025 alone, over $22 billion worth of USDT has been minted on Tron. This figure already surpasses the full-year totals for both 2023 and 2024, which each saw around $16 billion in USDT issuance.

The growth represents a 38% increase above previous records. Three separate $2 billion USDT mints have occurred on the network this year, a pattern that was absent in 2024.

These large-scale issuances typically indicate institutional demand or major infrastructure deployments. The data suggests growing trust in Tron as a foundational LAYER for stablecoin transactions.

Technical Analysis Shows Strong Momentum

TRX remains above all key moving averages. The Simple Moving Average indicators show SMA7 at $0.30, SMA20 at $0.29, SMA50 at $0.28, and SMA200 at $0.25.

The RSI indicator sits at 69.39, approaching overbought territory but indicating strong buying pressure. The MACD remains positive at 0.0071 with a bullish histogram of 0.0016.

Stochastic oscillators show %K at 77.19 and %D at 83.14. These levels suggest the asset is nearing overbought conditions while maintaining bullish momentum.

Bollinger Bands analysis reveals TRX trading NEAR the upper band at $0.31. The %B value of 0.8255 highlights strong bullish momentum and potential for a breakout above resistance levels.

The Average True Range sits at $0.01, indicating relatively low volatility. This may appeal to traders seeking less volatile price movements.

Key Price Levels and Support

Current resistance levels are positioned at $0.31, with the pivot point at $0.30. Support levels are established at $0.27 and $0.26.

TRX is testing its pivot level of $0.30 with strong resistance at $0.31. A breakout above $0.31 could signal further upward movement.

The 12-hour chart shows TRX holding firmly above the $0.30 level after a strong breakout in early July. This continues the uptrend that began in March.

The price has been making higher lows and higher highs over the past four months. All key moving averages are sloping upward, reflecting sustained bullish momentum.

Record USDT Activity Drives Network Growth

The explosive growth in USDT minting highlights Tron’s efficiency as a low-cost, high-speed settlement layer. The network’s appeal stems from its ability to handle stablecoin transactions with minimal fees and high throughput.

Historical data shows 2021 remains the record year for USDT issuance on tron with over $46 billion minted. However, 2025 is already closing in on that benchmark with current mid-year totals.

If the current pace continues, Tron could surpass its all-time high for USDT issuance. This WOULD signal a level of adoption and transactional utility not seen before on the network.

Recent volume surge alongside the price breakout adds conviction to the rally. The breakout above $0.30 clears a psychological resistance level that had capped TRX since late 2024.

TRON’s 52-week range spans from $0.16 to $0.43, with the current price consolidating near critical resistance levels. The cryptocurrency has maintained its position above all key moving averages throughout the recent uptrend.